Rafaella to acquire Spanish tungsten-tin project in transformative deal

Published 27-MAY-2019 10:00 A.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Junior exploration company Rafaella Resources Limited (ASX: RFR) is expanding its portfolio, looking to acquire the Santa Comba tin and tungsten project in northwest Spain.

Rafaella has entered into a conditional Heads of Agreement to acquire 100% of the shares of the private Spanish company Galicia Tin & Tungsten (GTT), owner of the Santa Comba project.

GTT, holds 15 granted mining licences that are valid to 2068, in the Spanish province of La Coruña, which is part of the autonomous community of Galicia – a top-tier mining jurisdiction in a known rich tungsten and tin province. The tenements cover the seven kilometre long Santa Comba mineralised granite massif.

The company intends to focus on development of the newly discovered near-surface mineralisation, potentially as an open pit, and restarting the high-grade Mina Carmen underground mine.

Previously, the Santa Comba underground was mined in commercially significant quantities between 1980 and 1985. However it became uneconomic due to low tin and tungsten prices at the time.

Demand for tungsten and tin is now surging – as are their prices. This comes down to the metals’ varied industrial uses including construction, automotive, aerospace and electronics.

These improved economic present RFR with a compelling opportunity to re-commission the mine.

On top of that, there’s GTT’s recent discovery of the near-surface Resource at Santa Comba, suggesting significant additional low cost tonnage could be developed via open pit mining.

Mineral Resources

The project is fully permitted for underground and partial open pit mining.

Following its maiden drilling program and assessment of historical data, GTT defined maiden JORC (2012) Mineral Resource Estimates in 2016 for both near-surface disseminated and underground vein-style mineralisation.

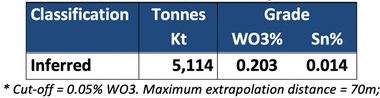

Inferred Mineral Resource Estimate (JORC, 2012) – near-surface disseminated mineralisation and veinlets:

Near-surface Inferred Mineral Resource reported at range of cut-off grades:

The near-surface disseminated and veinlet JORC (2012) Inferred MRE is based on 23 drill holes (2,219m) conducted over less than 10% of the prospective endogranite lithology. Individual lode widths range from 2m to 30m, while 5.1 million tonnes grading an average 0.21% WO3 (0.05% WO3 cut-off) has been defined.

As part of feasibility studies, the company will assess this style of mineralisation for potential open pit mining.

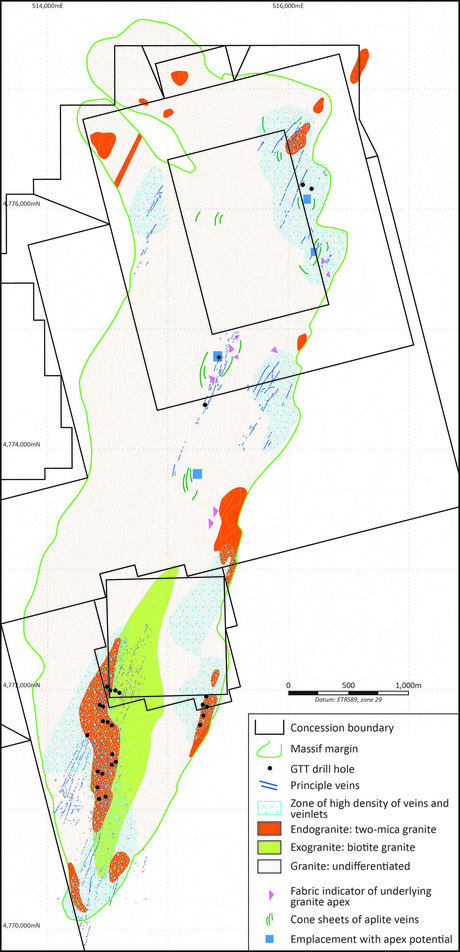

Here’s a schematic geological map of Santa Comba massif highlighting spatial extent of endogranite lithology prospective for near-surface tungsten mineralisation. Previously completed drill holes are also shown.

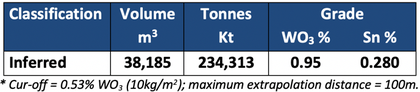

The project also hosts a high-grade, vein-hosted underground JORC (2012) Inferred Mineral Resource estimate of 234,000 tonnes at 0.95% WO3 and 0.28% Sn contained within four primary veins within the historic Mina Carmen underground mine.

However, that represents just a part of a non-JORC historical estimate completed in 1987 by previous owners. That estimate identified vein-hosted mineralisation across seven primary veins.

