Share price catalysts on the horizon for Superior Lake

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It was a disappointing end to fiscal 2019 for Superior Lake Resources Ltd (ASX:SUP) as the company’s shares collapsed 35% in the space of 10 days, a development that could largely be attributed to a heavily discounted capital raising on June 26, 2019.

The company also appeared to feel the brunt of tax loss selling on the last day of the financial year as its shares declined under heavy volumes.

Notwithstanding these negative developments, Superior Lake is a stock to watch over the next 12 months as it focuses on the redevelopment of the high-grade Superior Lake Zinc Project in north-western Ontario, Canada.

Even in the near term, there are potential share price drivers, in particular the release of the definitive feasibility study (DFS).

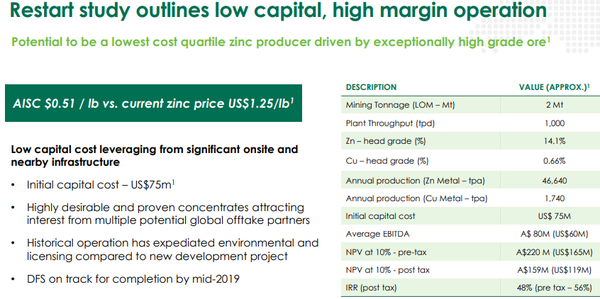

The project is a high-grade zinc deposit with a JORC resource of 2.35 million tonnes at 17.7% zinc, 0.9% copper, 0.38 g/t gold and 34 g/t silver.

A restart study completed in 2018, forecast that the project could potentially produce approximately 46,000 tonnes of zinc per annum with estimated all in sustaining costs (AISC) of US$0.51 per pound.

Even though the zinc price has fallen substantially in the last six months, a factor that has also created negative sentiment towards Superior Lake, the forecast AISC as indicated below implies a healthy margin of US$0.55 per pound based on the current price of US$1.06 per pound.

Restart study indicates strong project economics

It is worth noting that when the restart study was released, the zinc price was trading in the vicinity of US$1.25 per pound, indicating that it is currently only about 15% shy of that mark, questioning whether investors using the restart study as a benchmark should be applying what could only be described as a substantial discount to valuation based on the commodity price retracement.

While the restart study is a low-level technical and economic assessment with a +/- 35% degree of accuracy, it carries some relevance evidenced by the company’s share price performance when it was released.

Following the release of the result in October last year, shares in Superior Lake surged 15% in the ensuing days to hit 5.3 cents, a level that remains the company’s 12 month high.

Following the June share price weakness we referred to earlier, there was a recovery in July which was more than just investors taking advantage of an oversold stock.

Importantly, it was driven by encouraging drilling results at brownfield exploration targets.

Further exploration results along with the completion of studies (particularly the DFS) which should add further weight to the restart study appear to be the key share price catalysts for the remainder of 2019.

The completion of a positive DFS could well trigger the group’s entry into offtake agreements.

Offtake agreements, along with progress with permitting and approvals would significantly de-risk the project, paving the way for financing which would be central to the company realising its goal of commencing construction in the first half of 2020.

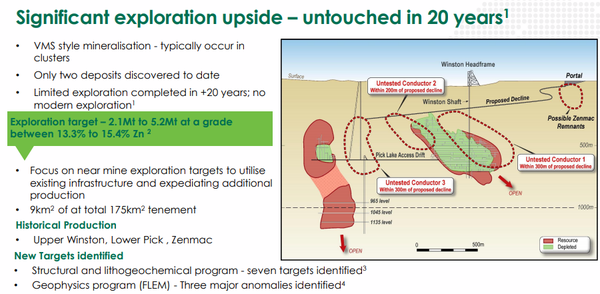

Superior Lake’s ability to expand its resource through exploration appears to be relatively strong as outlined in the following graphic.

It is worth noting that the group’s exploration focus is on targets in close proximity to the existing deposits, indicating that success could potentially add mine life or an increased production profile under a relatively fixed cost base given that the group would not require a standalone project supported by its own infrastructure.

Offtake agreements and financing

Negotiating offtake agreements and securing satisfactory financing terms will be two of the company’s key goals in the next 12 months.

Management recently said that Orimco Resource Investment Advisers, the company’s advisors with respect to project financing, sent an Information Memorandum to numerous major global banks and resource funds based in both Australia and overseas during the June quarter.

Non-binding indicative terms are expected to be received during the September quarter, providing additional share price sensitive news flow.

Management provided some additional details regarding potential offtake agreements in the course of delivering the quarterly activities report last week.

Superior Lake has received two indicative proposals regarding concentrate offtake that provide guidance on pricing, treatment and refining charges, as well as product specification.

Management sees this as an endorsement of the quality of the concentrate to be produced, and there is also the potential for such support to extend to financing.

Melbourne-based research house, BW Equities initiated coverage of Superior Lake last week with a buy recommendation and a target price of 6.5 cents, implying a capital return of more than 250% at the time the report was released when the company’s share price was 1.8 cents.

In summing up his thoughts on the group, analyst Daniel Seeney said, ‘’SUP provides investors exposure to an emerging zinc producer in a stable jurisdiction, with lightly explored ground and proven production history.

The project can come into production quickly (we expect 2021) with the benefit of existing infrastructure and permitting.

Furthermore, the shares trade at a significant discount to our 6.5 cents per share valuation, set using 1.0x P/NPV based on our DCF valuation.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.