Pure Minerals reveals high-grade manganese results at Battery Hub project

Published 09-FEB-2018 10:33 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

ASX small-cap, Pure Minerals (ASX:PM1), this morning updated the market with additional results from the first phase of drilling at its Battery Hub manganese project, situated in WA’s renowned Gascoyne region.

Encouragingly, drilling indicates the presence of high-grade mineralisation exceeding 30 per cent manganese within zones of thick, continuous mineralisation.

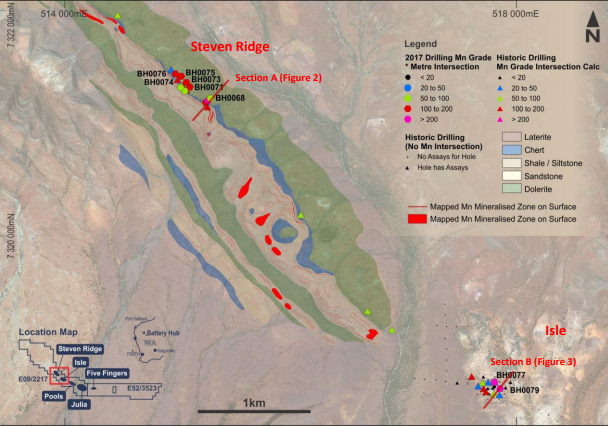

These results relate to 13 reverse circulation (RC) drilling holes at the Steven Ridge and Isle prospects, situated at the eastern half of tenement E09/2217 and immediately west of the Pools prospect. Drill results at Pools, which pointed towards large Resource tonnage potential, were released to market at the end of January.

Most recent RC drilling results include:

- BH0068: 3m at 31.79% manganese within 9m at 17.93% manganese

- BH0079: 4m at 33.40% manganese within 12m at 18.42% manganese

PM1 has confirmed that mineralisation extends a further 8.6 kilometres to the northwest of the Pools and Julia prospects, where manganese mineralisation was identified in drilling over an 8.3 kilometre strike length.

Drill hole collar map of the Isle and Steve Ridge prospects, including mapped geology and outcropping manganese mineralisation

Promisingly, all but one drill hole encountered manganese mineralisation. Mineralisation remains open down-dip, up-dip and along strike.

These holes represent the deepest holes to date, suggesting high grades extend below the zone weathering. Mineralisation was identified to a median maximum depth of 40 metres.

15 significant primary intercepts were observed from 12 mineralised holes, with a median thickness of manganese mineralisation of 20 metres. Seven of the intercepts included a medium grade core averaging 6.1 metres thickness with a weighted average grade of 15.32 per cent manganese.

Of course, as with all minerals exploration, success is not guaranteed – consider your own personal circumstances before investing, and seek professional financial advice.

First phase drilling program

The 79 hole, 2,880 metre RC drilling program was completed in early December last year, tested for shallow (less than 60 metres in depth) manganese mineralisation with bulk tonnage potential at the Julia, Pools, Isle and Steven Ridge prospects, all located within tenement E09/2217.

Another objective here was to confirm historic drilling for which no physical records remain. More than 1,500 samples were submitted to ALS Global laboratory in Wangara, WA, for assay testwork in December.

PM1 plans to begin preliminary metallurgical test work, designed to determine the potential for the various forms of mineralisation to be beneficiated or converted into a downstream product such as electrolytic manganese dioxide.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.