Red Mountain trades strongly following release of first round of assays

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Red Mountain Mining Limited (ASX:RMX) has released highly promising initial assay results following the completion of maiden drilling at the Mt Maitland Gold Project, triggering a 20% share price increase when the market opened on Wednesday morning.

Approximately 1850 metres of reverse circulation (RC) drilling was completed across 27 holes.

The programme focused on four primary targets, being Mt Maitland South, Lenanphyl, Second Chance South and Jacia.

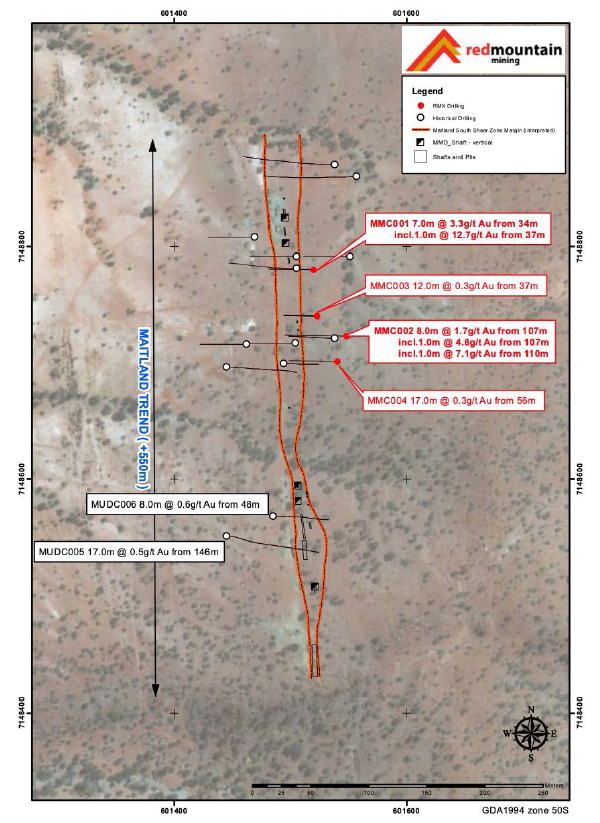

Prioritised assay results for the first four drill holes at the Mt Maitland South prospect have returned significant gold intercepts, including 7 metres at 3.3 g/t gold from about 37 metres (MMC001) and 8 metres at 1.7 g/t gold from just over 100 metres.

MMC001 also included one metre at 12.7 g/t gold.

As a backdrop, the Maitland South Prospect is a long outcropping shear zone of more than 550 metres hosting mineralised sulphidic quartz veining as shown below.

The prospect is characterised by numerous historical workings and shafts in addition to several historical drill holes proving endowment along its entire length.

High-grade core bodes well for identification of larger system

Drilling results from both holes were particularly encouraging as they contained a higher grade core, and both highlight the potential for a high-grade system which is currently open down-dip of these holes.

Assay results from MMC003 and MMC004 intersected significant shallow mineralisation, highlighting the thickness of the Maitland South Shear Zone in general and also the potential for hosting significant widths of mineralisation.

Results for MMC003 and MMC004 included 12 metres at 0.3 g/t gold and 17 metres at 0.3g/t gold at depths ranging between 37 metres and 73 metres.

All assay results have now been returned from the ore zones at the Maitland South prospect, with remaining samples from the prospect to be reported over the coming weeks.

Further potential share price catalysts on the horizon

Aside from Maitland South, the Lenanphyl Prospect is characterised by a series of historical shafts, workings and drilling that have featured significant results.

Twelve RC holes for 849 metres were drilled at the prospect with assays expected to be announced over the coming weeks.

Zones of magnetite-silica alteration were intersected with quartz-carbonate veining bearing disseminated sulphide within the interpreted ore zone, a positive sign in terms of the quality of upcoming results.

Elsewhere, the Second Chance South Prospect is a coincidental geochemical and structural target that has never been tested by drilling.

Nine holes for 531 metres were drilled at the prospect in the form of a single traverse of 25 metre-spaced angled holes to test the key zones of the target.

Fresh rock was intercepted close to surface, and there were some encouraging minor zones of sulphide bearing quartz veining.

These results are expected to be released over the coming weeks once reported by the laboratory.

Red Mountain also has the Jacia Prospect in play, a multi-element (copper-zinc-gold-silver) geochemical anomaly hosted within sheared basalts on the western margin of the greenstone belt.

Two RC holes for 127 metres were drilled into areas of geological interest with both intersecting zones of silicified quartz breccia with minor disseminations of sulphide hosted within sheared basalts.

Again, these results are expected to be released over the coming weeks, suggesting today’s share price momentum could be continued.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.