PM1 defines large lithium-tantalum soil anomalies

Published 06-OCT-2017 13:06 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Pure Minerals (ASX:PM1) yesterday updated the market with results from its maiden exploration programme at its 80%-owned Morrissey Hill project located in Western Australia’s Gascoyne region.

During August, the company commenced an initial soil sampling survey and rock chip sampling programme over the northern portion of its 59 square kilometre Morrissey Hill Project in order to determine the project’s prospectivity for lithium-tantalum mineralisation.

PM1 collected 133 samples on a 200m x 800m grid during its soil survey. The soil sampling program was designed to identify lithological packages with anomalous pathfinder elements for lithium-caesium-tantalum pegmatites (Li, Cs, Ta, Nb, Rb) which could indicate sub-cropping prospective pegmatites.

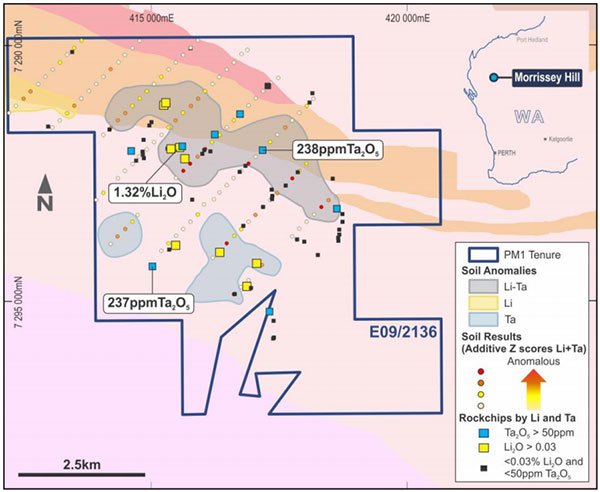

Given that the area is known for its multiple pegmatite intrusions and fractionated granites with the potential to host lithium mineralisation, it was no surprise that the soil sampling successfully delineated two key anomaly areas within a broad caesium anomaly above 10ppm Cs.

At the same time, it’s worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

A significant elevated lithium-tantalum anomaly of more than five kilometres long and up to one kilometre wide was delineated. Results included up to 0.045% Lithium oxide (Li2O) and 20.9 ppm Tantalum pentoxide (Ta2O5) (MSS0053).

Two additional tantalum anomalies of 1.6km x 1.4km and 1.0km x 0.4km were also defined with results up to 18.9 ppm Ta2O5 (MSS0025).

These can be seen on the map below:

The company also collected 50 rock chip samples from various pegmatite and granite outcrops within the soil sampling grid and its surrounds. These will supplement historic rock chip samples sampling which, in the northern Li-Ta anomaly, registered grades up to 1.31% Li2O and 238.7 ppm Ta2O5.

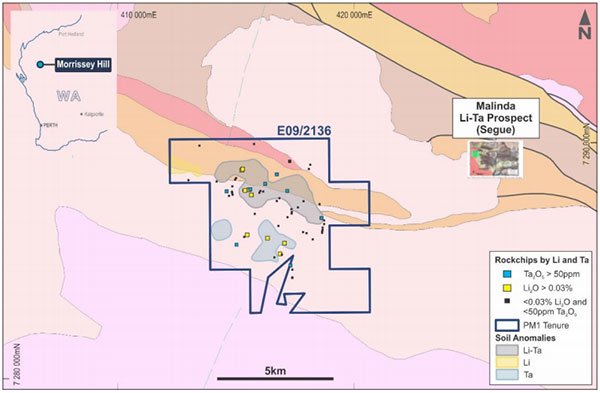

Encouragingly, these results have similarities to initial results from Segue Resources’ (ASX:SEG) Malinda (formerly Reid Well) lithium discovery, located less than ten kilometres to the east.

In an encouraging sign for PM1, in September 2017, Segue announced assay results from the first six holes of its maiden RC drill programme that intersected thick zones of pegmatite of grades greater than 1.0% Li2O.

The location of Morrissey Hill and the nearby Malinda can be seen on the map below.

The next step for PM1 is infill sample of the areas showing the strongest lithium and tantalum anomalies in the soil sampling program to enhance the definition of the anomaly for improved drill targeting.

An 80 mesh fraction will be trialled to determine if this improves the resolution of the anomalous area. In addition, PM1 Minerals will take further rock chips samples and undertake petrographic analysis to identify the lithium and tantalum minerals in the rock chip samples, as well as characterise the different pegmatite phases.

PM1 Executive Director and CEO, Sean Keenan, commented on the results:

“The large size of the lithium and tantalum anomalies, plus the similar orientation relative to the pegmatites mapped at the nearby Malinda discovery, are very encouraging. We believe the project warrants additional sampling and mapping to enhance the resolution of the anomaly with the ultimate goal of developing priority drill targets.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.