Nusantara expanding low cost, long life gold project

Published 19-FEB-2019 12:30 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Asia‐Pacific gold development company Nusantara Resources Ltd (ASX:NUS) has commenced a vital drilling campaign at the Puncak Selatan near-mine prospect part of the group’s Awak Mas Gold Project in South Sulawesi, Indonesia.

An initial six-hole drill program totalling 1600 metres at Puncak Selatan will provide important information as to the prospectivity of the broader area.

This has the potential to assist the company in meeting its dual strategy of expanding the two million ounce resource and bringing the project into production.

On this note, managing director, Mike Spreadborough said, “The commencement of near mine exploration is the first step in identifying additional resources that have the potential to be processed at the proposed processing plant and add further value to the long life, low cost Awak Mas Gold Project.”

Promising trenching results at Puncak Selatan include narrower high-grade widths such as 5 metres at 2.3 grams per tonne gold and broad sections such as 35 metres at 1.2 grams per tonne gold, including one metre at 4.7 grams per tonne gold.

Nusantara’s share price has increased approximately 50% since December, and it could be argued that further success at Puncak may see this positive momentum sustained.

Improving project value is the key

Increasing resources and reserves would effectively create a more economically viable project paving the way for project financing and plant construction.

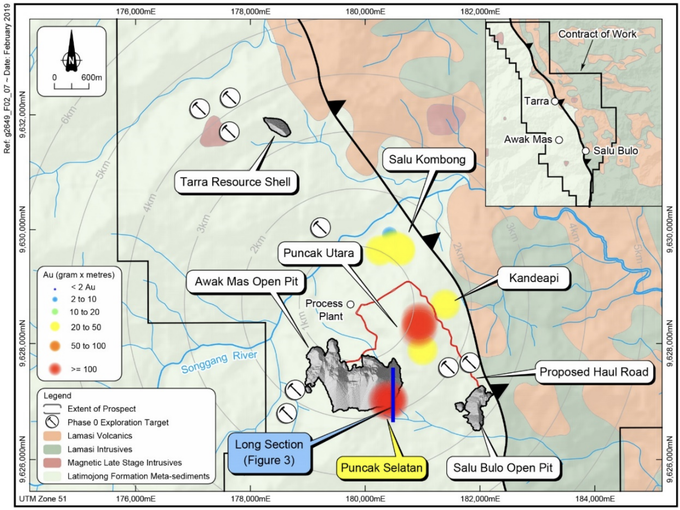

Recent field exploration has focused on numerous near-mine prospects within a two kilometre radius of the planned processing plant with the aim of enhancing and extending the proposed eleven-year mining operation.

The area being targeted for drilling can be seen to the south-east of the Awak Mas open pit deposit where the company plans to process ore from the current resource.

Exploration success during the upcoming drilling campaign would be a significant development for the company as it would provide scale, as well as adding mine life and potentially reducing production costs.

Awak Mas has a rich history

Discovered in 1988, the project has over 135 kilometres of drilling completed in over 1100 holes.

To date, over 1500 metres of near-mine trenching has been completed, and the project has a 1.1 million ounce Ore Reserve and 2.0 million ounce Mineral Resource.

Nusantara’s development strategy is for construction of a low strip ratio open pit operation with CIL (carbon in leach) ore processing expected to deliver high gold recoveries.

Environmental approval has been received, and the project is close to established roads, ports, airports, and grid power.

In tandem with bringing the project into production, Nusantara intends to expand the resource in order to support a mining operation beyond the initial project life of 11 years.

Multiple drill-ready targets have already been outlined, extending from the three main deposits and in other areas of the 140 square kilometre site.

Near surface mineralisation at Puncak Selatan

The Puncak Selatan prospect was identified as a priority drill target given the significant surface mineralisation and its proximity to the planned Awak Mas open pit.

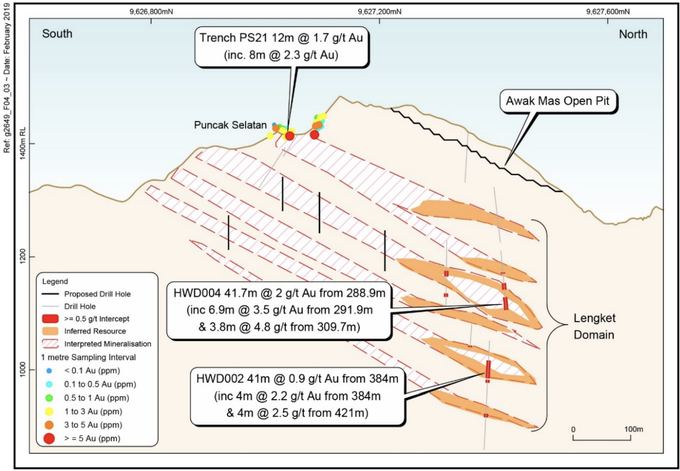

The drilling program will test the possibility that the Awak Mas eastern mineralisation (Lengket domain) could extend up-dip as the Puncak Selatan prospect surface expression and provide information to assist in confirming the geological model in the near-mine area.

An initial six-hole drill program totalling 1600 metres at the Puncak Selatan prospect has commenced.

The following is the Puncak Selatan prospect schematic long section showing proposed drill holes and interpreted continuation of the recent Awak Mas eastern highwall discovery (Lengket domain).

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.