RC drilling at Amani Gold’s Peteku prospect suggest Giro style mineralisation

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

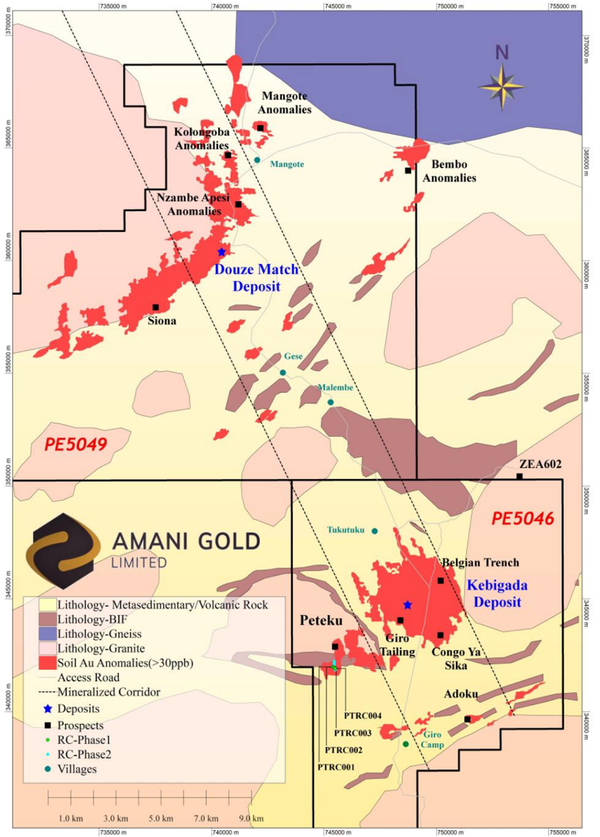

Amani Gold Limited (ASX:ANL) has provided an update on its drilling program at the Giro Gold Project in the Democratic Republic of Congo (DRC).

The update covered Reverse Circulation (RC) drilling operations (drillholes PTRC001 - PTRC004) at the project’s Peteku prospect, specifically alteration and sulphide mineralisation intervals.

Peteku prospect is located approximately four kilometres southwest of Kebigada gold deposit (PE5046) and is currently an active artisanal gold mining site. Peteku pit is located within granite and mafic volcanic rocks.

Peteku is currently an active artisanal gold mining site with the pit approximate dimensions of 50m X 40m and 20m deep with the primary target for the artisanal miners being oxide gold hosted by quartz veins. The Peteku quartz veins and structures strike east-west and dip steeply to the north.

Drilling targeted near surface gold mineralisation below a regional gold in soil anomaly.

A review (visual inspection only) of PTRC001 - PTRC004 RC rock chips outlined several intervals within each hole of alteration and/or sulphide mineralisation which is typically a good indicator of gold mineralisation at Giro.

Holes PTRC001 - PTRC004 were completed at depths of 77m to 120m with RC rock chip samples already en route to SGS Mwanza laboratory (Tanzania) for gold analysis with assay results expected later this month.

Total initial drilling completed for 397m. If significant gold mineralisation has been intersected in these initial four holes, further drilling may comprise an additional 25 RC core holes, each nominally 150m in length (total 3,750m).

Drillhole PTRC001 was collared in granite and drilled with an inclination of 60° and an azimuth of 180° and targeted near surface gold mineralisation.

It intersected intervals of silica altered granite with pyrite mineralisation from 43m to 71m (28m interval containing 1% pyrite) and from 91m to 98m (7m interval containing 1% pyrite). The drillhole also intersected an interval of quartz vein with pyrite mineralisation from 98m to 103m (5m interval containing 1% pyrite).

This style of alteration and sulphide mineralisation of granite and quartz veins are typically good indicators of gold mineralisation at Giro.

Drillhole PTRC002 was collared in granite and drilled with an inclination of 60° and an azimuth of 180° and targeted near surface gold mineralisation. It intersected intervals of silica altered granite with pyrite mineralisation from 54m to 58m (4m interval containing <1% pyrite) and from 62m to 66m (4m interval containing <1% pyrite) and intervals of quartz veins with pyrite mineralisation from 8m to 10m (2m intervals containing <1% pyrite) and from 83m to 84m (1m intervals containing <1% pyrite).

As was the case for drillhole PTRC001, this style of alteration and sulphide mineralisation of granite and quartz veins are typically good indicators of gold mineralisation at Giro.

Drillhole PTRC003 was collared in granite and drilled with an inclination of 60° and an azimuth of 180° and targeted near surface gold mineralisation. PTRC003 did not intersect intervals of altered granite or quartz veins.

Drillhole PTRC004 was collared in granite and drilled with an inclination of 60° and an azimuth of 180° and targeted near surface gold mineralisation. It intersected intervals of carbonate-silica-chlorite altered mafic volcanic with pyrite mineralisation from:

- 47m to 49m (2m interval containing <1% pyrite)

- 53m to 57m (4m interval containing <1% pyrite)

- 60m to 70m (10m interval containing 1-2% pyrite)

- 82m to 87m (5m interval containing <1% pyrite)

- 96m to 99m (3m interval containing <1% pyrite)

It also intersected intervals of quartz veins with pyrite mineralisation from 99m to 103 (4m interval containing <1% pyrite).

This style of alteration and sulphide mineralisation of mafic volcanic and quartz veins are typically good indicators of gold mineralisation at Giro, specifically the Kebigada deposit.

The company make note that this information provided is based on a visual review and interpretation of drillholes PTRC001-PTRC004 and that the actual assessment may vary from initial interpretation.

Assay results from PTRC001 – PTRC004 are pending and expected during November.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.