Nickel one to watch as it edges towards a 5 year high

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

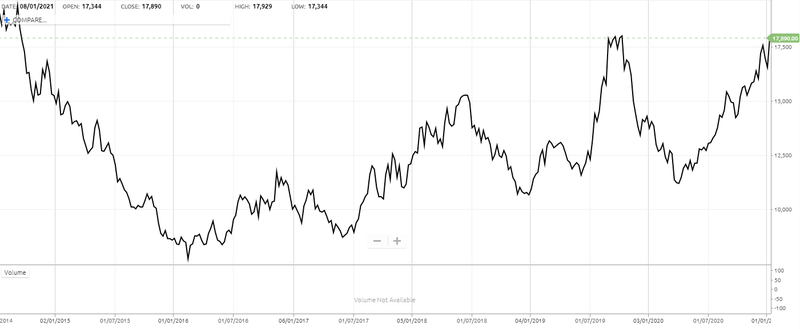

Nickel is inching closer and closer towards its 5 year high, as a resurgence influenced by demand from China and a more positive iron ore outlook have pushed prices to US$17,891 per tonne, just shy of the US$18,600 per tonne high in September 2019.

The high that was struck at the end of last week represented a 62% rebound since lows experienced in March last year when China was deep in its struggles with COVID-19.

This is great news for ASX-listed nickel hopefuls, who are currently looking down the barrel of a potentially bountiful 2021.

Galileo buckling down for drilling

High on this list is Galileo Mining Ltd (ASX:GAL), a well-funded, systematic explorer focused on furthering its understanding of large scale magmatic nickel-copper deposits identified in the Fraser Range, as well as exploiting the high-grade nickel-copper-cobalt resources at its Norseman project.

Galileo’s update provided on December 15, 2020 discussed locked-in drilling and field programs at both the Fraser Range and Norseman Projects, flagging positive early news flow from such activities in the early months of 2021.

The company has spent recent years undertaking EM surveys and preliminary drilling campaigns that while necessary, generally identify targets rather than delivering discoveries.

Early 2021 is likely to bring in material results as Galileo’s drilling campaign kicks into gear again.

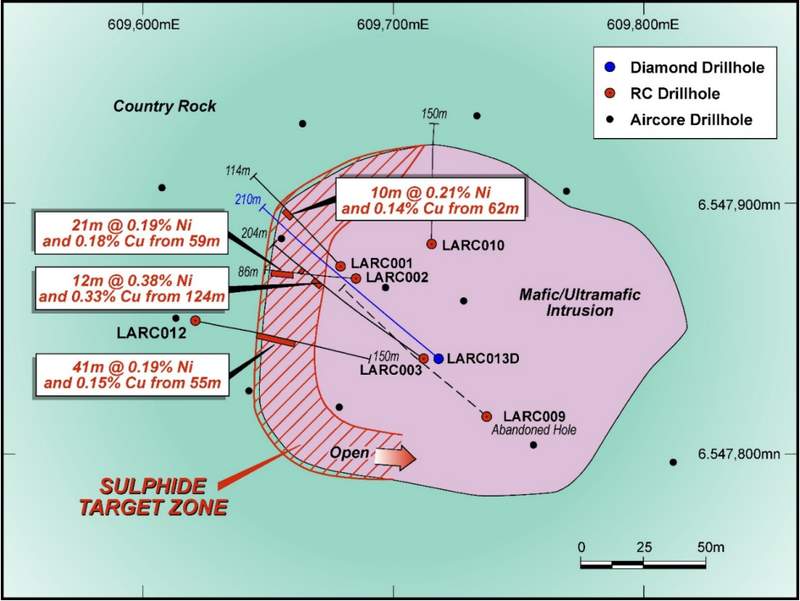

Reverse circulation (RC) drilling of priority Fraser Range nickel targets at the Lantern East and Lantern South prospects have been scheduled for mid-February 2021, and these have the potential to generate significant interest in the company.

