Pursuit Minerals pursues nickel for growing energy storage demand

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

By 2025, 500,000 tonnes of refined nickel will be used annually in lithium-ion batteries for electric vehicles (EVs).

This equates to a five-fold increase from the amount of nickel used in EVs in 2018.

Seeking to capitalise on Europe’s rapidly expanding battery production capacity for both energy storage and use in electric vehicles, Pursuit Minerals (ASX: PUR) is taking steps to supply European battery manufacturers with the critical metals to expand the region’s battery production capacity and battery deployment.

Pursuit expands European nickel exploration

Pursuit listed on the ASX in August 2017 following the acquisition of a portfolio of projects from Teck Australia Pty Ltd, which remains the company’s largest shareholder.

Its project portfolio is focused on Battery Metals nickel and vanadium. In 2018, the company was granted exploration tenements in Sweden and Finland, covering projects with historical deposits of vanadium and extensive confirmed areas of vanadium mineralisation.

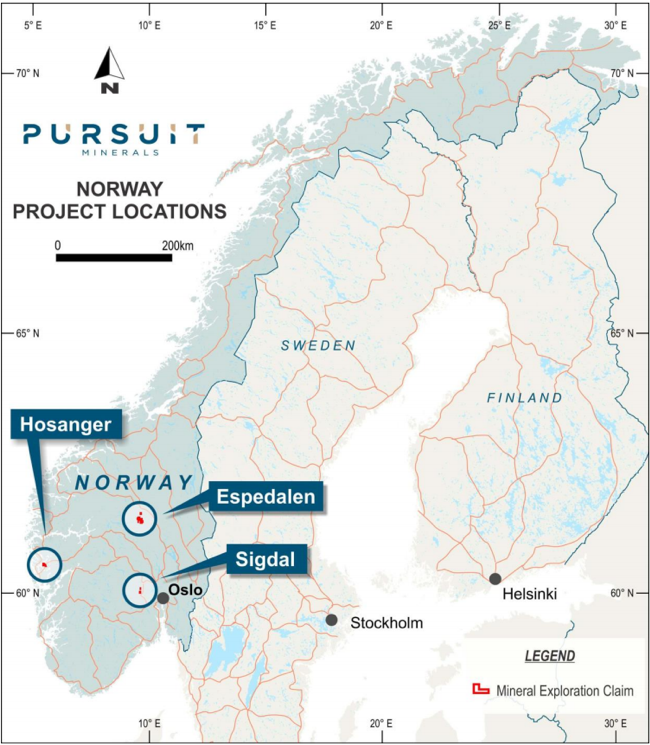

In February 2020, Pursuit expanded its portfolio through an Option agreement, with the ability to purchase 100% interests in the Espedalen, Sigdal and Hosanger projects in Norway.

Eurasian Minerals Sweden AB, a wholly owned subsidiary of EMX ROYALTY CORPORATION, currently owns these three advanced nickel sulphide projects.

The projects comprise 20,000 hectares of exploration licenses and are located in three separate historic mining districts that were identified through EMX's regional generative programs and acquired in 2018.

Pursuit is required to pay US$25,000 cash, issue 20 million shares and incur exploration expenditure of US$250,000 in 12 months to become entitled to exercise the option to acquire 100% of the projects.

Pursuit chairman, Peter Wall explained “The transaction structure that has been negotiated is relatively non-dilutive to existing shareholders, with only a very modest number of shares being issued upfront. This was an important factor in proceeding with the transaction in order to preserve and maximise shareholder value.”

