Shree prepares to drill targets at Golden Chimney

Published 20-AUG-2019 10:10 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shree Minerals Ltd (ASX:SHH) has received promising assays from a reconnaissance mapping, and infill auger soil sampling program at its Golden Chimney Project.

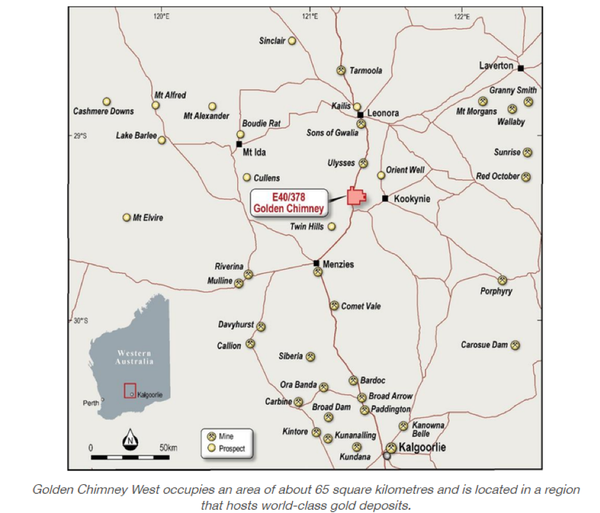

The project located 40 kilometres south of Leonora occupies an area of approximately 65 square kilometres within the prolifically mineralised Leonora geological terrain.

Significant gold deposits in the area include the Sons of Gwalia gold mine (1.9 million ounces in reserve at a grade of 7.5 g/t), the King of the Hills mine (resources of 380,000 ounces), Tower Hill (resources of 625,000 ounces) and Ulysses (resources of 760,000 ounce).

As indicated below, two of the largest of the surrounding mines in Sons of Gwalia and Ulysses lie only a short distance to the north, with the former boasting particularly high grades.

Across Exploration Licence E40/378, the company drilled 240 shallow, vertical auger holes on a 100 metre x 50 metre spaced grid.

This enabled Shree to focus on widespread, coherent near-surface gold and multi-element anomalies located over mafic and felsic volcanic rocks identified in a prior 200 metre by 100 metre grid.

Fieldwork and the infill auger sampling have enhanced the geochemical anomalies at both Golden Chimney West and Golden Chimney East.

Altered felsic volcanic rocks at Golden Chimney West are anomalous in gold, bismuth and silver.

Upcoming drilling campaign could drive shares higher

Previously unknown old gold workings were found at the Golden Chimney East gold and arsenic anomaly, and sampling of the mullock dumps returned assays up to 30 g/t gold.

Management said that it expects to commence drilling of defined targets in the near term.

Early stage mapping results have created share price momentum with Shree now trading approximately 30% above July levels.

Consequently, there is the prospect of sustained upside should the company deliver successful drill results.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.