Pacifico Minerals updates market on polymetals portfolio

Published 02-JAN-2018 15:04 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Pacifico Minerals (ASX:PMY), an ASX-listed junior metals explorer, has published an update on its impressive array of resource projects spread across some of the most prospective regions in the world.

Spanning multiple continents, the company’s portfolio boasts considerable polymetallic potential which could prove profitable as green technology continues to ignite metals market worldwide.

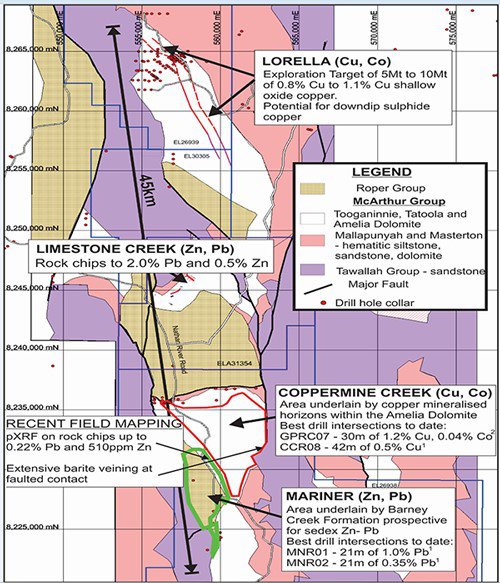

In Australia, PMY is advancing its Borroloola West project in the Northern Territory as part of a Joint Venture with Sandfire Resources (ASX:SFR). The Borroloola West project is particularly interesting because of its close proximity to the world’s largest producing zinc/lead mine, thereby giving PMY an increased chance of discovering a world-class Resource once it completes the necessary exploration work.

In Colombia, PMY is progressing a project that sits in the southern part of the prolific Segovia Gold Belt and is characterised by a number of operational, artisanal-scale adits — geological formations that have consistently supported high-grade polymetallic deposits. Given the early geological work already completed by PMY, the Berrio Gold Project has the potential to provide a steady flow of gold at amenable cost profiles.

However, it is early stages here and investors should seek professional financial advice if considering this stock for their portfolio.

Latest developments at Pacifico Minerals

PMY has extensive plans for drilling and exploration in future, following a programme of reconnaissance geology and rock chip sampling at its Berrio Gold Project. In tandem, PMY has announced an initial exploration target for oxide copper mineralisation at its Lorella Project in the Northern Territory.

Source: Pacifico Minerals

Lorella: oxide and primary copper (cobalt)

The air core programme at Lorella intended to test strike extensions of previously intersected oxide copper mineralisation, and for indications of significant down-dip primary sulphide mineralisation, is now planned for post-wet season 2018 ahead of reverse circulation (RC) and diamond drilling.

Later next year, PMY plans to establish oxide copper Inferred Resources having had last year’s programme cut short by seasonal rain. The company has an exploration target of 5 to 10 million tonnes of 0.8 per cent copper to 1.1 per cent oxide copper at Lorella.

Mariner: zinc – lead

The Barney Creek Formation is host to the world-class McArthur River zinc-lead deposit and is therefore considered a strong candidate for the discovery of further zinc-lead deposits.

Diamond drilling in 2017 at the Mariner Prospect established the presence of the Barney Creek Formation carbonaceous and pyritic shales and siltstones — two features that are likely to be conducive to high-grade mineralisation.

Recent geological mapping and portable X-Ray Fluorescence instrument reconnaissance has identified anomalous lead and zinc rock chip geochemistry (values to 0.21 per cent lead and 510ppm zinc), confirming the prospectivity of the sub-basin of the Barney Creek Formation.

PMY will explore this opportunity further in 2018 and intends to declare diamond drill targets in the foreseeable future.

Coppermine Creek: copper – cobalt

According to PMY, copper mineralisation is extensive, stratabound and gently dipping, with large areas where the depths of this layer are at only 50-250 metres depth. This was confirmed by diamond drilling in September 2017, which intersected copper mineralisation over significant widths.

In addition, anomalous cobalt has been intersected in previous drilling. GPRC07 contained 30 metres of 0.04 per cent cobalt (and 1.2 per cent copper).

Limestone Creek: zinc – lead

Rock chip sampling has obtained values of up to 2.0 per cent lead and 0.49 per cent zinc over a strike length of one kilometre. The values are obtained from ferruginous and gossanous material within the Amelia Dolomite, which in this area comprises dolomite, ex-evaporite beds, carbonaceous shale, conglomerate, grits and sandstone.

PMY expects to see a key license (ELA 31354) to be granted in the first quarter of 2018, thereby adding further exploration targets to its developing Resource portfolio.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.