NSL on track with first iron ore sale in India

Published 29-OCT-2014 12:14 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

NSL Consolidated Limited (ASX: NSL) has finalised its first sales agreement for iron ore in India.

NSL will receive $230,000 AUD, ex mine gate, for the sale of 5,000 tonnes of iron ore at +45% Fe purity.

The news coincides with a favourable backdrop in India’s domestic iron ore industry, with domestic demand for steel tipped to increase 3.4% in 2014 to 76.2 million tonnes (Mt), while domestic iron ore supply is expected to experience a shortfall of 10 Mt – 15 Mt due to mine closures in several Indian states causing declines in production. The re-opening of these mines remain uncertain.

NSL, currently with a market cap of approximately $7M AUD, targets iron ore in the Indian state of Andhra Pradesh. Projects Kuja, AP23 and Mangal are located in the Kurnool district of Andhra Pradesh. The AP14 magnetite project is situated in the Karimnagar district of Telangana (Andhra Pradesh).

More sales with other buyers are currently being negotiated, targeting 50%-55% Fe purity, an iron ore grade that NSL believes will continue to show robust demand.

NSL believes that if the sale of +45% Fe continues at current levels, it may be able to exceed planned production and plant yield by utilising the sale proceeds. Current estimates by NSL target the production of 7000 t per month of saleable iron ore.

Stockyard dry beneficiation aiming to ramp up production

NSL is gearing up for more sales volume over the next six months.

Its dry beneficiation plant currently produces approximately 50% Fe grade product for local sale in anticipation for the future. The 7000t per month target of saleable product currently would be revised upwards as a result of increased interest from additional buyers.

The dry beneficiation plant at NSL’s stockyard in the Kurnool district of Andhra Pradesh restarted in early September. The stockyard currently produces 52% Fe product from 28% ROM feed (run-of-mine: raw material from the mine for processing). Current production levels translate to a production cost of $28 AUD per tonne.

Third party use of NSL’s plant and facilities can potentially increase production significantly at the stockyard. NSL has identified third party mines within close distance to its beneficiation plant that it can process material from. ROM material from third party mines is currently being transported to NSL’s stockyard for processing, whilst awaiting Government issued royalty passes.

Domestic iron ore outlook continues to favour NSL

India is currently in the grips of an iron ore supply shortage due to mining restrictions and mine closures in several states. While India is traditionally a major iron ore exporter, ranking third globally in recent years, the current supply shortage has meant that India has become a net importer of iron ore, with NSL the only foreign owner operator of iron ore mines in India.

Iron ore production in India has been on a steady decline in recent years. Data from Espirito Santo Investment Bank shows that production in India has declined from 218.5 Mt in 2010 to a low of 135.8 Mt in 2013.

The political landscape in India has been favourable to NSL. The crackdown on illegal mines were one of the reasons behind the closure of 26 mines in Karnataka and Goa. Mine closures have also occurred in other states. Additionally, NSL has received government support at its AP14 project to fast track mining targets as they come to light.

On the demand side, India is set to increase demand in 2014 and 2015 on the back of pro-business reforms by the incoming government.

According to the World Steel Association, ‘India’s outlook is improving following the election of a new government which is promising pro-business reforms.’ It further added that demand in 2015 would be even higher than 2014 with conditions favouring 6% growth. NSL believes the Indian steel industry is anticipated to triple over the next ten years.

Global iron ore price under pressure

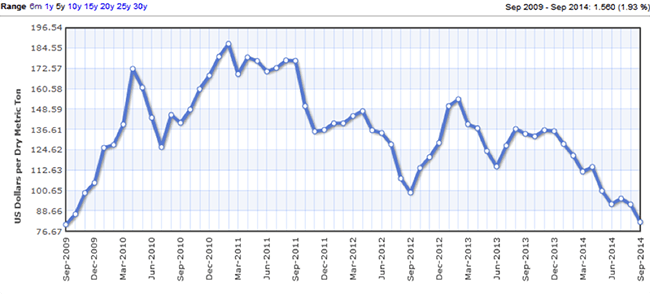

On a global scale, the iron ore price has been on the decline since 2011, when it hit a high of $184 per tonne compared to the current price in the mid $70s.

Iron Ore Monthly Price – US Dollars per Dry Metric Ton, Sep 2009 – Sep 2014

The decline in demand from China as well as global oversupply are placing downward pressure on the metal. The iron ore bear market precipitated from global oversupply by mining giants Rio Tinto, BHP and Vale.

In contrast, the domestic Indian iron ore price is much higher than the imported price. Domestic producers of iron ore earn $56 AUD per tonne of 50% Fe product, which is a substantial premium to the international imported price.

Such has been the high demand for iron ore in India that the relatively higher Indian iron ore price has not stopped NMDC, a state owned iron ore producer, from experiencing 23% sales growth year on year in August 2014.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.