Is ScandiVanadium sitting on another Nova Bollinger?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

ScandiVanadium Limited (ASX:SVD) has provided an update on progress at its 100% owned Gnama Nickel Project in the Fraser Range of Western Australia, including details regarding the existing geophysical database and upcoming electromagnetic survey.

Executive chairman David Frances highlighted that previous drilling at the Gnama Project had identified significant elevated nickel and copper, bearing similarities to mineralisation delineated prior to discoveries at Nova and Legend Mining's (ASX: LEG) Mawson prospect.

The former was discovered by Sirius Resources which was subsequently taken over by IGO (ASX:IGO) in a $1.8 billion deal.

There is still significant activity at the Mawson discovery. Legend Mining (ASX:LEG) has released drilling and downhole electromagnetic results in recent weeks suggesting there is the potential for expansion of what is already shaping up as a high profile project.

Legend entered a trading halt on Friday pending the release of an announcement regarding exploration results after defining a ‘’very strong’’ off hole conductor with the results supported by DHTEM survey, a factor that will resonate with Frances based on his upcoming exploration strategy.

LEG has a market cap of $417 million, having increased substantially on the Mawson discovery.

With a market capitalisation of $18.5 million, there's upside potential in SVD, however is in the very early stages of exploration and success is no guarantee.

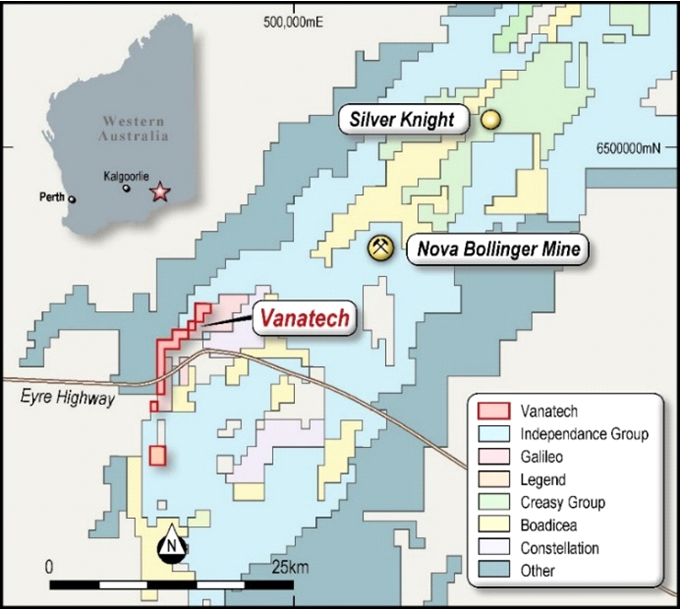

The following map shows the close proximity of the Vanatech (wholly-owned subsidiary of SVD) tenements to Nova Bollinger and the other Creasy Group interest, Silver Knight.

Frances discussed SVD's strategy in employing similar techniques in saying, ‘’The ability to run a higher-powered ground EM over our project compared to previous surveys completed in 2005 allows us to investigate deeper parts of the system that have not previously been tested.

‘’We are planning a SQUID survey to test up to 550 metres depth, potentially identifying the source of the 20 metre thick nickel-copper-cobalt anomaly in historic drilling.”

According to the CSIRO, SQUIDs (Superconducting Quantum Interference Devices) are highly sensitive sensors capable of detecting magnetic fields which are one hundred millionth smaller than the earth’s magnetic field.

This makes them ideal for detecting and distinguishing deeply buried, highly magnetic sulphide ore bodies, including nickel and silver ores.

Historical drilling shows shallow nickel-copper mineralisation

As indicated above, the Gnama Project is located at the southern end of the Fraser Range, and the discoveries that have occurred along the trend to be surveyed by SVD bear similar characteristics.

These include shallow oxide nickel-copper-cobalt anomalies within barren intervals below supergene enrichment.

