PNX updates mineral resource at Hayes Creek ahead of mid-year PFS.

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

PNX Metals Limited (ASX:PNX) has updated the total Mineral Resources at the 100% owned Hayes Creek Project containing the Iron Blow and Mt Bonnie zinc-gold-silver deposits, which are located in the Pine Creek region of the Northern Territory. This takes into account a new mineral resource estimate at the Iron Blow deposit.

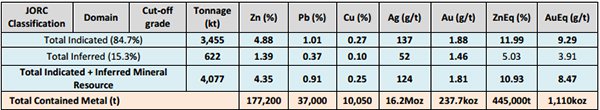

The combined mineral resource for the two deposits as outlined below features robust zinc and gold grades of 10.93% zinc equivalent or 8.47 grams per tonne gold equivalent.

The Hayes Creek project now hosts total indicated (84%) and inferred (16%) mineral resources of 4.1 million tonnes of precious and base metals which represent 445,000 tonnes of zinc equivalent or 1.11 million ounces of gold equivalent.

While this development should prompt a significant uptick in the company’s share price, another near-term catalyst is the completion of the Prefeasibility Study (PFS), which could be released as early as June.

The PFS will expand on the Scoping Study completed in March 2016, which found that mining and processing ore extracted from the proposed open-pit and underground operations at Hayes Creek would generate strong financial returns for PNX.

Although, this is speculative and investors should seek professional financial advice if considering this stock for their portfolio.

Iron Blow strengthens Hayes Creek prospective low-cost, high margin characteristics

PNX has conducted two drill programs at Iron Blow since late 2014, with a 30-hole reverse circulation and diamond drill program spanning more than 5000 metres being completed in early January 2017.

Commenting on the significance of the resource update in terms of the broader Hayes Creek project, PNX Managing Director James Fox said, “The completion of this favourable Resource update at Iron Blow is another important achievement in the development of the Hayes Creek Project which now contains over 1.1Moz gold equivalent with more than 84% of the mineral resources having been categorised as Indicated”.

Fox confirmed that detailed open-pit and underground mining studies are now underway. He is of the view that the project’s close proximity to essential services and infrastructure, and high zinc and gold equivalent grades will make for a potentially low cost, high margin multi-commodity operation.

Finalisation of the studies required for the PFS are imminent, and its likely release in mid-2017 will be an important milestone for PNX.

Drilling results indicate the potential for both open pit and underground mining

Drilling has delineated two main massive sulphide lodes. An eastern hanging-wall lode is defined by its significant zinc-gold-silver-lead mineralisation, and underneath lies a broader predominantly zinc-gold rich western footwall lode.

Four additional subsidiary lodes were also modelled and reported separately, two of which were gold rich zones located in the hanging-wall to the East Lode and footwall to the West Lode, and two gold and base metal zones delineated between the East and West Lodes referred to as the “interlode” domain.

The highest base metal and gold grades in the deposit are contained within the two massive sulphide lodes, which have defined continuously over a strike length of about 250 metres, with true widths between 1 and 30 metres and plunging moderately to the south.

This suggests that a portion of the mineral resource may be readily accessible by open pit mining methods and the remainder by underground mining methods. Detailed mining studies are being completed to determine the best strategy.

Bearing this in mind though, it is also worth noting that drilling has delineated an extension to the western lode to surface which enhances the potential for an initial open-pit in addition to the previously considered underground development.

PNX also offers significant exploration upside with the potential for mineralisation to extend underneath the extent of existing drilling and the resource estimate, with the deposit remaining open at depth.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.