Nusantara approaching development stage at Awak Mas

Published 31-JUL-2019 10:23 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As the Australian dollar gold price continues to make new highs, now pushing up towards the $2100 mark it may be well worth considering emerging producer, Nusantara Resources Ltd (ASX:NUS).

The group has a sizeable resource and development could commence in 2019.

Nusantara’s flagship project comprises the 1.1 million-ounce Ore Reserve and 2.0 million ounce Mineral Resource Awak Mas Gold Project located in South Sulawesi, Indonesia.

The project has over 135 kilometres of drilling completed in over 1,100 holes.

Nusantara has a two-fold development strategy involving the construction of a modern, low strip ratio open pit operation with ore processed by standard carbon-in-leach (CIL) processing delivering high gold recoveries.

Environmental approval has already been received for the project, which is favourably located in non-forestry land close to established roads, ports, airports, and grid power.

Nusantara’s second strategy is to grow the resource base and support a mining operation beyond the initial project life of 11 years.

Multiple drill-ready targets have already been outlined, extending from the three main deposits across an area of 140 square kilometres.

A key focus for the September quarter of 2019 is to advance the funding process for the development of the Awak Mas Project.

While this represents a significant milestone for the company, it is worth examining the progress made in the June quarter, and on this note management provided a comprehensive update on Wednesday.

Metallurgical testing delivers positive results

During the quarter, detailed metallurgical testing and post-definitive feasibility study (DFS) Phase 2 test-work was completed.

The average gold recoveries showed an improvement in the test-work used as the basis for the DFS, which increased the overall recovery assessment for the project from 91.1% to 93.3%.

Historical gravity and whole ore leach test-work was conducted using different parameters to the post-DFS Phase 2 test-work (e.g. coarser grind size, no gravity recovery, lower cyanide addition), which contributed to the lower recoveries seen in these earlier tests.

The post-DFS Phase 2 program results validated the design parameters selected for the DFS and provides a more robust basis for the prediction of gold recovery.

As highlighted in the DFS, management believes there is potential for the Awak Mas Gold Project to realise a grade uplift when the ore body is mined.

This would have a positive impact on project economics, potentially providing share price momentum.

Nusantara has traded strongly over the last two months with its shares increasing nearly 50% to touch on 20 cents on three occasions since mid-June.

It appears that a break above that resistance point could trigger a further rerating.

Exploration focus is on Salu Bulo

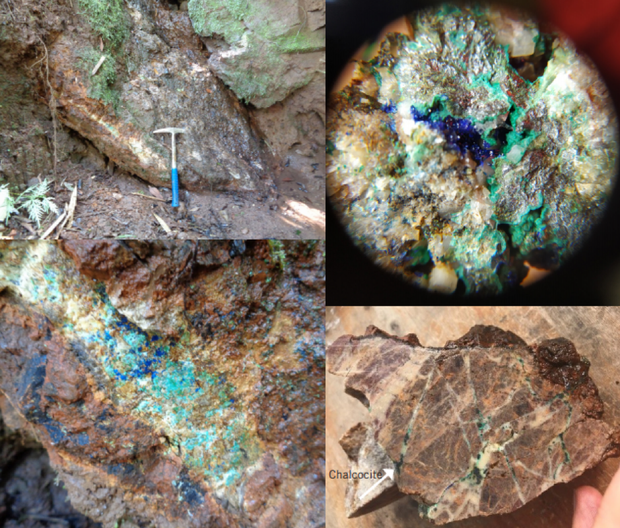

There has been a significant development at the Salu Kombong prospect where further outcrop sampling has been undertaken.

This has been focused on previously reported copper and gold occurrences, confirming the possibility of a porphyry style mineralised system as indicated in the following samples.

This fits well with the recent geophysics concept of Awak Mas being part of a large scale Intrusive Related Gold System.

Nusantara is currently assessing the significance of this development, and the company will be exposing the mineralisation via mechanical excavation in the September quarter ahead of confirmatory diamond drilling.

Two drill holes were completed during the quarter in the target quarry site identified in the DFS.

The rock characteristics have been confirmed as suitable for road and tailings storage facility development.

An additional four drill holes have been planned for the September quarter to confirm tonnage ahead of project development.

Exploration activity for the quarter focused on a ground-survey geophysics program designed for the highly prospective Salu Bulo area where significant mineralisation extension potential exists.

Salu Bulo is within a three kilometre radius of the planned Awak Mas Gold Project.

Mineralisation in the area has demonstrated elevated gold grades compared with other project areas and mineralisation trends extended into large untested areas.

The Salu Bulo resource is 3.6 million tonnes grading 1.6 g/t gold containing nearly 200,000 ounces of gold.

Based on recent structural interpretations recognised from the Puncak Selatan drilling program, this work tested the interpretive signatures as derived from the reprocessed historic aeromagnetic data.

The ground based electrical geophysics program was completed over a three kilometre strike length covering the Salu Bulo deposit and potential strike extension structures to the north and south of the existing deposit.

A combination of exploration results to be released in coming months, as well as a transitioning of Awak Mas into a development project as suitable financing is procured could well see shares in Nusantara hit new highs in the second half of 2019.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.