Pacifico completes successful drilling campaign at Sorby Hills

Published 10-DEC-2019 11:29 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

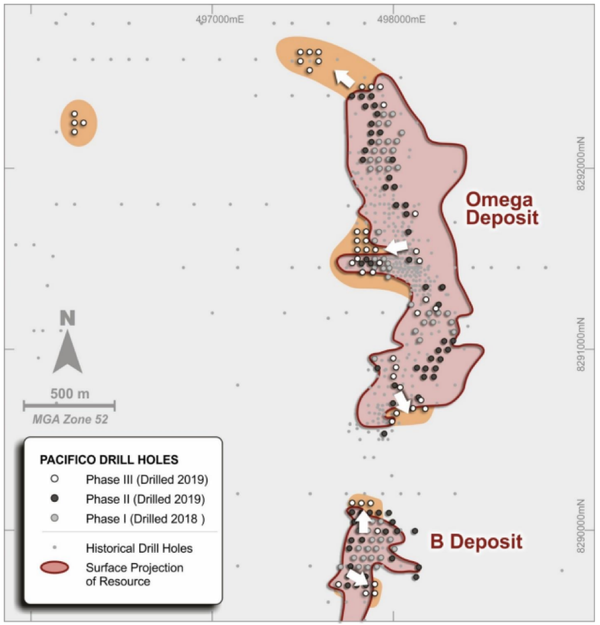

Pacifico Minerals Limited (ASX:PMY) has completed the Phase III expansion and exploration drilling campaign at its 75% owned Sorby Hills Lead-Silver-Zinc Project 50 kilometres north-east of Kununurra in Western Australia.

This exploration program consisted of 49 reverse circulation (RC) drill holes across a distance of 3265 metres.

A total of 526 one metre intervals have been submitted to the laboratory with results anticipated in January 2020.

Rock chip logging suggests that the new results will support the geological model, with pXRF field data indicating that extensions to the southern portion of B Deposit and south east, west and north of Omega Deposit are likely following the return of lab assays.

Providing further encouragement, four shallow wildcat holes all intersected mineralisation in the regolith zone.

To put these developments into perspective, Pacifico had established a mineral resource estimate earlier in the year of 36 million tonnes at 4.7% lead equivalent and 0.5% zinc.

These drilling results will feed into a revised mineral resource estimate in 2020.

Early indications suggest key objective have been met

Phase III commenced in mid-October 2019 with the objective of increasing confidence and increasing Inferred Resources while also converting existing Inferred Resources to higher confidence Indicated status, as well as following up on historic intercepts.

The B Deposit and Omega Deposit as illustrated below were a key focus.

All RC drill holes have now been geologically logged and sampled.

Logging and pXRF testing of rock chips provided a qualitative guide to mineralisation and indicate that significant intersections have been obtained.

A subset of 526 one metre samples were selected from a total of 3,265 metres drilled and dispatched for analysis, and assay results are expected in January 2020.

While laboratory assay data is still required to confirm the drilling results, management discussed some of its observations from rock chip samples that were logged during the process.

Test holes at B Deposit indicated strong and continuous mineralisation at shallow depths of between 30 metres and 55 metres.

The southern extension of the Omega Deposit indicated conformable mineralisation.

Management was more specific with regard to the northern extension of the Omega Deposit, highlighting that there were indications of mineralisation of varying thicknesses and minor zinc associated with the near surface weathering profile.

There were also additional significant intervals of lead at depths ranging between 80 metres and 100 metres.

The westward extension of Omega produced the highest density of drill holes for phase III, yielding significant mineralisation indications at shallow depths of between 10 metres and 20 metres.

The eastward extension and infill showed that mineralisation is open to the east at increasing depths.

Extension drilling suggests potential for new discovery

Four exploratory holes were drilled to the extreme west, and these intersected mineralisation at shallow depths, suggesting there could be significant mineralisation discovered.

This area has now been prioritised as a key target for diamond drilling in upcoming exploration.

In summing up these developments, managing director Simon Noon said, ‘’Collectively, the field observations are indicative of a successful drilling campaign likely to support further conversion of Indicated and Inferred resources to higher classes of classification and to replace Inferred resources whilst building on the potential of new deposits to be found to the west.’’

Further promising news emerged following a re-analysis of dewatering data which has shed new light on the hydrology of the I Deposit area

Although too early to present any hydrogeological results, management is in no doubt that there will be a step improvement in the predictive understanding of local hydrogeology.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.