Outstanding drilling results by Birimian point to extension of high-grade lithium resource

Published 31-AUG-2016 18:16 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

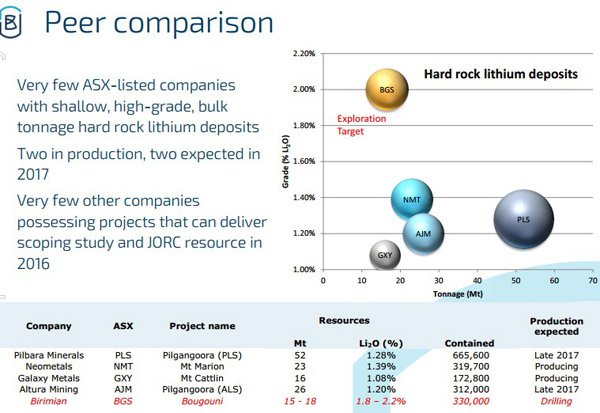

An announcement on Wednesday by Birimian Gold (ASX:BGS) in relation to drilling results from the West Zone of its Bougouni lithium project in southern Mali suggests there is scope for additional resource tonnages, particularly in light of the high grades delineated.

These included 56 metres grading 1.91% lithium dioxide including 8 metres grading 2.35%. The wide zones intersected combined with quality grades suggests the company is better positioned than many other players in the sector to progress a commercially viable project.

Given the license tenement spans an area of 250 square kilometres there is the potential to substantially increase the previously estimated exploration target at the Goulamina deposit within the broader Bougouni lithium project.

As a backdrop, in March Birimian estimated an initial exploration target at Goulamina in the range of 15 million tonnes to 18 million tonnes at grades between 1.8% and 2.2% lithium dioxide, representing contained lithia in a range between 270,000 tonnes and 396,000 tonnes.

Management highlighted at the time that the quantity and grade of the exploration target was conceptual in nature and that further exploration would need to be undertaken to gain a better understanding of the deposit.

Developments since then have been extremely positive resulting in the company’s share price increasing from circa 6 cents to a high of 42 cents in mid-May.

Since then it has traded in a range between 25 cents and 35 cents, but today’s news has seen it rally 15% to trade as high as 33.5 cents. Given that latest drilling has delineated the widest and highest grade lithium mineralisation at shallow depths, the potential for further news flow driven share price momentum appears strong.

However, it should be noted that prior share price performance is not an indication of future trading patterns and this should not be used as a basis for an investment decision.

While management’s initial conservative approach should be commended in a sector that at times can run on hype, the company couldn’t be blamed for assuming a more confident stance based on developments since March.

With more drilling results to be announced over coming weeks in relation to exploration activity in the West Zone this is definitely a stock to watch, and as demonstrated below in comparing other players in the sector the superior grades being defined in Birimian’s resource are a standout feature.

Shallow, continuous, high grade lithium mineralisation over a strike length of approximately 700 metres has been defined at the Main Zone, and deeper drilling has intersected additional broad zones of visible mineralisation beyond 150 metres down dip.

Management highlighted that the broad width and moderate dip of the mineralised body should result in highly favourable low waste to ore strip ratios during mining.

With all drill core samples having been dispatched for geochemical analysis and analytical results pending there is the potential for the company to deliver a double dose of good news in coming weeks.

There are also potential share price catalysts in the coming months with the results of recent drilling potentially providing the necessary data for Birimian to establish an initial JORC compliant resource at Goulamina.

Such a development would support the scoping study which management expects would be completed before year-end.

As a highly speculative stock operating in a region with sovereign risk investors need to exercise a high degree of caution prior to investing in the company. It should also be noted that exploration results achieved to date are not an indication of what may be achieved in the future and any forward-looking statements regarding estimates and assumptions should not be used as a basis for an investment decision.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.