Sovereign makes progress on its world-class graphite project in Malawi

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Perth-based Sovereign Metals (ASX:SVM) says its best-in-class graphite concentrates project in Malawi is building upon its ‘outstanding results’ from its already completed Scoping Study.

Tests on graphite concentrates from SVM have raised expectations of SVM building out a low operating cost operation with annual graphite concentrate production of around 44,000 tonnes over an initial mine life of 17 years.

It is hoped SVM’s activities in the graphite space will translate into significant upside within the burgeoning growth in energy storage, made possible by lithium-ion batteries.

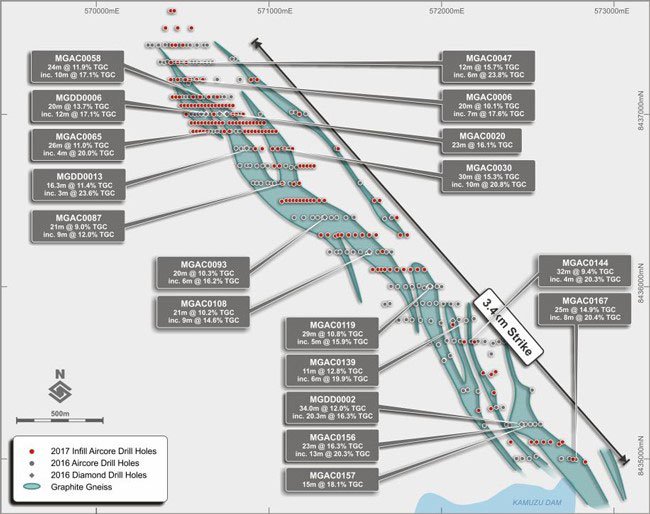

SVM says it has completed 210 holes for 6212 metres of aircore drilling to ‘upgrade the resource classification levels for the Pre-feasibility Study, as well as to test graphite mineralisation at Malingunde South Extension and other targets’.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

SVM’s first batch of assay results from Malingunde are expected early in the new year, and has already taken steps to initiate further evaluation of mine scheduling plans.

To develop its infrastructure, SVM is collaborating with SLR Consulting, to conduct a location study for the tailings storage facility (TSF), waste dumps, stockpiles and processing plant. SVM says a SLR hydrogeology team is currently on site at Malingunde for pump testing of approximately 17 new hydro-monitoring wells.

Earlier this year, SVM announced a maiden resource for Malingunde, confirming it as the world’s biggest reported soft saprolite-hosted graphite resource. According to SVM, the project has an indicated and inferred resource of 28.8 million tonnes at 7.1 per cent total graphitic carbon (TGC) including a high-grade component of 8.9 million tonnes at 9.9 per cent TGC.

Furthermore, a recent Scoping Study into the Malingunde Project highlighted a low capital cost of $US29 million and operating cost of $US301 per tonne concentrate.

Baseline specialist environmental studies have been ongoing since early 2017 with one wet season and one dry season of relevant data collected so far. On this front, field work is expected to commence shortly.

On the processing side, SVM has employed highly-respected Perth-based ALS Global, with a ‘metallurgical program underway focusing on the front-end scrubbing process’ says SVM in a market update, with additional variability test-work also going ahead at SGS Lakefield in Canada.

As part of its ongoing exploration work, SVM is in the process of selecting its nominated project engineering consultant with its preferred engineer to be appointed before the end of the year.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.