Superior Lake surges on pending finance and BFS news

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Superior Lake Resources Ltd (ASX:SUP) were up as much as 20% on Tuesday after the company announced that pursuant to the financing process that commenced in May 2019, it had received multiple non-binding indicative proposals for financing the redevelopment of its Superior Lake Zinc Project in Ontario, Canada.

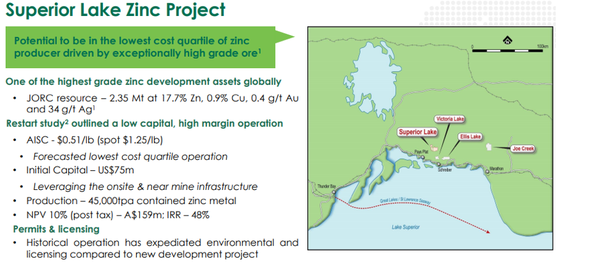

The project is a high-grade zinc deposit with a JORC resource of 2.35 million tonnes at 17.7% zinc, 0.9% copper, 0.38 g/t gold and 34 g/t silver.

A Restart Study completed in 2018, forecasted the project would produce approximately 46,000 tonnes per annum of zinc with all in sustaining costs (AISC) of US$0.51/lb.

This implies particularly strong margins based on the current zinc price of about US$1.01 per pound.

Even though the zinc price has retraced from just over US$1.30 per pound in April, it is still some 50% higher than it was when the commodity came under pressure in 2015/2016.

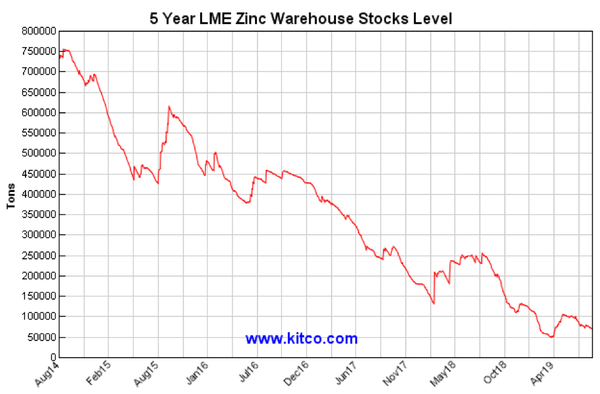

Furthermore, supply/demand metrics are looking strong with five-year London Metals Exchange (LME) zinc warehouse stock levels close to long-term lows as indicated below.

Developments that are expected to result in a reduction in the supply of zinc concentrate of approximately 400,000 tonnes by 2021 include the expected closure of multiple zinc smelters across North America and a decrease in production from China.

Proposals for finance up to US$70 million

Returning to the quantum of the finance proposals, they range between US$50 million and US$70 million, and importantly come at a time when the company is on the verge of releasing its bankable feasibility study (BFS), a development which in itself is likely to be market moving.

However, given management is well progressed with its financing arrangements, there is the potential for the BFS to have an even greater impact on the group’s share price.

The BFS will incorporate metrics regarding the capital investment required to build an economically viable plant, and if the non-binding finance proposals go a long way to covering such capital costs it would represent a significant de-risking of the project.

It would appear that the top end of the finance proposals received, being $70 million, would go close to facilitating a restart as studies to date have pointed to initial capital expenditure of US$75 million.

The financing process has been managed by Orimco Resource Investment Advisers, an independent advisory firm, specialised in funding solutions for emerging producers in the resources sector.

Management continues to work with Orimco in evaluating the merit of each proposal, and the company expects to select a short list of preferred financiers, after which it is anticipated that the process will involve site visits, legal and technical due diligence and documentation.

Commenting on the progress made in arranging suitable finance, chief executive David Woodall said, “To receive such significant interest from major global financial institutions and mining specialist funds is an outstanding outcome and testament to the quality of our Superior Lake Project.’’

While the company didn’t indicate the financial institutions involved, AFR’s Street Talk believes there are some heavy hitters ready to support the project.

The following is an excerpt from the Street Talk article published on Tuesday, August 27:

ASX-listed zinc hopeful Superior Lake Resources has caught the eye of some deep-pocketed potential funders as it goes about trying to redevelop its flagship mine in Canada.

Street Talk understands Superior Lake Resources has received a handful of indicative debt financing proposals, which could tip as much as $US70 million ($104 million) into its coffers.

The proposals are believed to be from the likes of Canadian investor Sprott Resources Lending, Australia's Tribeca Investment Partners and French bank SocGen - all of who are active players in the sector.

Superior Lake Resources is expected to seek to firm up the interest and tap one of the financiers later this year. It has been working with Orimco Resource Investment Advisers as part of the process and lending sources reckon it is seeking debt worth $US50 million to $US70 million.

Superior Lake Resources declined to comment when contacted on Monday.

It comes as the company juggles the project financing search with talks with off-takers and a bankable feasibility study for its Superior Lake Zinc Project in Ontario, Canada.

Shareholders have been told to expect the feasibility study shortly.

Superior Lake's pitch is about redeveloping the Canadian zinc and copper mine, which was shut more than two decades ago due to a prolonged period of low zinc prices.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.