The projects

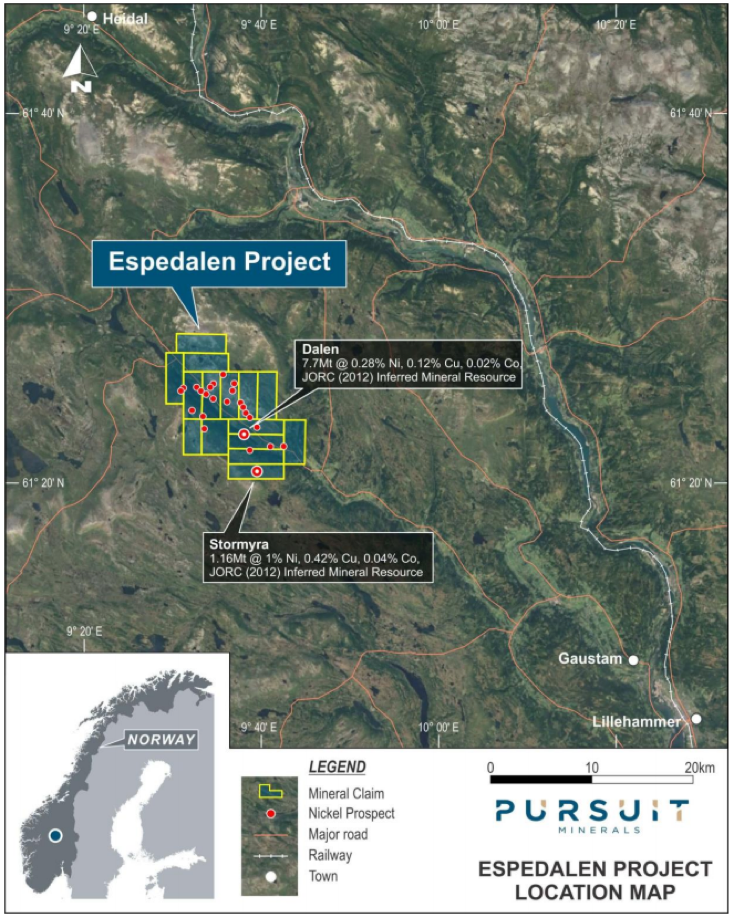

The Espaladen Project

The Espedalen Project contains two nickel deposits:

- Stormyra deposit comprising 1.16Mt @ 1% Ni, 0.42% Cu & 0.04% Co and classified as Inferred in accordance with JORC (2012)

- Dalen deposit comprising 7.8Mt @ 0.3% Ni, 0.12% Cu & 0.02% Co and classified as Inferred in accordance with JORC (2012)

The Stormyra Mineral resource is open at depth.

Drilling will be undertaken, to determine if the Mineral Resource can be expanded and to further investigate encouraging drill intersections including:

- 21.1m @ 1.75% Ni, 0.66% Cu & 0.06% Co from 64m in hole ES2005-20

- 7.1m @ 2.68% Ni, 1.26% Cu & 0.08% Co from 29.3m in hole ES2005-22

- 14.6m @ 1.74% Ni, 0.79% Cu & 0.06% Co from 80.4m in hole ES2004-09

The Espedalen Project also contains 10 prospects with nickel intersections of at least 5m @ >1% Ni which warrant follow up drilling.

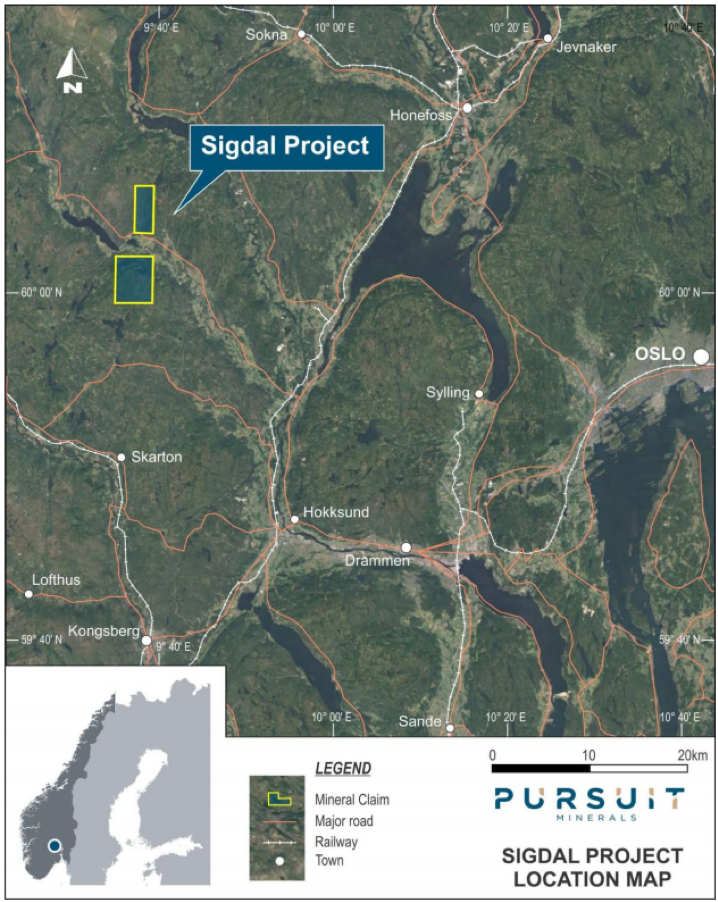

The Sigdal Project

The Sigdal Project contains a geophysical conductor associated with historical mine workings, which has only been tested with two short drill holes, returning gold grades over 10g/t with encouraging nickel and copper mineralisation including:

