Strategic Energy Resources in same copper-gold field as the $3.4BN Oz Minerals

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It was only yesterday that Finfeed flagged an imminent market moving development for mining minnow, Strategic Energy Resources (ASX:SER).

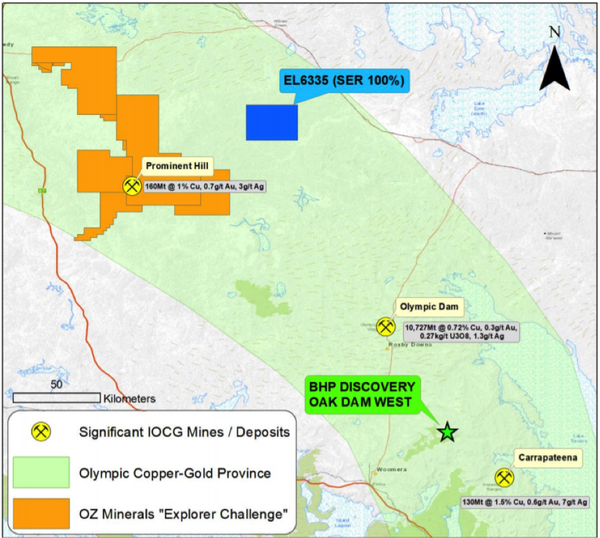

However, what looked like it could be weeks away occurred in the afternoon as SER informed the market that an exploration licence had been awarded for a landholding 60 kilometres north-east of Oz Minerals (ASX:OZL) prolific Prominent Hill copper-gold mine situated in the Olympic Copper-Gold Province of South Australia.

As the map shows, the awarded licence EL6335 is in prime territory, located in the Iron Oxide Copper-Gold (IOCG) corridor, home to some of the largest producing long life mines in Australia, including BHP’s Olympic Dam which lies to the south.

Importantly, this region is far from being mined out despite being one of the hottest spots for big discoveries.

It was only late last year that BHP made the Oak Dam West discovery which lies between Olympic Dam and Oz Minerals’ other key asset in the region, Carapateena.

A scoping study released in March indicated that this mine could produce up to 125,000 tonnes per annum of copper over a long mine life at a low cost of around US$0.95 per pound, implying a margin of US$2.00 per pound based on the current copper price.

Prospectivity is well recognised

As we indicated yesterday, this area is renowned for low-cost mining due to the combined production of gold.

EL6335 covers long-recognised coincident and offset gravity and magnetic anomalies.

Consequently, SER’s newly awarded licence, now referred to as EL6335 “Billa Kalina” is likely to bring the company under the spotlight.

This was certainly the case yesterday as the company’s shares surged more than 30% when the news was announced, and closed the day up approximately 16%.

Interestingly, the area remains largely underexplored as the key geophysical anomalies in this region of the north-eastern Gawler Craton are mostly held by blue-chip companies such as BHP (ASX:BHP), OZ Minerals and Fortescue Metals Group (ASX:FMG).

However, the following image of Gawler Craton shows key magnetic anomalies that are present in both BHP and SER’s landholdings.

SER plans to conduct an infill gravity survey to further define the primary drill target followed by a single drill hole.

Management is familiar with the area incorporated by EL6335, with staff having conducted a ground gravity survey at the location in 2014.

Other catalysts in the pipeline

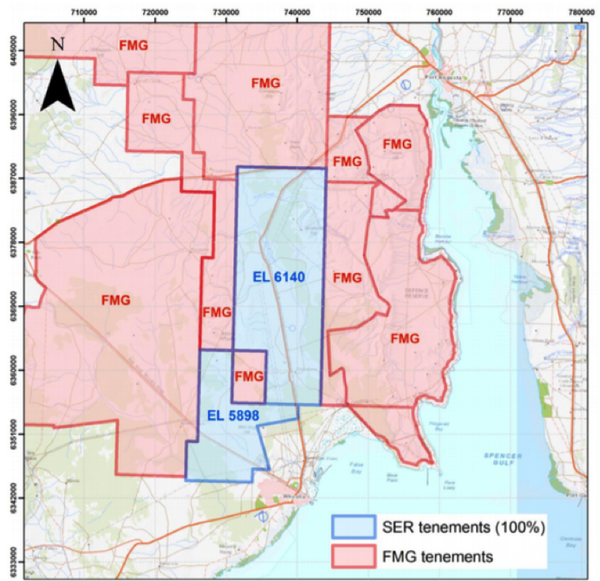

SER’s landholdings in the IOCG corridor aren’t limited to the recently awarded licence.

The exploration potential of the company’s Myall Creek holding was highlighted in November when its shares spiked on the back of BHP’s Oak Dam West discovery.

At that stage, SER was exploring the same system on the eastern margin of the Gawler Craton, an area it knows intimately after a long history of operating in the region.

Management is keen to conduct a more comprehensive exploration program at Myall Creek, and this could be facilitated by a farm-in agreement or joint venture with the $25 billion Fortescue Metals Group (ASX:FMG), particularly given the holding is strategically positioned relative to the extensive landholding Fortescue holds in the Gawler Craton.

As indicated below, FMG’s landholdings share common borders with most of the Myall Creek tenement holdings.

As we indicated yesterday, should a proposal be forthcoming from FMG it may well spark interest from investors from two perspectives.

Firstly, it would be recognition by FMG of the potential value of the tenements, and should the mining giant decide to assist in funding exploration through a farm-in agreement or joint venture that would be both financially beneficial for SER and arguably result in the undertaking of a more comprehensive exploration program.

Furthermore, it would assist in placing a value on both the tenement and SER, which has a seemingly heavily discounted market capitalisation of approximately $6 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.