Pure Minerals up on IPO price as investors warm to Battery Hub project

Published 28-AUG-2017 16:45 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

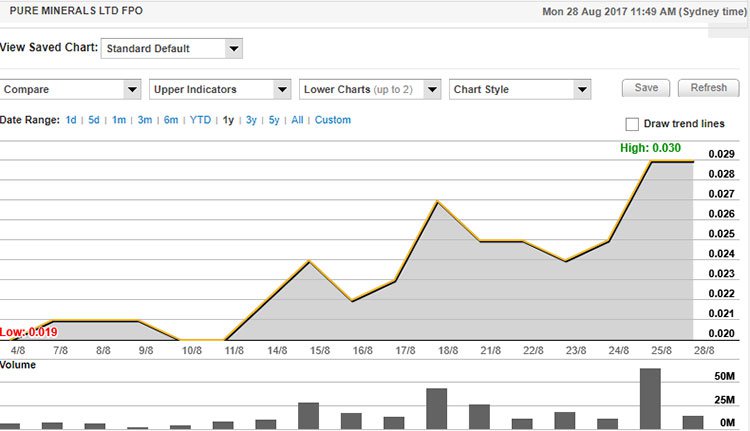

Microcap mining exploration group, Pure Minerals (ASX: PM1) has made one of the most stunning debuts of 2017. The revitalised group’s IPO price was 2 cents, and Friday, August 25 marked the three-week anniversary from commencement of trading.

On that day the company’s shares hit an intraday high of 3 cents per share, representing a 50% premium to the IPO price. There was strong interest in the stock in the latter part of last week as it surged 25%.

Of course share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

There was particularly strong buying activity on Friday with a record 64.8 million shares traded, and there was further strong support at this level when the market opened on Monday morning.

One would expect a steep premium to the IPO price to attract profit-taking from stag investors, but as evidenced in the chart below, retracements have been slight and importantly have occurred under low volumes relative to upward recoveries.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

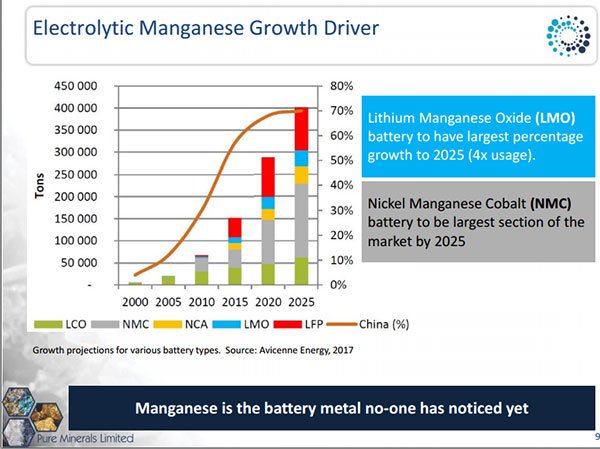

Interest in the stock appears to be driven by its exposure to highly favourable battery technology metals, especially manganese and electrolytic manganese. There is a school of thought that manganese batteries may become a dominant form of electric vehicle battery, but with all the hype surrounding graphite, lithium and cobalt, manganese has flown under the radar.

Pure Minerals modest enterprise value suggests there is more upside to come

The market is currently attributing very little value to the company’s diversified range of assets which aside from manganese, covers regions prospective for lithium, tantalum, copper, uranium and gold.

PM1’s market capitalisation is circa $7 million, and the company has cash of $4 million, indicating that the market is valuing the company’s assets at $3 million.

Management has identified a movement towards utilising cheaper input materials in lithium battery manufacture and energy storage technology. End users in electric vehicles, utilities and technology sectors are actively developing next generation of batteries containing manganese as a key ingredient.

Among those companies recently cited by PM1 were Tesla and BMW in the auto sector, Siemens and General Electric in the utilities/energy sector and Samsung and LG Chem in the technology sector.

As indicated below, industry sources have suggested that the lithium manganese oxide battery will have the largest percentage growth out to 2025, and the nickel manganese cobalt battery will be the largest segment of the market by 2025.

US 100% import reliant on manganese, supply clouded by sovereign risk issues

Of course, manganese will retain its position as a major input in steel production which currently accounts for circa 85% of demand.

US Geological Survey (USGS) noted in 2016 that the US was 100% import reliant on 19 commodities including rare earths, manganese and bauxite which are among a suite of materials designated as ‘critical’ or ‘strategic’ because they are essential to the economy and their supply may be disrupted.

Manganese supply is particularly prone to disruption because nearly 80% of the metal is produced in South Africa, a region that carries a high degree of sovereign risk. A further 10% is sourced from the Ukraine.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.