Sovereign Metals forges transport deal for graphite project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Emerging African graphite producer, Sovereign Metals (ASX:SVM) has negotiated an infrastructure term sheet agreement with Central East African Railways (CEAR), an infrastructure and logistics consortium in which Vale SA and Mitsui & Co. Ltd have significant ownership, with both parties also involved in the operational management of the transport facilities.

The agreement covers the provision of rail freight, port access and port handling services by CEAR to SVM for graphite concentrates produced from the Malingunde Project, subject to a binding agreement expected to be formalised 30 June, 2018.

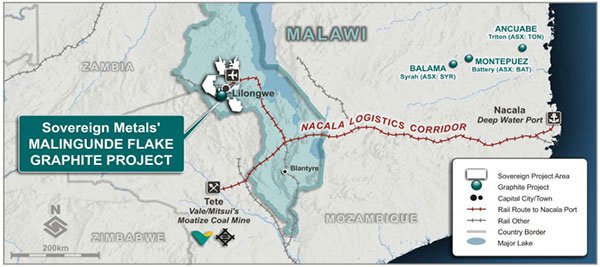

Under the terms of the agreement, ore will be transported via the Nacala Corridor which spans a length of 988 kilometres from Kanengo to the deepwater port of Nacala as indicated below.

Rail corridor runs within 25 kilometres of Malingunde

The Nacala logistics corridor has an interesting history as it was essential for the expansion of Vale and Mitsui’s coal extraction activities in the Tete region of Mozambique. US$1.2 billion has been invested to date and a further US$460 million is expected to be invested in port and rail facilities to increase the general cargo throughput capacity.

Importantly for SVM, the railway travels through Malawi and includes an operating rail line north to Lilongwe, passing within 25 kilometres of SVM’s Malingunde project.

This is an important development as it provides SVM with a secure and efficient pathway for the transport of its graphite concentrates in partnership with two world class organisations.

SVM highlighted that the signing of the agreement was a significant milestone in advancing the development of the exceptionally low-cost, high-quality natural flake graphite project at Malingunde.

Commenting on the development, SVM Managing Director Dr Julian Stephens said, “The signing of the term sheet with such reputable multinational partners is a very important step for Sovereign, and we are delighted to have such experienced operators assisting us in advancing the Malingunde Project”.

Agreement exceeds management’s projections

Under the agreement, services will be provided over a 20 year period for the movement of up to 100,000 tonnes per annum of concentrates, providing upside to SVM’s initial target of 44,000 tonnes per annum.

This covers the initial 17 year mine life of the project. Given that a single train can transport up to 84 containers at one time, SVM will only require one train movement every two weeks.

SVM’s scoping study considered production of approximately 44,000 tonnes per annum of graphite concentrates, equating to the movement of approximately 2000 twenty-foot shipping containers per year.

CEAR will supply and maintain all infrastructure, equipment and personnel required to provide the services. As a means of comparison, the Malingunde scoping study logistics cost estimate was circa US$65 per tonne free on board (FOB), based on indicative pricing for the services.

The graphite space has been in favour since August with shares in ASX 200 player Syrah Resources (ASX: SYR) surging approximately 40 per cent from circa $2.50 to $3.75. This appears to have rubbed off on some of the smaller players in the sector, with shares in SVM increasing 20 per cent in recent weeks.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.