Tando to employ dual development vanadium strategy

Published 17-JUN-2019 11:21 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Having recently completed a scoping study and capital raising, emerging vanadium producer, Tando Resources (ASX:TNO) is planning to implement parallel development strategies, rapidly advancing both phase I and phase II of the world class Steelpoortdrift (SPD) Vanadium Project in South Africa.

The updated strategy is being driven by the addition of the company’s South African joint venture partners and original vendors of the Steelpoortdrift (SPD) Vanadium Project to the management team as consultants.

The phase I scoping study focused on the direct sale of concentrate to end users in order to generate early cash flow.

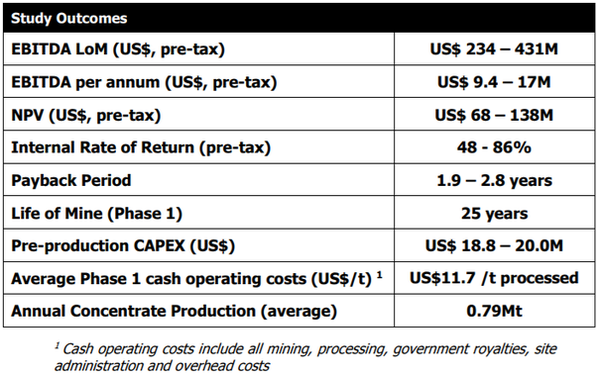

The study unveiled attractive economic metrics for phase I as highlighted below.

Phase I will go ahead as planned, but management is now looking to accelerate development, while also undertaking further commercialisation of Steelpoortdrift through studies into phase II of the SPD Project.

Phase II is envisaged to utilise the high quality concentrate generated in phase I for downstream processing to produce value added specialist products suitable for the steel, renewable energy and industrial minerals markets.

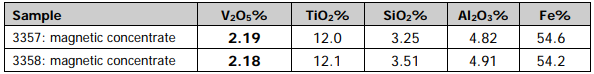

As indicated below, the concentrate contains approximately 2.2% vanadium pentoxide, 12% titanium and 55% iron, all commodities consumed by these markets.

Negotiations around an offtake agreement continue to advance, supported by the recent positive upswing in the vanadium pentoxide pricing environment and low global inventories for both ferrovanadium and 98% V2O5.

Improved pricing implies big uptick in returns

Management believes the vanadium market has returned to a sustainable upward trajectory and that a continued stable pricing environment makes phase I more likely to be concluded successfully.

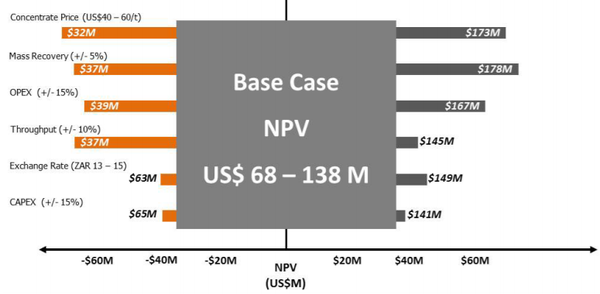

In fact, the following table indicates how much upside could stem from an improved pricing environment if one compares these numbers with the base case scenario outlined in the aforementioned scoping study.

The extensive work completed for the scoping study on phase I confirmed the global significance of SPD and will now lead to a prefeasibility study (PFS), which is expected to take only four months at a relatively low cost of about $250,000.

Completion of the PFS, Reserve drilling and offtake contracts will pave the way for Tando to secure project funding and commence construction.

The increasing confidence levels achieved in phase I is anticipated to be attractive to offtakers and financiers, an important aspect to keep in mind given that these are contributing factors in derisking projects, and are quite often catalyst for share price reratings.

Phase II targets downstream manufacturing opportunities

Phase II studies will assess all available technologies and processes that make the production of a suite of products possible, including established methods and newer techniques aimed at generating battery grade vanadium pentoxide.

Phase II studies will initially assess which technologies and processing options are most appropriate for the vanadiferous titanomagnetite concentrate produced from SPD with the purpose of determining the optimum method, or combination of methods of downstream processing that deliver the highest value.

Phase II studies are planned to unlock significantly higher value and transform Tando into a producer of high value specialist products suitable for the steel, renewable energy and industrial minerals markets.

These and subsequent studies, will compare conventional downstream processing methods such as the salt roasting method already used in South Africa at Bushveld’s Vametco Operations and Glencore’s Rhovan Operations with established pyro- and hydrometallurgical processes to the SPD vanadium concentrate, along with possibly other more innovative methods.

Samples have already been dispatched for testing at various laboratories and process development facilities worldwide.

Low capital expenditure strategy

Similar to its approach to phase I, management will focus on options for phase II that require low capital expenditure.

The development of Phase I will assist in this goal, as the crushing and beneficiation circuits will be established during its development.

The intention is to leverage the high grade and large tonnage Mineral Resource at SPD to enable Tando to produce 98% V2O5 flake for the steel industry, along with ferrovanadium and higher purity vanadium pentoxide products suitable for use in vanadium redox flow batteries.

Phase II will also aim at generating, if possible, specialist iron and titanium products from the suite of economic elements contained within the SPD mineralisation which could substantially distinguish Tando from existing competitors.

Management anticipates that the size, grade and scope of the existing Mineral Resource at SPD, particularly the shallow high-grade resource of 169 million tonnes at 1.07% (in situ) vanadium will enable the development of a long-life operation for both phases I and II.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.