Pacifico set for a defining Q2 2020

Published 19-FEB-2020 17:03 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Pacific Minerals (ASX:PMY) has spent the last couple of days at Western Australia’s RTIU Explorer’s Conference, a major Australian forum for the junior resources sector.

The idea is mineral exploration companies and emerging new miners attract an ever-growing group of brokers, fund managers and investors to hear their presentations.

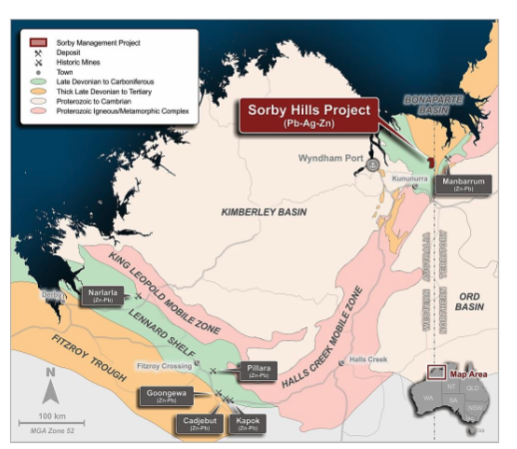

To coincide with the event, Pacifico released an updated presentation that highlights its achievements at its Sorby Hills lead, silver, zinc project located ~50 kilometres north east from Kununara.

For those unfamiliar with the story, Pacifico is progressing Australia’s largest undeveloped near-surface lead-silver-zinc deposit.

This is a near-surface lead-silver-zinc deposit held within a series of structures referred to as ‘Mississippi Valley’ deposits which can be prolific producers of base metals such as zinc and lead.

Sorby Hills is a potentially highly economic base metal deposit with shallow open-pittable mineralisation from 20 metres to 100 metres in depth, simple mineralogy allowing for low-cost beneficiation before plant treatment, robust metal recoveries, high silver credits and existing sealed roads to the nearby Wyndham Port.

For Pacifico’s Sorby Hills Project, all roads lead to fast tracked production.

Pacifico has a 75% stake in Sorby Hills. The other 25% is owned by Henan Yuguang, China’s largest lead smelting and silver producer.

Pacifico investors should note that Henan Yuguang is contributing 25% of all project expenditure and during discussions with MD Simon Noon last year made clear its intentions of securing supply of mineral concentrate to feed into its operations.

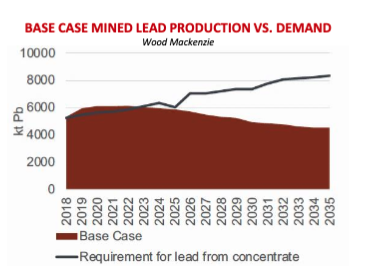

Lead is important in this equation, particularly as demand continues to increase on the back of rising energy storage solutions.

However, stock of short-term refined lead is close to record lows, with a deficit for mined lead without new supply predicted to hit in 2023.

Lead is also required for Start-Stop technology (SSV), which contains 25% more lead. Forecasts show approximately 50% of all new vehicles will be SSVs by the end of 2020.

The project

The deposit size at Sorby Hills is expected to grow significantly as extensions and other targets outside of the main defined deposits are drilled and added to the resource base.

Pacifico is working towards an optimised PFS in the second quarter 2020 and is targeting a substantial increase in mining rate following highly successful drilling and a resource inventory and classification increase in 2019.

You can read about the latest drilling results in our previous article:

Read: Pacifico’s Phase 111 drilling returns robust results

The company holds a Global Resource of [email protected]%Pb equivalent (3.7%Pb,39g/tAg) and 0.5% Zn from 20 metres below surface and open along strike and down dip.

The Resource size and confidence level is substantially increasing with each drilling program.

Looking forward

Pacifico expects to make excellent headway in 2020. And is on track to produce a Definitive Feasibility Study (DFS) in 2021.

The following graphic is what investors can expect from Pacifico moving into Q2 2020.

The next few months should offer up some defining moments for the company as it continues its hard work at Sorby Hills.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.