Shell Watch: ICX Reaches For the $60 Billion Cloud in Pursuit of Innovative e-Learning Business

Published 20-JUL-2015 13:49 P.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

International Coal Ltd (ASX:ICX) is successfully pursuing its newly found market niche in the tech sector. Last month, ICX announced a reverse takeover of existing cloud based technology company Velpic – including its core revenue business ‘Dash Digital’ in a $5.2 million deal.

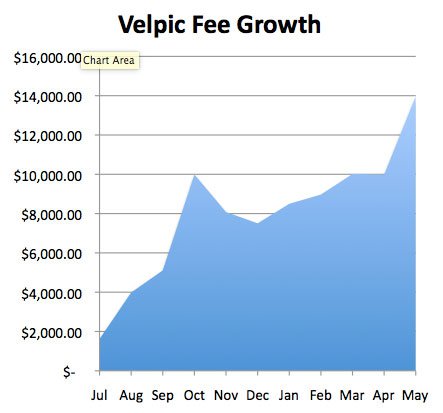

Most recently, Velpic struck deals with ‘Coffey International’ and ‘AusGroup’ to provide its proprietary Learning Management System (LMS) services on its way to recording 30% growth in month-on-month Pay Per View (PPV) fees.

In addition, under the Velpic brand, Dash Digital recently signed a $280,000 App development deal as part of plans to include Australia’s superannuation sector in its service coverage.

The LMS market is estimated to be worth around US$2.55 billion today, and expected to rise up to US$8 billion by 2018.

Velpic is a technology company determined to revolutionise how companies train and educate their staff. The company hopes to simplify sophisticated content creation techniques such as video editing and allow users the ability to create engaging digital content with diverse applications.

Velpic is currently achieving in excess of 30% growth in month-on-month recurring revenue fees and Dash Digital has generated $1.9 million in professional services revenue in the past 12 months. With existing blue chip ASX 200 clients, and a plan for global growth modelled on the Xero and Atlassian success stories, funding from the deal will fuel Velpic’s global expansion plans.

Within this Learning Management System (LMS) marketplace, Velpic is a unique player because it allows users to create video-based lessons and manage training programmes from a single platform. The other key element is that since all content is held in the cloud, Velpic’s platform is more usable, accessible and effective than traditional LMS systems that are not cloud-based.

The cloud market globally is currently worth around $60 billion annually and is expected to be worth over $191 billion by 2020 due to the amount of spare capacity still available in the industry. More than 60% of businesses are expected to have at least half their infrastructure dependent on cloud computing by 2018 – representing a significant opportunity for ICX as it undergoes the transformation to Velpic.

ICX’s Bid for Revenue Generation

Formed in 2013 from the merger of three long established boutique Perth-based consulting firms, Dash Digital has been generating revenue from expert consulting services spanning brand, web and app development and has provided the cash flow to develop Velpic over the past few years.

As Velpic’s ‘brand technology agency’ or professional services team, Dash Digital integrates the different disciplines of business communication and brand development into a holistic service offering including graphic design, e-commerce, web & app development and online advertising.

Dash Digital reconciles the two equally important, ‘brand’ and ‘technology’ elements which makeup the core of Velpic’s professional services business.

Figure 1 PPV & SaaS fees growing strongly at Velpic

Existing high-profile clients include Alcoa, Fugro and Clough, potentially paving the way for future sales.

ICX and Velpic’s Deal in Detail

The $5.2 million reverse takeover is largely comprised of shares and intimately tied to future performance which is a good sign for ICX investors. Currently, ICX is valued at just under $3.5 million and will undertake a future capital raising for the acquisition of Velpic. The total value of the reverse takeover including the $200,000 option fee (and assuming all milestones are met) is $5,200,000 based on a share price of $0.02 per share.

As part of the deal ICX will change its name to Velpic including obtaining a new ticker code on the ASX.

ICX Growing as Velpic

Having grown its combined annual turnover up to $2.1 million over the past two years, Velpic is seeking to list on the ASX via the dormant shell ICX, and conduct a further capital raising in parallel to growing its cloud-based training platform.

In its own words, Velpic’s platform is akin to “PowerPoint on steroids”. The service offering allows the user to create and distribute engaging video presentations including sophisticated animation features that do not require intensive training or in-depth knowledge of video editing.

Velpic is aiming to take advantage of the parallel growth in both cloud-based services and training requirements across a variety of industries. To stand out from the crowd Velpic wants to revolutionise the entire LMS model by incorporating advanced video creation tools within a fully-fledged LMS system.

In a similar vein to $2.6BN Xero’s business model, Velpic CEO Russell Francis is directing the firm towards implementing strategic partnership programs to boost business development and client acquisition. Specifically, this includes affiliate agreements, white-label solutions and reseller incentives while geographically, Velpic is keen to focus on the United States, Singapore, Hong Kong and Europe as their target regions for expansion.

A Different Way of Learning

Whereas in the past a company may have sent their employees on a training course for a week, companies now prefer to train their employees via digital platforms done at the employee’s discretion and location.

The fact that learning is continuous and can be adjusted on-the-fly means companies can obtain greater control over how their employees are trained. The technological capability of Velpic’s cloud-based platform also allows companies to track their employee’s progress and gauge how effective the content is.

Velpic has a definitive focus on video content as the prime medium for education because of the greater level of interaction and steeper learning curve the medium provides compared to others such as text and audio in isolation.

The technology market ICX is poised to enter

The global cloud computing market is expected to grow from $58 billion USD in 2013 to $191 billion USD in 2020, generating a Compound Annual Growth Rate (CAGR) of 19%.

Concurrently, the global market for Corporate Learning and Development grew at annual rate of 15% last year and is worth approximately $130 billion, according to Deloitte. According to ‘Markets and Markets’, a research consultancy, the Learning Management System (LMS) market is expected to grow from $2.55 billion in 2013 to $7.83 billion in 2018, at a CAGR of 25%.

Moreover, it is widely expected that cloud technology will attract greater interest from businesses in all industries given the cost and efficiency savings cloud-computing provides.

To the Horizon and Beyond

Velpic is looking for additional revenue streams by providing premium content creation services to companies that cannot create the educational material themselves. The company also plans to launch a marketplace for third-parties to create training content and market it to Velpic clients.

Velpic’s LMS platform is expected to gain traction with educators and trainers encouraging organizations to focus on holistic development, capability and talent management. In addition, the company is supplementing the core product with commercially expansive ideas linked to branding, online marketing and affiliates.

The adoption of cloud-based LMS services continues to grow, fuelled by significant cost and efficiency savings for all users. In parallel, organisations large and small are switching focus towards continuous learning rather than compulsive training as part of their own business requirements.

The end result is that ICX as a dormant shell company will soon be reborn as a tech firm called Velpic, offering a different set of services in a different market niche.

A sign of the times indeed.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.