Red Mountain results could be the catalyst to revisit a 12 month high

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

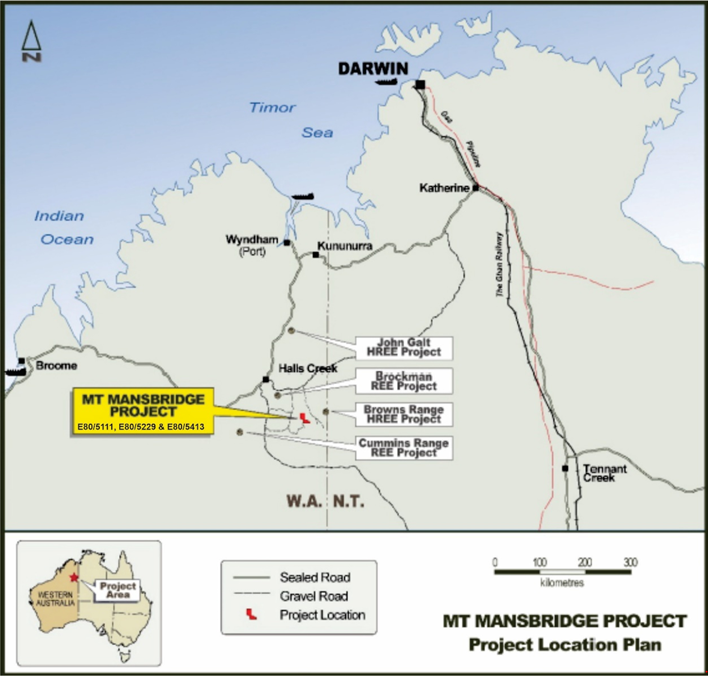

Red Mountain Mining Limited (ASX:RMX) has released some promising results from the recently completed assessment of the radiometric data that was acquired in December 2020 at the company’s Mt Mansbridge HREE Project.

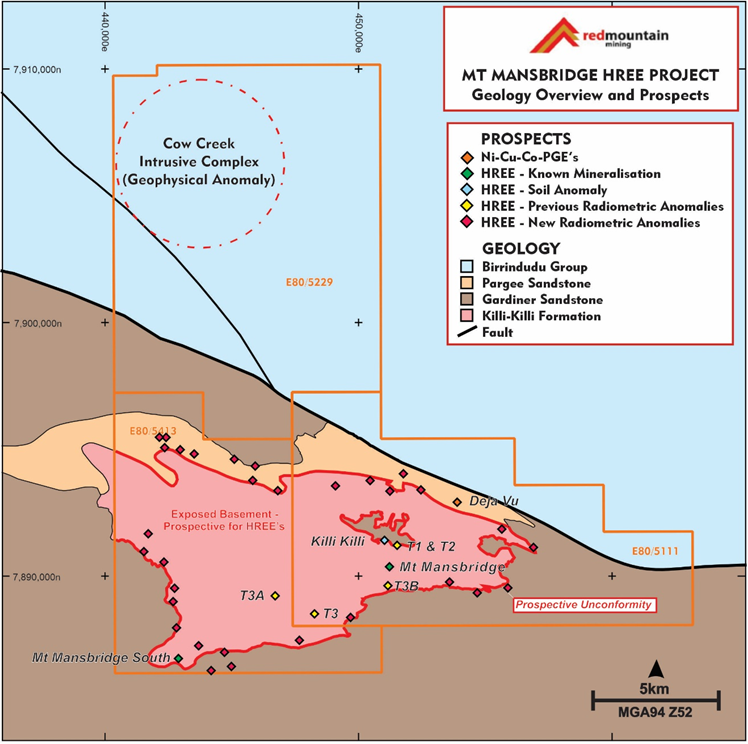

Assessment of recent airborne radiometric survey data identified 32 priority Heavy Rare Earth Element/Dysprosium (HREE) targets along 33 kilometres of prospective unconformity.

By way of background, Mt Mansbridge is a Kimberleys based heavy rare earths and nickel-cobalt project, and at the time of acquisition management noted that heavy rare earths were a critical and strategic component of the modern economy and that this was being reflected in recent healthy price rises in November, particularly in relation to dysprosium and terbium.

The targets are analogous to Northern Minerals Ltd’s (ASX: NTU) unconformity related HREE deposits Dazzler and Iceman.

It is worth noting that shares in Northern Minerals have responded positively to the buoyant commodity environment since November, doubling to a 12 month high of 6.7 cents in late January.

Establishing 32 targets could be catalyst to revisit 12 month high

While shares in Red Mountain also spiked at the start of January, they have pulled back slightly, suggesting today’s news may be the catalyst required to revisit the 12 month high that was made only a month ago.

In discussing the survey results released today, management highlighted Mt Mansbridge South is a prospect with known xenotime mineralisation.

This is considered particularly encouraging as it validates the exploration technique as an effective method of identifying areas prospective for HREE mineralization.

The company has already begun planning access with relevant native title claimant groups, with an anticipated initial reconnaissance trip to review prioritised targets in the June quarter of 2021 once the project is accessible with drilling anticipated to commence in June 2021.

Improved surveying technologies pay dividends for Red Mountain

In HREE/Xenotime deposits, radiometric data has proven to be valuable in vectoring in on HREE targets.

At Mt Mansbridge, the collection of more informative data when compared with historical surveys has paid off for Red Mountain.

Processing and ratioing of the newly acquired 800 kilometre line airborne radiometric data set has identified and delineated 32 additional basement and unconformity related HREE/Xenotime targets for further exploration.

These newly identified targets are in addition to the previously reported areas of known Xenotime mineralisation at Mt Mansbridge’ and Mt Mansbridge South, the Killi Killi HREE geochemical anomaly and previously reported radiometric anomalies.

All of these targets are summarized below and will be the focus of exploration in the June quarter.

The Mt. Mansbridge South Prospect is one of the two prospects within the project area with observed xenotime mineralisation.

Processing of the radiometric data highlighted the area as prospective for HREE/Xenotime.

The company views this as a validation of the radiometric data set as a targeting method for HREE/Xenotime mineralisation.

Due to the positive radiometric response over the Mt Mansbridge South Prospect, similar radiometric anomalies in the vicinity have been identified and prioritised as exploration targets.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.