Sovereign Metals digs up funding to conduct Feasibility Study

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

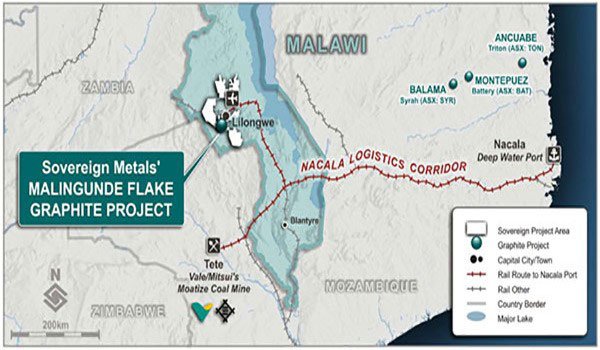

Formal confirmation of how plentiful its flagship Malingunde Project will be, is a step closer for Sovereign Metals (ASX:SVM).

The Australian graphite junior, has announced that it has now secured A$6.5 million through the issue of 59 million new shares at $0.11 each, as part of a capital raising aimed at institutional and sophisticated investors in Australia and the United States.

The capital raising also included Sovereign’s Chairman Ian Middlemas, who has also chosen to participate in the Placement, for a total of 2 million shares, subject to necessary ASX and company approvals.

Sovereigns’ Placement is due to be completed in two tranches:

Tranche 1: 38,956,189 new ordinary shares at $0.11 each to raise approximately$4.3 million before costs.

Tranche 2: 20,134,720 new ordinary shares at $0.11 each to raise approximately$2.2 million before costs. Tranche B is subject to shareholder approval at a general meeting of Shareholders to be held on or around 8 December 2017.

According to sources from within Sovereign, it expects to complete Tranche 1 of the placement in early November 2017 and move onto Phase 2 immediately thereafter.

The multimillion dollar capital injection will likely be used to expedite ongoing exploration activities at the Sovereign’s wholly-owned Malingunde Flake Graphite Project in Malawi, including all technical works, enabling completion of the pre-feasibility and definitive feasibility studies.

However, it is early stages in this company’s development and investors should seek professional financial advice if considering this stock for their portfolio.

The Malingunde Project is already JORC certified, with an Indicated and Inferred Resource of 28.8 million tonnes at 7.1% TGC at 4% TGC cut-off, including a high-grade component of 8.9 million tonnes at 9.9% TGC (7.5% TGC cut-off). Sovereign hopes to upscale its operations over time by sequentially adding to its existing JORC Resource and gradually expanding its endowment at Malingunde.

Significantly, 80% of the total saprolite and 80% of the high-grade component is in the Indicated Resource category.

Dr Julian Stephens, Sovereign’s Managing Director commented, “We are delighted to have raised funds to complete all technical disciplines required to proceed to a final investment decision at Malingunde”.

“The significant institutional support received from Australia and the United States highlights the demand for simple, low-cost projects in the rapidly expanding graphite space,” he added.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.