Inferred Mineral Resource Estimate (JORC, 2012) – underground veins:

The drilling and subsequent resource modelling has identified a substantial near-surface Inferred Mineral Resource.

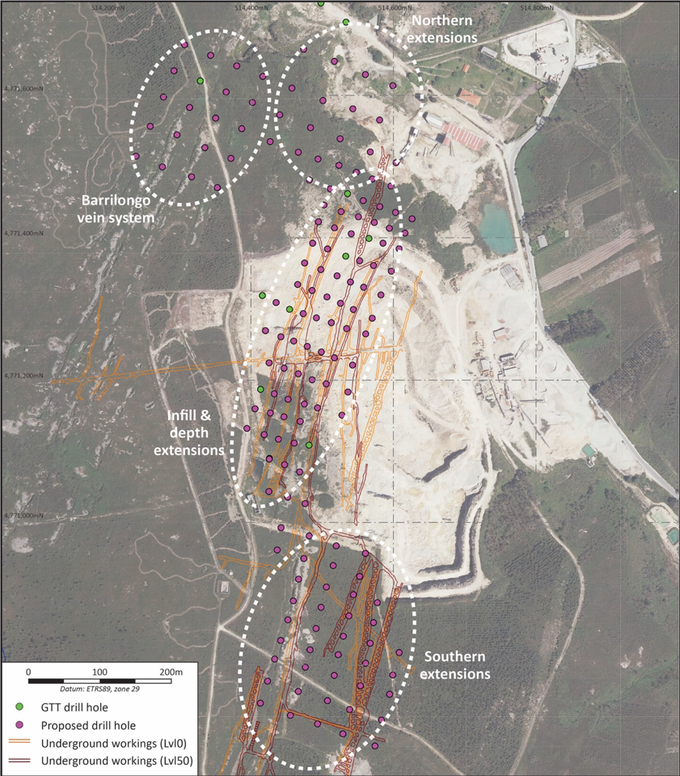

Considerable exploration potential has been identified both along strike and at depth at the primary prospects of the Quarry and Eliseo where mineralisation is still open. These prospects will be the main focus of proposed Resource extension and infill drilling program.

Furthermore, significant tungsten mineralisation has also been identified at surface elsewhere in the massif, offering excellent potential for additional near-surface resources.

Drilling and resource modelling has covered only a fraction of the prospective endogranite lithology, providing further encouragement for additional resource potential. Significant underground development of circa 7,000m remains accessible at the project, including the large capacity primary access ramp.

Plan view of Quarry prospect showing interpreted extensions to near-surface mineralisation:

Project Strategy

Rafaella is targeting a low cost, high margin tungsten-tin mining operation based on the shallow open pit Resource and the sunk capital expenditure.

The project is subject to an offer for offtake with leading global supplier, H.C. Starck Tungsten GmbH, which has obtained pre-approval for a Federal German Government Untied Loan Guarantee Scheme of up to €11.0 million (A$17.8M) to fund pre-production development capital expenditures at the project.

Post-acquisition, Rafaella plans to spend $1.3 million on a circa 8,000 metre drilling campaign to upgrade the Inferred Resource and increase the overall Resource base.

The company also intends to carry out a $1 million feasibility study, as required to access the German Untied Loan Guarantee Scheme.

Rafaella currently has cash reserves of $3.59 million.

To support the development of Santa Comba, Rafaella has proposed a share placement aiming to raise $2.6 million at 20 cents per share.

Details of the Deal

GTT currently is 75% owned by the private Australian company Biscay Minerals, with the remainder held by private Spanish entity Ulex Recursos SL.

The proposed transaction would see Rafaella issue 17.5 million shares to the vendors at 20c per share.

The vendors will earn 15 million more shares once GTT achieves a JORC-compliant Resource (Measured and Indicated) of a minimum 10,000 tonnes contained WO3, grading at least 0.18%.

GTT will issue a further 15 million shares to the vendors upon Santa Comba securing debt funding, subject to a mineral reserve of at least 7,000 tonnes of contained WO3.

RFR will conduct 30 days of final due diligence before making a final decision, which shareholders will then vote on.

Rafaella Resources Executive Director Ashley Hood said, “The proposed deal is a transformative one for the company, which currently holds copper-cobalt and gold projects in Canada and Western Australia. I believe the project represents an attractive tungsten opportunity with low entry costs and the prospect of great returns for shareholders”.

“Peer companies require many times more capex to yield similar results. Furthermore, low capex allows favourable operating environments irrespective of the macro conditions. Globally, the project economics are supported by the positive outlook for tungsten. Currently China accounts for 85% of global tungsten concentrate supply and 50% of demand, but with the continuing reduction of concentrate exports, non-Chinese supply will become severely limited.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.