Nelson identifies gold bearing system at Woodline Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Nelson Resources Limited (ASX:NES) has made a good start in terms of achieving its goal of tracking down the next Tropicana - a prolific gold resource that accounts for a large chunk of IGO’s (ASX: IGO) annual production even though it is majority-owned by AngloGold Ashanti.

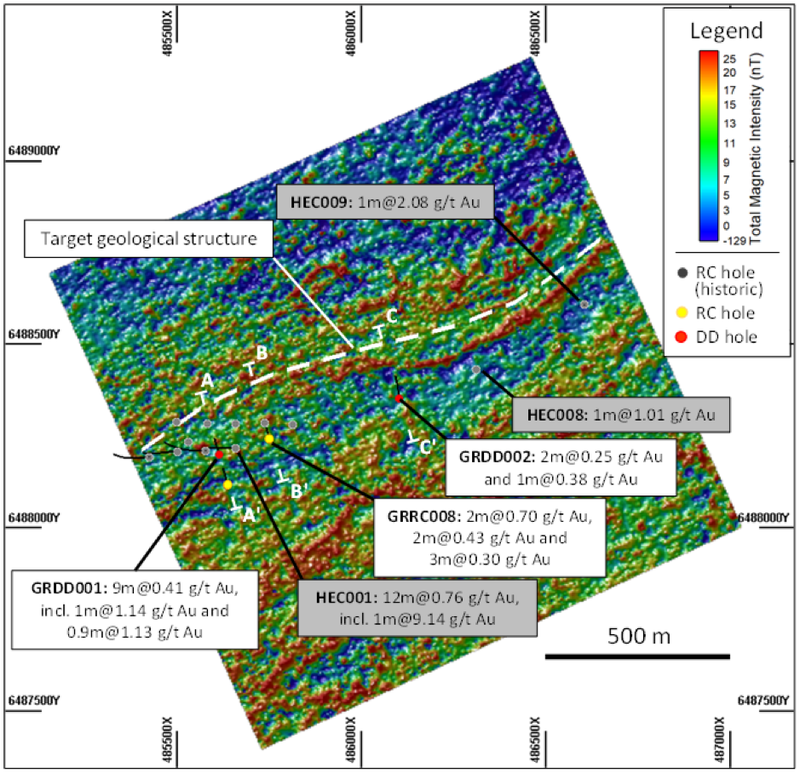

Exploration results from initial drilling at the group’s Grindall Project, part of the Woodline Project in the Fraser Range has identified 500 metres of bedrock gold bearing strike.

Grades are well above background and indicate the presence of a significant gold bearing system.

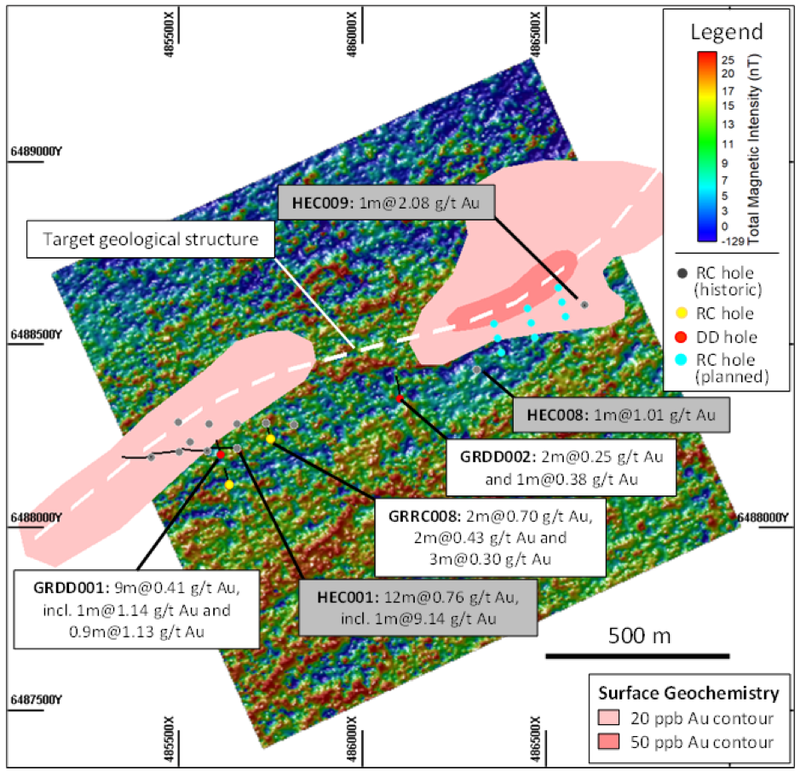

Management said it is pleased with the effectiveness of its targeting methodology, and as a result of this targeting success the company intends to increase its current 6000 metre reverse circulation (RC) program to around 10,000 metres to actively test strike and dip of the Grindall Project whilst also completing RC drilling of Redmill and Socrates West as shown below.

