Nelson Resources eyes off the next Tropicana

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Nelson Resources Ltd (ASX:NES) is a gold exploration company with a portfolio of gold projects located in Western Australia.

The group listed on the ASX in December 2017 and following exploration across a number of its assets, management decided to build a position around its Socrates prospect which yielded promising early stage drilling results.

Phase 2 drilling went on to support management’s view that this was highly prospective territory which was the green light to acquire adjacent and nearby assets on a similar geological trend.

However, before narrowing our focus on the Socrates area which, following the addition of other tenements, is now termed the Woodline project, it is worth examining the company’s other prospects.

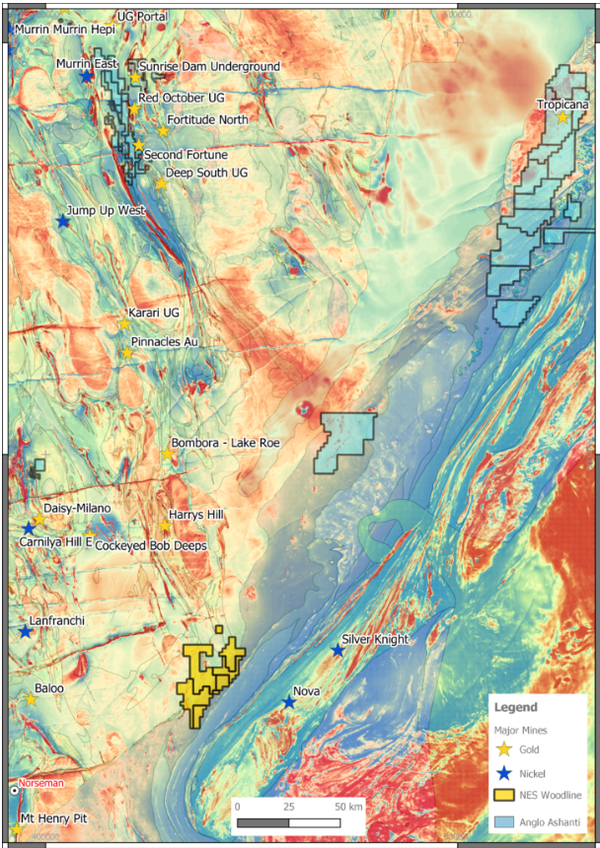

From a broader perspective Nelson’s projects are located within the Eastern Goldfields Superterrane of the Yilgarn Craton, which contains substantial greenstone belts, considered highly prospective for gold mineralisation.

This area is one of the most gold-endowed regions in the world, and mines in the broader region include Paddington (7.4 million ounces), Kanowna Belle (6.4 million ounces), Sunrise Dam (15 million ounces) and Sons of Gwalia (6.8 million ounces).

The Wilga Well Project is located 9 kilometres east of AngloGold Ashanti’s Sunrise Dam Gold Mine, and historical production at the project included 296 tonnes at 43 g/t gold and 650 tonnes at 11.3 g/t gold.

The two other main projects are Yarri and Fortnum, but little recent work has been done at those tenements as management has been focusing on Woodline, its flagship project which it hopes one day will be a Tropicana scale gold deposit.

The reason for projecting a Tropicana style discovery is based on the similar geological trends which can be seen below.

The AngloGold Ashanti/Independence Group Tropicana project is a low-cost operation that is forecast to achieve fiscal 2019 production in a range between 500,000 ounces and 550,000 ounces.

The Woodline tenements (yellow) can be seen in the south-east corner of the map, just to the west of Nova.

To the north-east lies Tropicana, part of a transition zone that has now been identified as a new major Australian gold province known as the Tropicana Gold Belt.

Tropicana gold belt

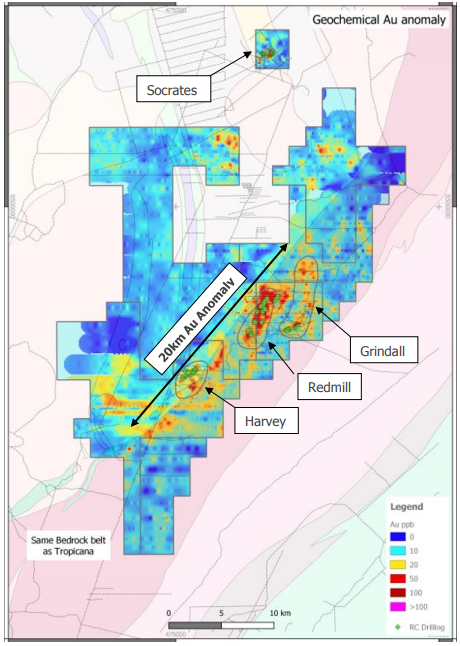

The Socrates prospect is located at the northern part of the project and lies in the Archean greenstone belt which is host to orogenic gold deposits.

Within the Woodline Project, Nelson now has three new prospects, extending the project area to approximately 660 square kilometres.

At this stage, they are individual projects named Socrates, Grindall, Redmill and Harvey with the latter three located at the south-eastern part of the project in the transition zone between the Archean Yilgarn-Craton and the Proterozoic Albany-Fraser orogen which is a belt of the earth’s crust involved in the formation of mountains.

While this gives some background as to the highly prospective geological nature of the Woodline ground, one only has to glance at the numerous star symbols on the Tropicana Belt map to realise that Nelson is definitely in gold territory.

Achievements to date at Woodline

Though Socrates is now just a relatively small part of the overall Woodline Project, it is the area where there has been the most substantial and recent exploration activity, making it a good place to start in terms of appreciating what may lie ahead as Nelson gets busy with the drill bit.

A phase II reverse circulation (RC) drilling campaign conducted in the second half of 2018 identified a gold rich sulphide system at Socrates, a development that resulted in the strike length increasing from 120 metres to 370 metres.

Drill results provided a good mix of wide lower grade intersections and high grade narrower intersections.

These included 192 metres at 0.5 g/t gold from 58 metres and 8 metres at 3.5 g/t gold from about 200 metres.

Importantly, the mineralised system remains open at depth, providing management with a significant degree of confidence regarding the delineation of a much larger resource than initially anticipated.

Combining Nelson’s current work with the integration and re-interpretation of historic work by previous owners (Sipa-Newmont Exploration Limited JV) the exploration program has considerably enhanced management’s understanding of the controls and distribution of the gold mineralisation at Socrates.

The latest drilling has confirmed that the mineralisation consists of a series of multiple stacked lodes, which strike 60 to 70 degrees to the north-east, indicating that the optimal drilling direction is 155 degrees to the south-east.

Management highlighted that none of the holes drilled to date by Nelson or Sipa-Newmont have been best orientated to intersect the mineralisation, providing further confidence that a well-directed exploration campaign could uncover something special.

Acquisition of Woodline data

It was just this week that Nelson acquired an additional data package relating to its Woodline/ Harvey Project from MRG Metals Ltd (ASX:MRQ).

The data includes the results of 789 metres of diamond drilling (5 holes) and 1556 metres of RC drilling (7 holes).

This acquisition includes the core “shed” which is the only diamond drilling conducted in the Woodline Project.

Acquiring this data rather than conducting a costly diamond drilling campaign is strategically beneficial in terms of conserving capital.

The historical expenditure by previous owners was approximately $12 million.

Nelson will combine the acquired data with its current comprehensive data set to better understand the structural setting and lithologies of the eastern Yilgarn margin.

This will better guide the company’s future exploration strategy due to it being proximal to Redmill and Grindall, and it also complements previously compiled data.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.