Red Mountain Mining to commence gold drilling within 10 days

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

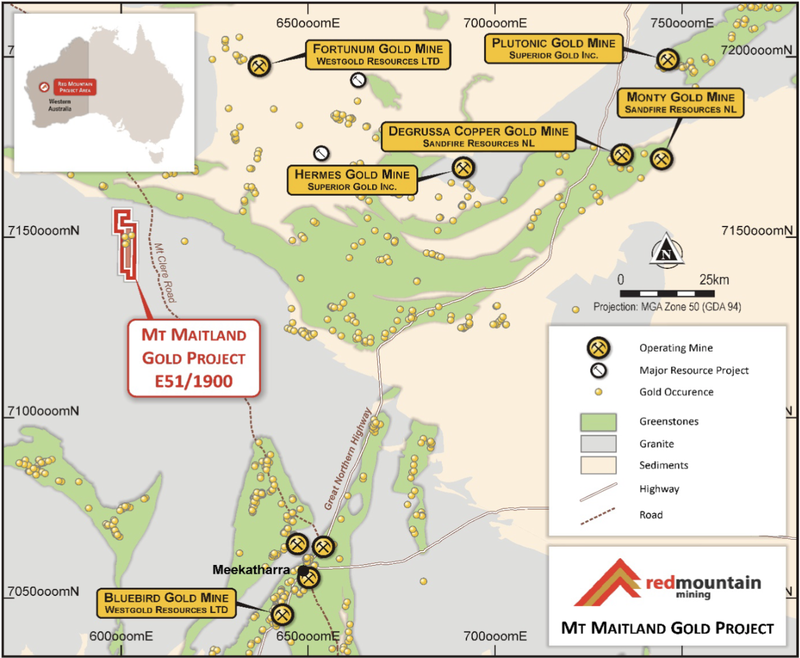

Red Mountain Mining (ASX:RMX) is set to commence drilling at its Mt Maitland Gold Project.

RMX acquired the project, which lies within the prolific Murchison Goldfields in WA in July this year.

The Mt Maitland Gold Project comprises a 62km2 parcel of tenure and contains two, distinct north-south mineralised shear zones over a strike length of 19km within an Archean greenstone belt.

It is in close proximity to the $1.1 billion Westgold Resources Fortunum Gold Mine and its Bluebird Gold Mine to the south of Mt Maitland and the $773.6M capped Sandfire’s Monty Gold Mine and its Degrussa Copper Gold Mine.

Aussie junior Superior Gold Inc. is also prolific in the region.

The Mt Maitland Project came with multiple drill-ready targets and historic production which averaged 19g/t Au.

Outstanding results from historic exploration at Mt Maitland include:

- gold-in-soils: peak 2,724 ppb, anomalies over 13 kilometres of strike

- rock chips: up to 62g/t Au, 8.8% Cu and 290g/t Ag channel sampling: 2.50m @ 22.7 g/t Au and 0.75m @ 61.8 g/t Au

- Drill results include 13m @ 2.53 g/t from 9m, 2m @ 1.53 g/t from 13m

RMX recently completed a heritage survey and pre-drilling earthworks and secured the drill rig to begin drilling within the next seven to 10 days.

The programme is planned for 18 holes for approximately 1,300 metres.

During the heritage survey, additional geological mapping was conducted which has assisted RMX to vector this maiden drill programme.

Conclusions include that gold mineralisation is concentrated in discrete domains within the project area, more specifically, either within or proximal to narrow vein-breccia stock-work, or occur in clusters of small to medium size mineralised bodies along shears or favourable lithological units.

Another mineralisation style appears to be related to steeply dipping dilatational structures, where a high-angle shear at the mafic/ultramafic contact intersects a steeply dipping more competent rock type (BIF) and refracts to a steep angle.

Continued strike-slip displacement causes this refracted surface to develop as an extensional structure. Rock chip sampling was undertaken across certain prospects within the tenure, with samples submitted for laboratory analysis.

The potential high-grade nature of the mineralisation at the Mt Maitland can be seen below in this significant gold nugget shown below:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.