Commenting on the initial results, chief executive Adam Schofield said, “Nelson’s targeting methodology has proven to be an effective way for us to identify and then test gold bearing zones within the 20 kilometre long gold geochemical anomaly we have at the Woodline Project.

“This targeting will produce many new targets within our substantial land package which now includes an additional 680km2 of new tenure and 4 large fault zones.

“Due to the initial success at Grindall we are now considering an additional 4000 metres of drilling in the current campaign to really test the gold bearing structures’ dip and strike.’’

Positioned to directly target gold bearing structure

The company anticipates seeing improved gold intercepts in future drilling at Grindall as it is now able to directly target the gold bearing structure.

From a more detailed perspective, the maiden diamond drill program at Woodline has provided Nelson with valuable information about the mineral system at Woodline, with broad zones of alteration and strike lengths of over 500 metres of the target gold-bearing mineralised structure intersected in the drilling.

This has provided management with important geological information that will assist in future exploration, and management intends to use similar methods to those used in the course of the Tropicana gold discovery.

Assay results included 9 metres at 0.4 g/t gold from 81 metres, including 0.9 metres at 1.13 g/t gold from 82 metres.

Nelson also identified mineralisation in the course of deeper drilling with gold grading approximately 0.4 g/t from 130 metres.

The following is a snapshot of drilling to date.

Walking in the footsteps of giants

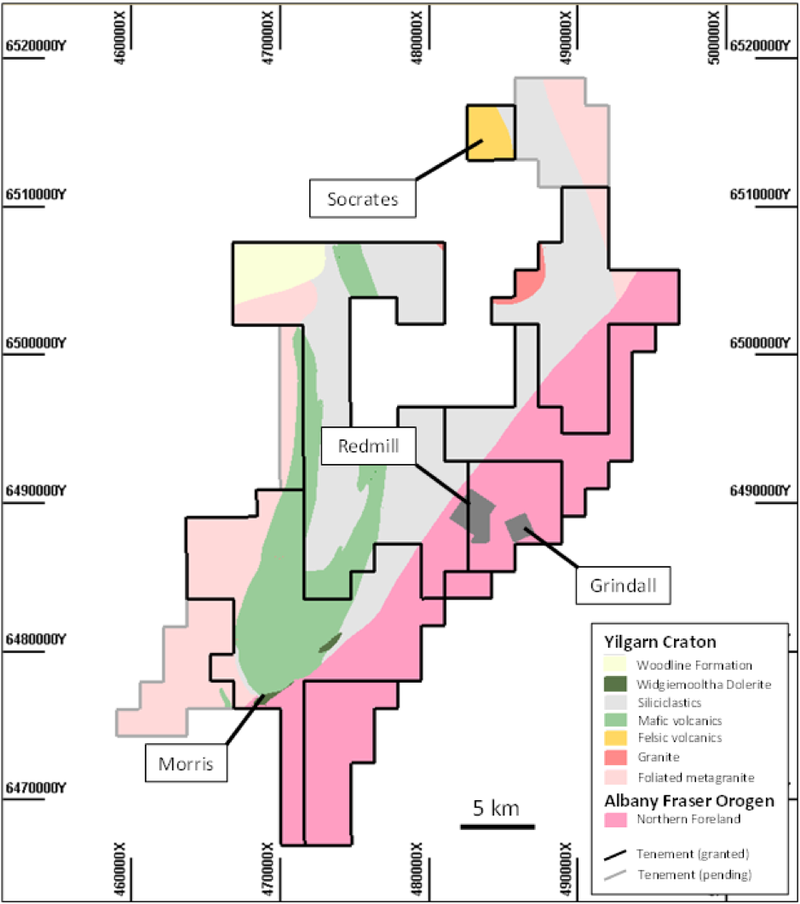

While Nelson Resources is an exploration company with multiple holdings spanning nearly 1000 square kilometres, the key focus for the company is its 830 square kilometre Woodline Project.

The Woodline Project lies on the boundary of the Albany Fraser Oregon and the Norseman - Wiluna Greenstone belt in Western Australia.

More specifically, this project incorporates 45 kilometres of the Cundeelee Shear Zone which already consists of a known +20km Gold Geochemical and bedrock anomaly, hosted in the same geological structural setting as the 7.7 million ounce Tropicana Gold mine.

Ongoing exploration at Grindall will now shift to the north-east of the project area where a surface geochemical anomaly of greater than 50 ppb Au is coincident with the interpreted position of the mineralised structure that has been intersected as shown below.

From a broader perspective, management aims to drill down plunge from the known mineralisation at Socrates as well as testing targets identified from the recently completed Loupe survey.

The company anticipates receiving its maiden diamond drilling results from Socrates in early May.

Induced Polarisation and additional electromagnetic geophysical surveys will be used to map the disseminated sulphides at West Socrates to assist with definition of drill targets.

Follow-up surface geochemistry, geophysics and drilling will be conducted at the Morris nickel prospect, and this work will be done in conjunction with ongoing exploration at the company’s Tempest gold and nickel project which is 100 kilometres east of Woodline.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.