Tempus finalises valuable JV as gold breaks through US$1900 per ounce

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Tempus Resources Ltd (ASX:TMR; TSXV:TMRR) surged more than 8% on Monday morning after management announced that the gold explorer had executed a Property Option/Joint Venture agreement with respect to the company’s Mineral Creek Gold Project British Columbia, Canada.

The agreement that provides Robinhood Gold Corp (RGC) with the potential to earn an initial 75% interest in the property is based on the group investing a minimum of C$2 million in maintaining the mineral claims in good standing, with Tempus having no obligation to contribute to project expenditures during the term of the Option/Joint Venture Agreement.

Following completion of RGC’s investment, the parties will establish a joint venture and contribute to project expenditures on an equity basis, while Tempus will retain a 1% Net Smelter Royalty on the Mineral Creek Property.

In commenting on the joint venture agreement, managing director Brendan Borg said, ‘’We welcome this opportunity to unlock value from the project through this transaction with Robinhood, and look forward to seeing the story develop as exploration proceeds.’’

Further share price momentum could be imminent given the importance of this development in terms of opening up opportunities in known high-grade areas of mineralisation.

There was also promising news on the commodities front overnight with gold breaking above US$1900 per ounce for the first time in nearly two months, signalling a possible return to gold stocks after a lull in November.

The push above US$1900 per ounce represents a sustained rally of about US$130 per ounce over a five week period, no doubt fuelled by safe haven buying as COVID concerns continue to impact upon the market.

Historical data bodes well for the future

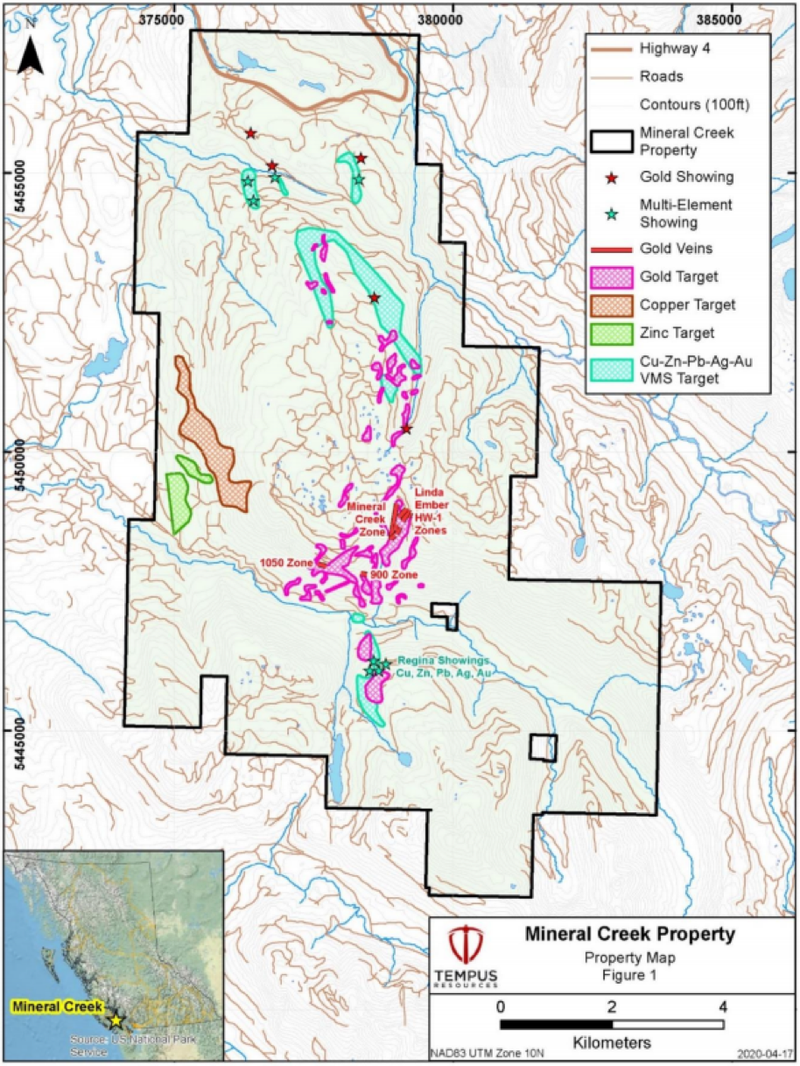

As a backdrop, the Mineral Creek Gold Project was acquired along with Tempus’ flagship Blackdome-Elizabeth Gold Project in late 2019.

The property is located on Vancouver Island, British Columbia, approximately 10 kilometres east of the town of Port Alberni.

As shown below, the property consists of 42 contiguous mineral claims totalling 9,877.29 hectares, and all 42 mineral claims that do not have any underlying royalties are owned 100% by Tempus subsidiary Sona Resources.

The property is readily accessible by an extensive network of all-season logging roads.

Mineral Creek has a long history of gold mining dating back to the late 1800’s where placer gold was mined from Mineral Creek and China Creek.

Gold was also mined from high grade gold-quartz veins situated in several adits along the Mineral Creek Fault Zone.

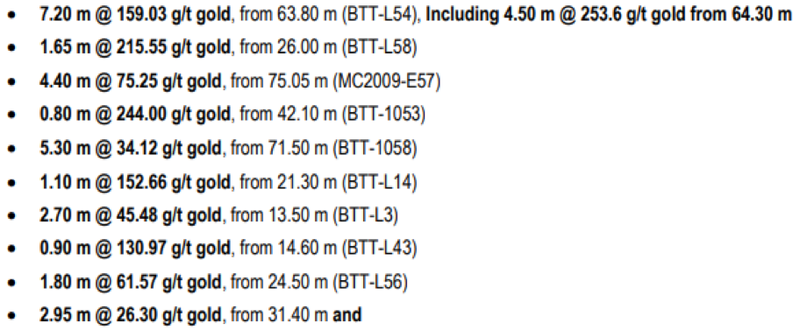

Some results from the most recent diamond drilling programs conducted between 2005 and 2010 are highlighted below.

It is worth noting the shallow high grade nature of mineralisation, features that often improve the potential commercial viability of projects due to the strong returns that can be realised from low-cost mining.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.