PNX Releases Preliminary Feasibility Study

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

PNX Metals (ASX: PNX) has released an impressive Preliminary Feasibility Study (PFS) confirming the potential for its Hayes Creek project located in the Northern Territory to be developed into a low cost, high margin zinc and precious metals mine.

With the zinc price having surged more than 15% in the last month, this is a timely development for PNX, and it isn’t surprising to see its share price up 30% in morning trading.

Of course share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Having a dual precious metals exposure provides healthy diversification in an industry where cyclical changes come with the territory. The PFS indicates annual production of 18,300 tonnes of zinc, 14,700 ounces of gold and 1.4 million ounces of silver, representing a combined total of 39,100 tonnes of zinc equivalent.

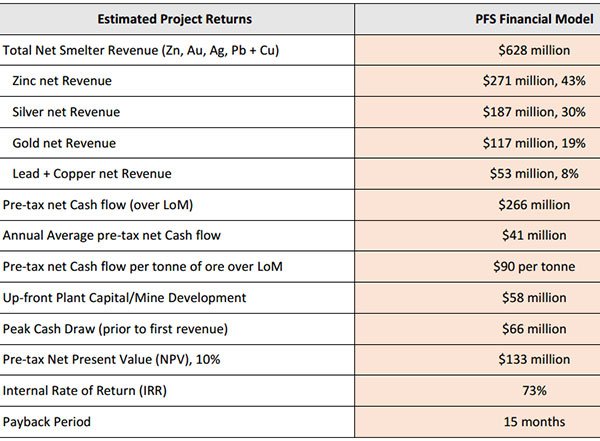

The project is forecast to generate net smelter revenues of $628 million over a 6.5 year mine life. However, this doesn’t take into account the prospect for expansion of the projects mineral resource, a scenario which would appear quite likely given the company’s exploration success to date and the highly prospective nature of near mine and regional exploration targets.

Other key takeaways from the PFS include the generation of pre-tax cash flow of $266 million over a 6.5 year period which should translate to an internal rate of return of 73%. Development costs are expected to be $58 million.

Commenting on the outcome of the PFS, PNX’s Managing Director James Fox said, “The completion of this PFS is a significant milestone for the company, confirming the strong potential for the Hayes Creek project to become a low cost, high margin zinc and precious metals mine with a low upfront capital requirement of less than $60 million.”

Fox pointed to the relatively moderate capital investment and rapid investment payback (15 months) as significant for a junior developer. Indeed, the low-risk nature of the project should assist the company in raising capital to not only fund its development, but also to assist in financing ongoing exploration.

PFS appears conservative ahead of 2018 Definitive Feasibility Study

PNX has taken the decision to immediately commence a Definitive Feasibility Study (DFS) which it expects to complete in 2018.

Management confirmed that completion of the DFS will require, and is subject to further funding with the company evaluating a number of options in this regard.

Considering the low-risk nature of the project it would appear that PNX should be able to partly debt fund the project with the prospect of an equity raising, which on balance could be struck at a reasonable placement price given likely institutional and retail shareholder support.

It is also important to note that based on current commodity prices and broker projections, the DFS could surprise on the upside.

Although it should be noted that that broker projections are only estimates and may not be met and commodity prices do fluctuate and caution should be applied to any investment decision here.

The PFS indicates that zinc accounts for 43% of net revenue. The calculation of income and rates of return from the project were based on a projected zinc price of US$2570 per tonne and a AUD/USD rate of US$0.73.

This implies an Australian dollar zinc price of $3520 per tonne. Based on the current zinc price of circa US$2820 per tonne and the current AUD/USD rate of approximately US$0.76 PNX would be receiving a price of $3710 per tonne.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.