Nusantara’s Awak Mas Project emerging as centre of new goldfield

Published 01-FEB-2019 11:27 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Since snapping up the Awak Mas Gold Project in 2017, ASX junior Nusantara Resources (ASX:NUS) has wasted little time in firming up its assets.

The Awak Mas Gold Project, which sits in Indonesia’s South Sulawesi region, is one of just a few undeveloped gold projects within the Asia-Pacific region. The project, which has all approvals in place for development, has a 1.1 million ounce Ore Reserve and a 2 million ounce Mineral Resource.

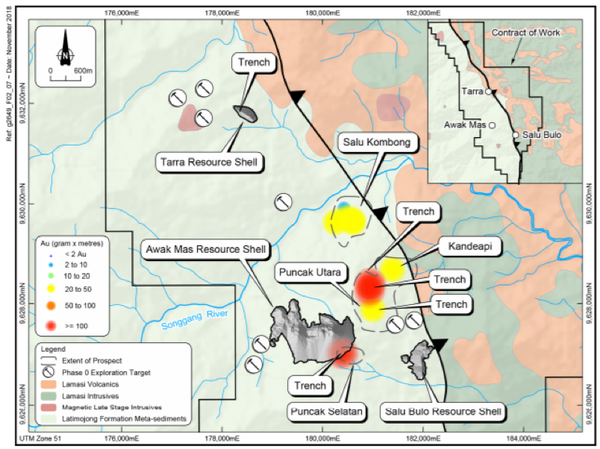

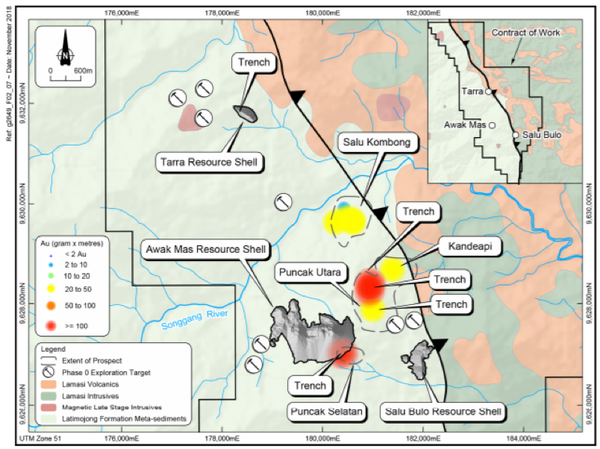

In late December, NUS released high-grade results from near mine exploration. These clearly demonstrate the Awak Mas deposit is the at centre of a goldfield that hosts a number of significant mineralised zones.

Most recent results have included wide zones of 28 metres at 1.2 grams per tonne gold and 37 metres at 2.3 grams per tonne gold, as well as a narrower high-grade width of 11 metres at 2.6 grams per tonne gold.

These results come from the Puncak Selatan, Puncak Utara and Tarra prospects, which form part of the broader Awak Mas project, highlighting the mineralisation potential of these areas.

Backed by a bullish gold outlook, these latest exploration results continue to demonstrate the potential of the Awak Mas Gold Project to grow organically and provide potentially high-grade satellite operations to augment production from the existing deposits.

The exploration program will now be guided by significant new information provided through the re-processing of historic geophysical data which clearly demonstrates the potential for further discoveries across the entire contract of work area.

To date, over 1000 metres of near mine trenching has been completed, which has yielded significant results. The current exploration focus is to follow up on historical exploration of numerous near mine prospects within a 2 kilometre radius of the planned processing plant, with the aim to extend the proposed 11-year mining operation.

A positive Definitive Feasibility Study (DFS) completed in October — which coincided with an 11% increase in ore reserves and the identification of significant near mine mineralisation — suggests that the project is economically robust.

The DFS supports an initial 11-year project producing approximately 100,000 ounces per annum at relatively low all in sustaining costs of US$758 per ounce. Based on current gold price, this means that the project is generating margins of around US$650/ounce.

The project is supported by extensive infrastructure, with access to low cost grid power, port facilities 45 kilometres from the project, and multiple daily flights from the city of Makassar.

The island of Sulawesi itself has a long history of mining and provides ready access to experienced contractors, services and work force for the construction and operation of the mine.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.