PAK to buy graphene specialist to diversify against coal downturn

Published 22-MAR-2016 15:57 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As the coal downturn remains beached, Pacific American Coal (ASX:PAK) is going fishing for graphene.

PAK has entered into a Heads of Agreement (HOA) to take a controlling interest in Imagine IM, the leading Australian developer of graphene-based coatings for industrial textiles and fibres. Founded in 2014 by Chris Gilbey and Phillip Aitchison, the company develops commercial applications for graphene and associated advanced carbon based materials. Imagine IM is the first company in the world to develop conductive geomaterials using functionalised graphene.

Imagine IM intends to build Australia’s first commercial graphene manufacturing plant in the foreseeable future with a focus on geosynthetics.

The pilot plant will have an output capacity of up to 10 tonnes per year of graphene. Imagine IM plans to use two tonnes of the graphene output in the first year of operation for products aimed at customers in Australian manufacturing.

PAK Coal Update

PAK’s coal exploration is progressing well seeing its summer work program at the ELKO Project rewarded, with the announcement of its maiden JORC Resource of 257 million tonnes. However, the US coal downturn has seen coal production levels fall to their lowest levels since 1986 with the closure of 264 mines in the US. PAK says this factor has forced it to “limit its investment in this sector, and to review all of its US projects to ensure the longer term viability of the company.”

To assist in this, PAK says it has “implemented a swathe of initiatives to help reduce overheads and ensure the business can conserve cash to weather the downturn in the current market conditions”.

Whilst trimming costs and overheads, PAK has now moved into acquisition mode, funded by a future capital raise backed by institutional investors.

The HOA deal in detail

- PAK will undertake an underwritten cash placement of 33 million new shares in PAK at an issue price of 4.8c, to raise $1.58m from sophisticated and professional investors.

- PAK will initially acquire 833,000 shares in Imagine IM at an issue price of $1.50 per share, comprising 20% of the issued capital of Imagine IM in consideration for a cash payment of $1.25m.

- Following completion of the Initial Acquisition, PAK will acquire shares in Imagine IM, comprising a further 20% of Imagine IM, from Imagine’s existing shareholders (in consideration for the issue of PAK shares to existing shareholders.

- Final completion of the HOA deal must occur on or before 30 June 2016, and is subject to due diligence, shareholder approval and regulatory permitting from ASIC and the ASX.

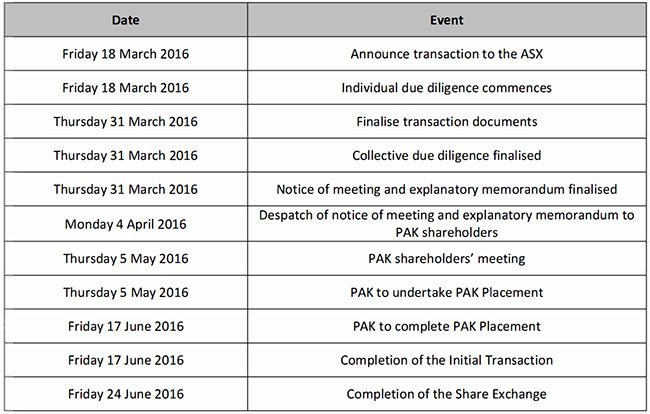

The timetable for the deal is shown below:

Timetable for PAK’s Heads of Agreement deal with Imagine IM

Bandy about Graphene

Graphene is the first two dimensional material and is classed as a “super-material” offering extremely high electrical and thermal conductivity, hydrophobicity, strength, and impermeability to all gases. Graphene’s discoverers, Andre Geim and Konstantin Novoselov were awarded the Nobel Prize in 2010.

Graphene offers high electrical and thermal conductivity, hydrophobicity, strength, and impermeability to all gases. Layered graphene can add strength, conductivity and self-repairing qualities to existing materials such as steel, glass and textiles.

Imagine IM says this can create nanocomposite materials with superior anti-clogging properties in geotextiles and enable a wider range of conductive materials.

Its first commercial products will be showcased at the 3rd Pan-American Regional Conference on Geosynthetics (GeoAmericas 2016), hosted by the North American Geosynthetics Society (NAGS).

Team Imagine

The team at Imagine IM boasts several high profile figures driving operations.

Chris Gilbey is the CEO having led businesses driven by monetizing intellectual property for over 35 years. As CEO of Lake Technology Limited (ASX:LAK), he led the company from research-focused idealism to becoming a product manufacturing and licensing business, shepherding the company’s sale to to Dolby Laboratories in 2003. As part of the takeover Mr. Gilbey joined Dolby and implemented a strategy to grow Dolby’s key licensing markets in consumer electronics in Korea, Japan and China.

Mr. Dolby is also credited with commercialising a water splitting technology dubbed ‘Aquahydrex’, funded by True North Venture Partners, a US venture capital firm.

Prior to being involved in technology businesses, Chris Gilbey was an entrepreneur in the music industry, and was involved in launching the careers of a number of globally successful artistes including AC/DC, Keith Urban and InXs. He was awarded the Order of Australia for his services to the Australian music industry and is currently an Honorary Principal Fellow at the Sydney Business School.

Leading Team Imagine is Chris Gilbey, CEO (L) and Philip Aitchison, Head of R&D and COO

Imagine’s scientific expertise comes in the form of Phillip Aitchison as Head of R&D and Chief Operating Officer at Imagine IM, having co-founded the firm.

He is a research executive with over 20 years’ experience in applied materials science, intellectual property, manufacturing, licensing and technology commercialisation. His main fields of success have been in energy storage, notably lithium-ion batteries and supercapacitors where nano-materials and carbon composites play a key role.

Also playing a crucial role is Warwick Grigor, Non-Executive Director and Chairman at Imagine. Warwick Grigor is one of the leading minerals analysts in Australia and also a veteran stock picker that has gradually raised his holding in PAK over the past 6 months, and now owns 8.16% of the company.

Warwick Grigor, Non-Executive Director & Chairman at Imagine, and shareholder at PAK with 8.16%

His presence at both companies is expected to ensure a smooth completion of the HOA deal by the end of June 2016.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.