NSL bags cost savings for phase two plant

Published 21-MAR-2016 13:05 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

NSL Consolidated (ASX:NSL) has managed to negotiate a 25% saving on its phase two beneficiation plant in India, with the payment timeline also pushed out to avoid a capital crunch.

It told the market today that as the result of negotiations with Chinese fabricators that it had managed to bag its phase two plant for just over $US1.05 million ($A1.38 million), a 25% saving on previous estimates.

It also managed to push the payment timeline out to February next year, with a staged payment plan within that timeframe outlined.

Previously, NSL was on the hook for 100% of the payment before the beneficiation plant was shipped out to India.

NSL had previously flagged talks between the company and Chinese fabricators on a cost-reduction, taking advantage of a well-publicised downturn in manufacturing capacity in Chinese fabrication yards.

At the end of the talks, Huate Magnetism was selected as the fabricator of choice – with NSL hinting that the play from Huate was more strategic than a simple fabrication contract.

“This agreement with Huate further supports the confidence in the company’s Indian iron ore projects and the larger scale Indian iron ore industry, an industry in [which] Huate desires to gain a position,” NSL said in a statement.

The plant will be shipped off to India in three stages, with on-site civil work to start immediately.

Onsite construction of the plant is slated for May, with NSL telling shareholders the plant would be cashflow positive in the fourth quarter.

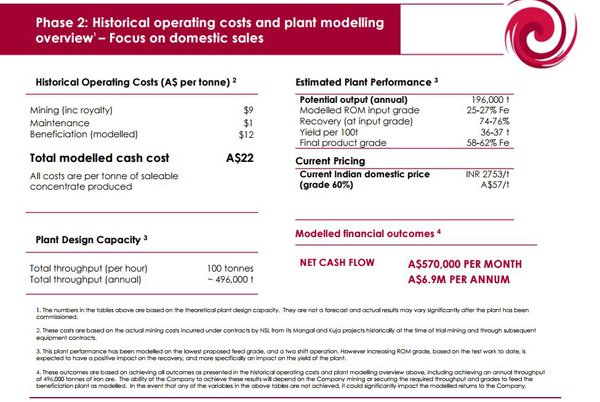

The plant is slated to have a cash-cost of $22 per tonne, with ex-gate sales price of $52/t.

What NSL Consolidated is doing

The second phase plant is one of two plants NSL is using to beneficiate lower-grade iron ore, bringing it up to a saleable grade.

The plant will be able to take low grade iron ore and improve it to achieve grades between 58% and 62%, with a production capacity of 200,000 tonnes per year.

Phase two economics for NSL Consolidated (ASX:NSL)

The construction of the wet plant is being underpinned by offtake agreements penned with industrial giants JSW Steel and BMM Ispat.

NSL has been hard at work tying up various offtake deals for its phase one, phase two, and specialised ‘lump’ product in recent times, but several of these deals are non-exclusive meaning NSL has scope to pursue a better deal should one come up.

The plant will be placed at its operation in the Indian state of Andhra Pradesh, which NSL continues to work with.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.