Scoping study confirms Vulcan’s potential to supply Europe’s EV and battery makers

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Dual ASX and Frankfurt listed Vulcan Energy Resources (ASX:VUL | FWB: 6KO) is capitalising on one of the biggest markets of the coming decade: the widespread roll out of electric vehicles.

A major component of electric vehicle batteries is lithium hydroxide, however traditional lithium recovery methods are incredibly environmentally damaging — extracting brines via evaporation ponds or open-pit mining of hard-rock lithium sources have a large carbon footprint.

Driven by changing consumer attitudes along with government legislations, electric vehicles are set to massively displace CO2 intensive internal combustion engine vehicles.

The European Union wants all greenhouse gas emission cut to net zero by 2050, and stresses that “Europe needs to accelerate the transition towards low- and zero-emission vehicles”.

This shift has been spectacularly demonstrated in the recent ascent of Tesla’s share price that has added US$70 billion to its market value in less than two months.

One issue facing Tesla going forward, and all major auto makers for that matter, is securing enough EV batteries, while battery makers themselves— the likes of LG Chem and CATL — struggle to secure adequate supply of battery quality lithium hydroxide.

But fulfilling supply, alone, is not enough. The next step in this evolution is the greening of the EV supply chain. Currently, while EVs are much greener to run, their manufacture generates significantly more CO2 emissions than that of traditional vehicles.

Located at the heart of Europe’s electric vehicle and battery industry in Germany, Vulcan Energy has a solution.

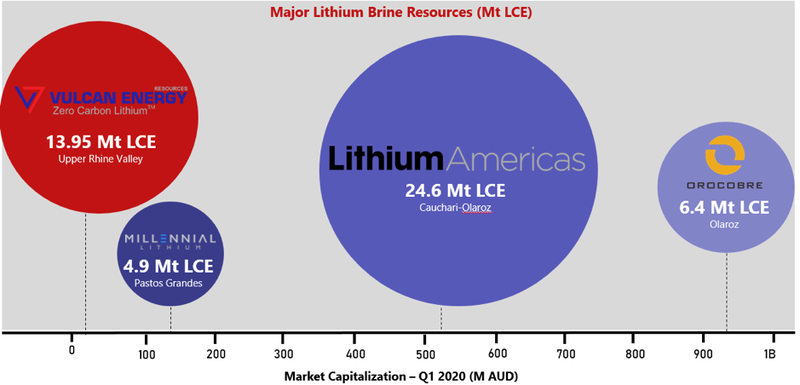

The company has a globally significant lithium resource — the largest in Europe — that, with its unique Zero Carbon LithiumTM direct lithium extraction process from geothermal brines, is perfectly positioned to deliver carbon neutral (or even carbon-negative) lithium to the supply chains of Europe’s rapidly growing battery electric vehicle industry.

The dual lithium hydroxide and renewables project will derive primary revenue from selling battery-quality lithium hydroxide (LiOH∙H2O) chemicals into the European market and secondary revenue from renewable geothermal power generation.

The Vulcan Zero Carbon LithiumTM Project comprises a very large, lithium-rich geothermal brine field located in Germany’s Upper Rhine Valley, just 60 kilometres from Stuttgart — the home of the German auto-industry and the centre of the burgeoning European lithium-ion supply chain.

The project is trucking distance to cathode manufacturers and EV battery “gigafactories” and is large enough to be Europe’s primary source of battery-quality lithium hydroxide.

Vulcan today released its scoping study indicating the potential for its Vulcan’s Zero Carbon LithiumTM Project to be the first negative carbon lithium project in the world, helping to decarbonise what is known to be a highly CO2-intensive product.

The study demonstrates the potential for a combined operation producing lithium hydroxide and renewable energy, all with a net zero carbon footprint.

Vulcan is planning for a staged ramp-up, with Stage 1 comprising the construction and operation of a Direct Lithium Extraction (DLE) and lithium hydroxide plant at the existing Insheim geothermal plant.

Stage 2 would later add considerably larger capacity, with the drilling of ten new production geothermal wells across two plants, construction of a new combined geothermal, DLE and lithium hydroxide plant at Vulcan’s 100%-owned Ortenau license.

After emerging from a trading and announcing the findings of the scoping study announcement, the stock hit 30 cents on the ASX, after previously closing at $0.255.

This comes amidst global shift in capital allocations is underway. Trillions of dollars are flowing into sustainable or green investments, as the, ‘environmental, social and governance’ (ESG) sector shakes off its image as simply a feel-good investment class.

New evidence demonstrates that profitability and environmental footprint are not mutually exclusive — but that ESG performance does in fact correlate with good financial results.

Corporate boards are cleaning up their operations and supply chains to be carbon neutral and environmentally friendly, while global fund managers are allocating to climate and eco-friendly companies, and increasingly refusing to back coal and fossil fuels.

In fact, the world’s largest fund manager, BlackRock — which manages nearly US$7 trillion in assets — is reengineering its investment strategy. According to BlackRock CEO and chairman Larry Fink, this shift is on the basis that climate change “has become a defining factor in companies’ long-term prospects”.

Last year 180 of America’s most powerful CEOs – as members of the Business Roundtable lobbying group – declared that corporations have a responsibility to the environment. Not only are these business leaders combating climate change, but it is a savvy, financially motivated move.

Bill Gates’ new fund, Breakthrough Energy Ventures, along with big name investors Jeff Bezos, Jack Ma, and Michael Bloomberg is investing in start-ups that are each capable of cutting emissions by 500-million tonnes annually and has attracted.

It was just announced overnight that Breakthrough has invested in a similarly themed low carbon lithium technology. The original co-founder of this rich-list backed, low-carbon lithium tech has recently joined Vulcan Energy as CTO of lithium extraction.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.