- 1.48m @ 0.36%Ni, 0.43% Cu, 10.1g/t Au, & 2.9g/t Ag from 22.6m in hole ER2006-13

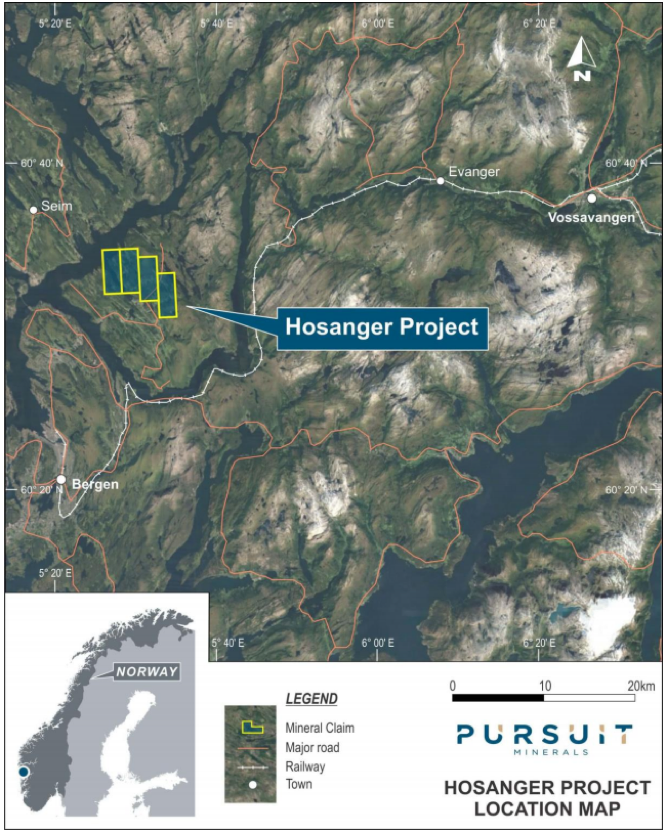

The Hosanger Project

The Hosanger Project contains the historical Litland nickel mine which produced 460,000t of nickel ore grading 1.05% Ni, 0.35% Cu and 0.05% Co from 1915 and which remains open at depth.

Why Norway?

Norway led the world in nickel production during the 1870s and was producing 75% of the world’s nickel by the turn of the century with over 40 nickel mines in production. More recently, the Bruvann Ni-Cu-Co mine, with 6.8Mt ore, operated between 1989-2002.

Glencore currently operate the Nikkelverk nickel refinery at Kristiansand in southern Norway, which has been refining nickel concentrate and exporting nickel products since 1910.

These mines were generally on the smaller to medium scale, however there is certainly potential here for much larger scale operations supported by modern mining knowledge and techniques.

Interestingly, the southern Norway location of Pursuit’s projects is geologically analogous to one of the world’s largest nickel mines: Voisey’s Bay nickel deposit in Labrador, Canada contains 141Mt nickel at 1.6%.

This shared geological history could point to Norway having a larger deposit lurking beneath the surface — possibly even of the scale of Voisey’s Bay.

In any case, there’s significant opportunity to progress Norway’s smaller to medium sized deposits towards commercial production.

Focused exploration

Pursuit’s immediate focus is on the Espedalen Project, where it will:

- Assess the potential to expand the high-grade core of the Stormyra Inferred Mineral Resource.

- Test a number of the targets of >5m @ >1% Ni.

- Assess the potential to define a maiden inferred mineral resource from the existing drill holes at the Megrund prospect.

Over the coming 12 months, the $2 million capped Pursuit will rapidly move to define and test nickel drill targets with the goal of expanding the known nickel deposits and discover new nickel systems and potentially boosting its market value.

With a limited number of quality nickel sulphide projects available worldwide, Pursuit is now just one of a handful of ASX listed companies with interests in an advanced nickel portfolio.

This is important, as there are few opportunities on the ASX to invest in companies with high quality nickel projects — particularly those with existing nickel JORC resources.

Backed by an experienced management team, having demonstrated its ability to quickly progress projects in Scandinavia, there’s a lot of potential to explore here — particularly for the ASX junior currently priced at just 0.6 cent per share price and with a sub-$2 million market capitalisation.

Additionally, protecting Pursuit on the downside is Pursuit’s option to acquire these projects at a really attractive price and with minimal dilution to existing shareholders.

The company is fully funded to complete these exploration programs this year.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.