Approximately 1,200 metres of drilling is planned to test electromagnetic (EM) conductors at Lantern East, while also examining deeper sulphide mineralisation at Lantern South.

Galileo also anticipates drill testing its Norseman Project for nickel sulphides in the June quarter of 2021.

This is located 50 kilometres from prominent nickel deposits at Cassini, Mariners and Wannaway.

Norseman already has a high-grade cobalt resource of 25 million tonnes with 26,600 tonnes of contained cobalt and 122,500 tonnes of contained nickel.

The project contains 278 square kilometres of prospective ground at the southern end of the prolific Norseman-Wiluna Greenstone belt, and it’s the potential for a large nickel sulphide discovery that interests Galileo in the project.

A new nickel sulphide discovery in this area would be sure to create value.

Pursuit Minerals finalises acquisitions in prosperous Julimar Complex

Next on our nickel watchlist is Pursuit Minerals (ASX:PUR), a mineral exploration and project development company that has acquired two highly prospective and complementary projects in Tier I jurisdictions in Western Australia.

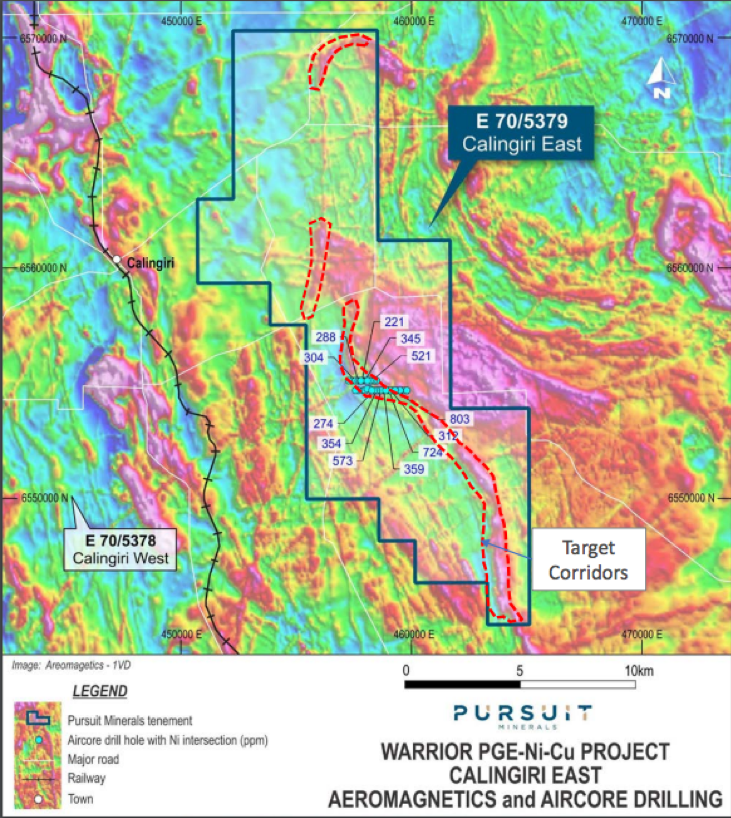

First is the Warrior PGE-Nickel-Copper Project, consisting of four highly prospective exploration licences in the Julimar Complex, Western Australia.

The Warrior PGE-Nickel-Copper Project covers a series of prominent magnetic anomalies whose magnetic response is similar to the mafic and ultramafic Gonneville intrusion, which has the potential to be the most important deposit of palladium in Australia.

Exploration is underway at Warrior PGE-Ni-Cu Project, and new results suggest there is the potential for mafic-ultramafic intrusions equivalent to the Julimar Complex.

Additionally, a prominent belt of aeromagnetic anomalies over a 14-kilometre strike length on the Calingiri East tenement has the potential to host PGE-Ni-Cu mineralisation.

The company has also acquired the Gladiator Gold Project in Laverton, WA, which is currently undergoing geochemical surveys to define targets for drilling in early 2021.

PUR is well funded, with active exploration programmes planned in the first half of 2021, including EM surveys and drilling across its projects, potentially providing near term catalysts.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.