Southern Madagascar emerging as global hub for battery-suitable graphite

Published 29-MAR-2019 10:01 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

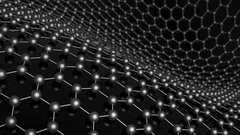

If you haven’t seen the popular animated film franchise, you’d be forgiven for not knowing much about Madagascar but that could be changing very soon. Graphite, as one of the most conductive materials, is set to be key to our sustainable future and recent exploration in Southern Madagascar has identified the Ampanihy Structure Zone as what could soon become a global hub of battery-suitable graphite.

In a recent interview with Investing News Network, Simon Moores, Managing Director at Benchmark Minerals Intelligence, was notably bullish on the graphite market and forewarned investors to look beyond basic commodity prices.

“Graphite is the number one raw input material into a lithium-ion battery,” said Moores.

“The order of graphite needed in these megafactories is in the millions of tonnes. At the moment, the anode space is about 165,000 tonnes per year but you’re going to need well over 1.6 million tonnes per year by 2030 if all these plans come on stream.

“That’s an incredible amount of anode material and you have to ask, where is it going to be coming from?”

One source of this battery-suitable graphite is going to be Madagascar where the Ampanihy Structure Zone hosts three major graphite projects which contain the right type to be used for battery anodes.

Within the Zone, NextSource Materials’ (TSX: NEXT) Molo Graphite Deposit which contains an exploration target in 141.28 million tonnes @ 6.13% Total Graphitic Carbon (TGC). With the project having garnered global attention from battery manufacturers already, a 10 year offtake agreement was signed in 2018 with a prominent Japanese Graphite Trading Company, for use in battery anode applications and electrical vehicles.

What has made the Ampanihy Structure Zone of even greater significance, however, are the two project exploration targets announced over the past 9 months.

Most recently, BlackEarth Minerals (ASX: BEM) announced a 20-34 million tonne Exploration Target @ 10-20% TGC* at their Ianapera Graphite Project which is located just 10km north of Molo. This target significantly increased BlackEarth’s assets within the Zone where the Company announced a 260-380mT Exploration Target @ 6-8% TGC* at their Maniry Graphite Project located 60km south of Molo.

Whilst BlackEarth Minerals is yet to join their Canadian counterparts in announcing offtake agreements, their sizeable assets could propel Southern Madagascar as a world class hub for battery-suitable graphite which will be crucial to meeting major demand increases in coming years.

The full interview with Simon Moores can be viewed here.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.