Historically, high-grade sulphide mineralisation has initially been identified by either electromagnetic or downhole electromagnetic survey.

Gnama was first identified by Newmont in the 1960's from geochemical sampling and shallow drilling.

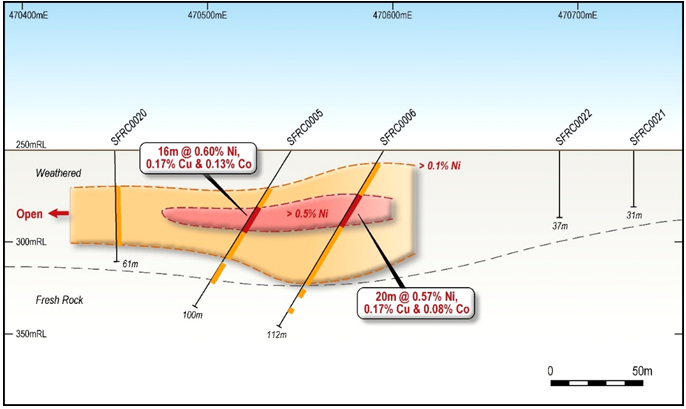

Sirius then held the tenement from 2004 to 2011 where the group intersected significant elevated nickel, copper and cobalt enrichment in the oxide zone at depths of between 28 metres and 36 metres.

Frances drew attention to comments made by Sirius at the time when the group said, “Whilst the elevated levels of nickel and cobalt could be explained by lateritic enrichment, the presence of copper suggests that the underlying rocks may contain sulphide mineralisation.”

While Sirius discovered Nova in 2012, a year after drilling the Gnama tenement, management noted that there was still potential to test for sulphide mineralisation below significant enrichment zones at Gnama South.

The following diagram shows the aforementioned intercepts that occurred in the vicinity of the 30 metre mark.

SVD gains access to historic geophysical data

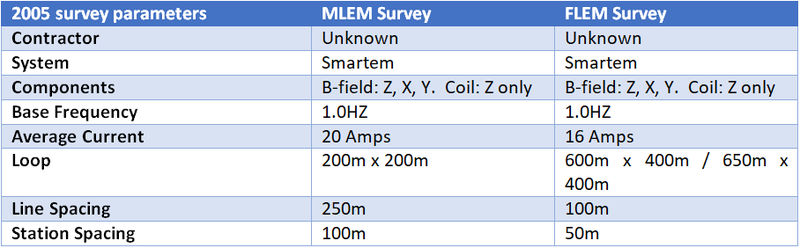

ScandiVanadium has secured access to a database of historic geophysical survey data including ground-based MLEM and FLEM surveys conducted in 2005.

Surveys are thought to have targeted shallow EM anomalies identified by the Questem airborne survey in 1997.

The 2005 ground-based surveys used both fluxgate (B-field) and coil (dBdt) antennas, which was common practice at the time as B-field fluxgates were still considered a relatively new technology.

Five EM anomalies were identified in historic data, however none of the anomalies persist into the late time channels.

Modelling of the conductors showed low conductivity and large lateral extent associated with each anomaly, parameters typically associated with shallow sedimentary conductors.

Given this backdrop, Frances said, ‘’Using modern surveying techniques, SVD intends to expand the depth of investigation beyond what was achieved in the 2005 survey to depths of approximately 550 metres.

‘’This can be achieved by increasing the size of the transmitter loop from 200 metres to 400 metres and using a Jessy SQUID receiver in the slingram configuration.’’

The company is planning to undertake a SQUID survey in December half with the aim of identifying nickel-copper mineralisation.

This next phase of ground EM will provide valuable data to help determine the sulphide source of the 20 metre thick nickel-copper-cobalt oxide mineralisation identified near-surface.

The combination of high-tech SQUID surveying and ground electromagnetic exploration could well provide an insight as to whether SVD is sitting on another Nova Bollinger.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.