PolarX’s gold copper project continues to expand

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

PolarX Limited (ASX:PXX) has announced wider, locally high-grade intersections of gold and copper at its Zackly East prospect within its Alaska Range Project.

Zackly East was discovered by PolarX in 2018.

It sits immediately adjacent to the Zackly Main skarn deposit, where the JORC Inferred Resource currently stands at 213,000oz of gold, 41,000t of copper and 1.5Moz silver.

It has been a solid couple of months for PXX.

Last month Finfeed reported positive news that the Zackly East drilling program has extended the known gold-copper mineralisation a further 320 metres along strike with visible gold noted in three drill holes.

PXX is clearly onto something, with the positive news continuing.

The highlight of today’s announcement is that Zackly East continues to grow with 69m near-surface intercept hosting 11.2m @ 2.5 g/t gold and 1.1% copper.

These results are all outside the existing JORC Resource estimate.

Further highlights include more wide, high-grade intersections of skarn mineralisation.

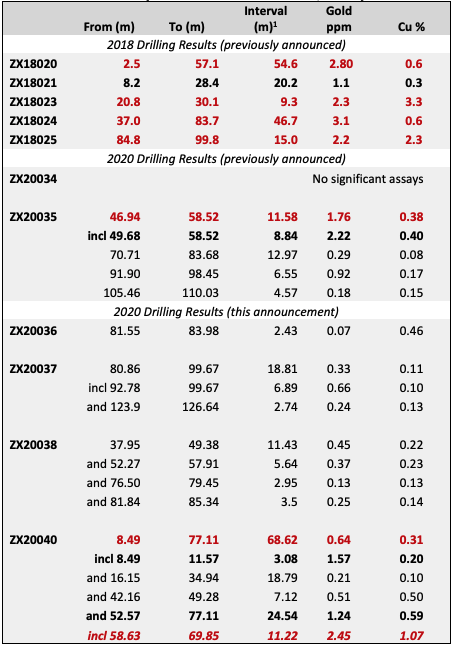

- ZX20040, has returned an assay of 11.2m @ 2.45g/t Au + 1.1% Cu from 52.6m depth. This is within a broader zone which returned 24.5m @ 1.24g/t Au + 0.6% Cu and occurs within an envelope of 68.6m @ 0.64g/t Au + 0.3% Cu which commences at 8.5m down-hole depth (i.e. almost from surface).

- Gold-copper mineralisation at Zackly East has now been outlined over a 900m strike length and remains open in all directions.

- Visual assessment of subsequent holes awaiting assay show they have the same key geological characteristics as holes which returned assays such as those referred to above.

- Almost 2km of new untested structures now identified along strong magnetic gradients.

- Ultra-high-resolution magnetic data has also identified a new nearby porphyry target.

Assays are now pending for a further 17 holes.

Below you can see the sum of assays to date:

PolarX Managing Director Dr Frazer Tabeart said Zackly East was continuing to grow to the east and remained open in all directions.

“These latest results prove that thick zones of near-surface mineralisation continue further to the east, showing locally high-grade zones within a very broad mineralised envelope,” Dr Tabeart said.

“Our most recent drilling has been to the east and north of these results. This again revealed strong skarn alteration in structures associated with very strong magnetic gradients. The high-grade mineralisation at the Zackly Main skarn is also associated with a similar magnetic gradient so further growth in mineralised strike is expected on receiving those assays. At least 2km of these newly identified structures remain untested to the north and east of current drilling these are now high priority drilling targets. We have also observed features in the new magnetic data consistent with a nearby porphyry target, which also remains untested.”

While mineralisation at the Zackly Main Skarn deposit is spatially associated with a structure running along a strong magnetic gradient, it also appears to be spatially related to such structures.

Drill holes ZX20050, ZX20053 and ZX20056 all tested a strong magnetic gradient ~150m to the north of that which hosts the known mineralisation at Zackly East.

Intense skarn alteration (assays pending) was observed in all three holes and further drilling to test eastwards extension of this structure will be carried out, along with a similar structure a further 100m to the north.

Over 2km of strike-length remains untested.

In addition to these structures, the recently acquired ultra-high-resolution magnetic data has highlighted a potential porphyry target to the north and east of current drilling, in which a magnetic high is surrounded by a magnetic low, producing an “eye” structure consistent with geophysical models of porphyry style mineralisation.

This is a high priority target for PXX and has never been drilled. The company will follow up shortly.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.