Thelma and Louise drive Talon’s North Sea expansion

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Talon Petroleum Ltd (ASX:TPD) has successfully conducted a joint bid alongside ONE-Dyas E&P Limited (ONE-Dyas) for a licence over Block 14/30b.

Talon has only just received notification from the UK Oil and Gas Authority that its application was successful, a development that could well provide share price momentum.

The joint bid by Talon and ONE-Dyas is part of a broad joint technical assessment of opportunities in the area by the two companies.

As a backdrop, ONE-Dyas is the largest privately-owned energy exploration and production company in the Netherlands.

It has a substantial asset portfolio in the North Sea, Gabon and Malaysia which includes both operated and non-operated positions.

The group holds approximately 200 million barrels of oil equivalent (boe) in reserves and has a current average production level of some 35,000 boe per day.

Increases significance of exploration success at Skymoos

Commenting on the new licence award and the highly promising location of the new ground, Talon managing director, Matt Worner said, “We are extremely pleased to be adding another highly prospective licence to the Talon portfolio in partnership with ONE-Dyas.

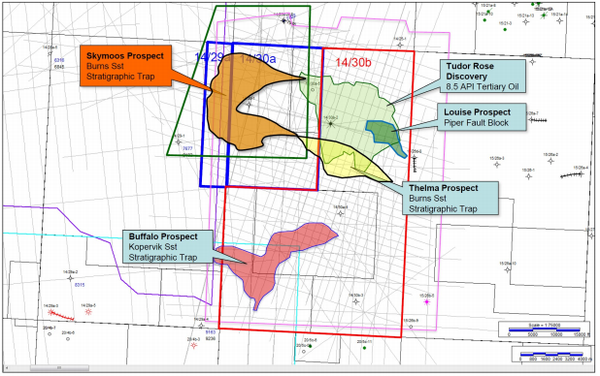

‘’The Thelma and Louise prospects within the block are adjacent to the play identified at Talon’s Skymoos prospect in neighbouring Licence P2363, which is currently the subject of an ongoing farm-out process by the company.’’

The acquisition of an interest in this new licence is a strategic move by management to expand and secure Talon’s position in the area, which could be leveraged in the event of successful exploration drilling at Skymoos.

The close proximity of Skymoos to Thelma and Louise is illustrated below, indicating the substantial upside that could flow from exploration success at the former.

Additionally, the Buffalo Prospect is a potentially significant gas prospect.

Upon award, the licence will be the fifth UK North Sea asset acquired by Talon since the company embarked on its UK North Sea strategy in mid-2018.

Perspective oil and gas resources in place

Importantly, all three prospects contain gross best estimate prospective resources.

The Thelma Prospect is a Burns Sandstone stratigraphic trap containing a gross best estimate prospective resource of 29 million barrels of oil (mmbo).

The Louise Prospect, a Piper Fault Block target contains a 17mmbo (gross best estimate) prospective resource.

The Buffalo Prospect, a Kopervik Sandstone target contains a gross best estimate prospective resource of 160 billion cubic feet (bcf) of gas.

Based on normal risking methodology used in the oil and gas industry, an estimated probability of commercial success after all technical work has been completed, is expected to be in a range between 20% and 25% for Thelma and Louise, and 30% for the Buffalo prospect.

Work program commitments for the initial two-year phase of the licence are in the order of $30,000 and include processing of 100 square kilometres of existing 3D seismic data, as well as geochemistry studies.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.