Tempus delineates wide zone of quartz veining with visible gold

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Tempus Resources Ltd (ASX:TMR; TSX.V: TMRR) has provided a promising update on the drilling program at the Elizabeth Gold Project in Southern British Columbia, Canada.

This is the group’s flagship project, having been the source of high-grade gold production in the past.

The group is currently midway through a drill program at Blackdome-Elizabeth that will form the basis of an updated NI43-101/JORC resource estimate.

The 2021 drilling campaign began on 5 June 2021, and diamond drill holes have been completed to date for a total of 774 metres.

Drillhole EZ-21-04 that was drilled on the northern extension zone of the South-West Vein has intersected a wide zone of quartz veining (approximately 4.2 metres), from 121.8 to this 126.0 m, with visible gold evident over approximately one metre.

Additional quartz veining with visible gold has been identified in diamond drill hole EZ-21-02.

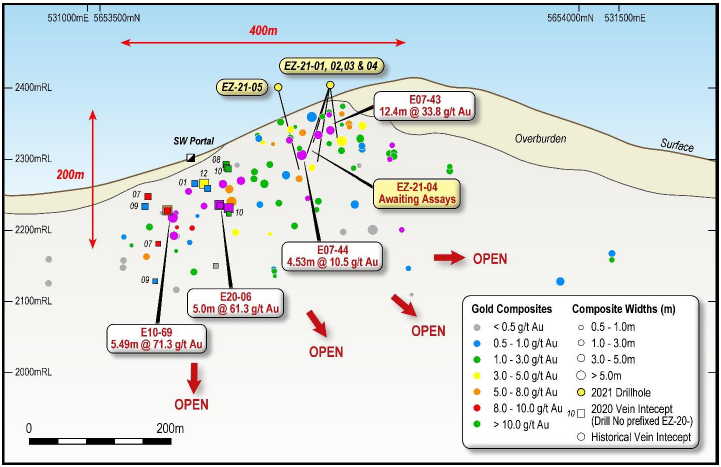

Current drilling is focused on the northern extension of the South-West vein, approximately 150 metres along strike toward the north-east from the high-grade ore-shoot intercepted in hole EZ-20-06 which intersected 5 metres at 61.3 g/t gold from 116.5 metres, including 1.5 metres at 186.0 g/t gold from 118.0 metres.

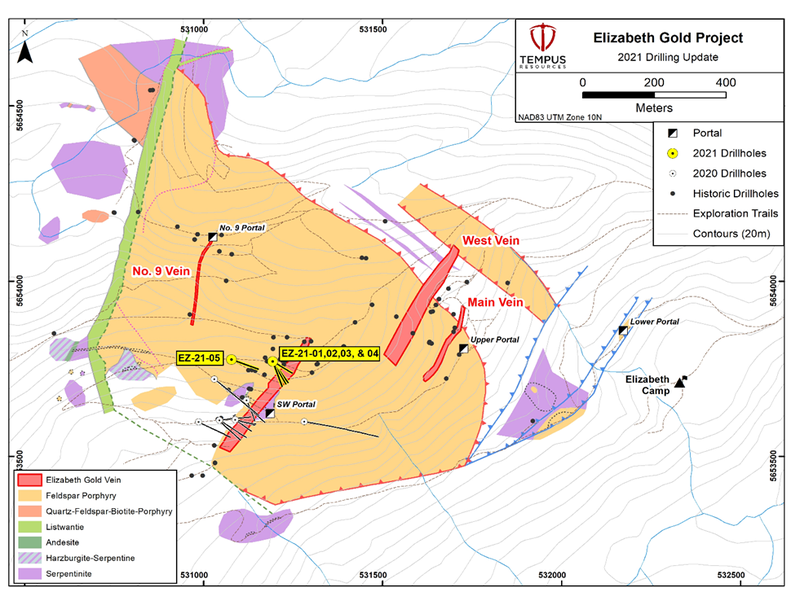

The grouping of the aforementioned drill holes can be seen below.

North Extension Shoot could deliver more high grades

President and chief executive Jason Bahnsen expressed his confidence in the group’s ability to identify more high-grade mineralisation in saying, "The 2021 drill campaign is off to a great start with this the presence of visible gold in the first few holes.

"We are looking forward to more high-grade results as we continue to demonstrate the extensions to the known vein systems at Elizabeth.”

The South-West Vein has been identified in drilling along a total strike of 800 metres and to a depth of 200 metres below surface.

Results for drilling undertaken during the last campaign are shown below, highlighting the apparent extensions to known mineralisation.

The initial five holes of the 2021 drilling campaign are focused on confirming and expanding an interpreted high-grade shoot (referred to as the North Extension Shoot) in the centre of the currently defined structure.

All five holes have intersected the vein that typically varies in width between one metre and 4.2 metres, and it is associated with strong sericitic alteration of the dioritic wall rocks.

From a geological perspective, multiple phases of brecciation and quartz precipitation are evident, with visible gold typically associated with fine limonitic partings and blebs, or with dark irregular bands of sooty sulphide composed of pyrite, arsenopyrite, galena and chlorite.

The high-grade quartz veins encountered in the 2020 (and visually in 2021) drilling at Elizabeth show close geological similarities to the Bralorne mesothermal vein system which has been mined to a depth of approximately 2,000 metres from surface.

This suggests there is strong potential to extend the mineralisation down plunge from the current deepest intersections that are approximately 200 metres below surface.

Resumption of news flow could see share price upside

Tempus is in the process of logging and sampling the core in preparation for analysis, and assay results will be keenly awaited given observations to date, particularly in terms of identifying visible gold.

Weather conditions impact mining activity in British Columbia, and it would appear that a hiatus in news flow during the northern hemisphere winter has seen the company slip off the radar.

However, with assay results coming on the back of the identification of visible gold it wouldn’t be surprising to see a resurgence in the group’s share price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.