Navarre commences drilling at Stavely Arc projects

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Navarre Minerals Limited (ASX:NML) has provided an update on exploration activities within the Stavely Arc of Western Victoria.

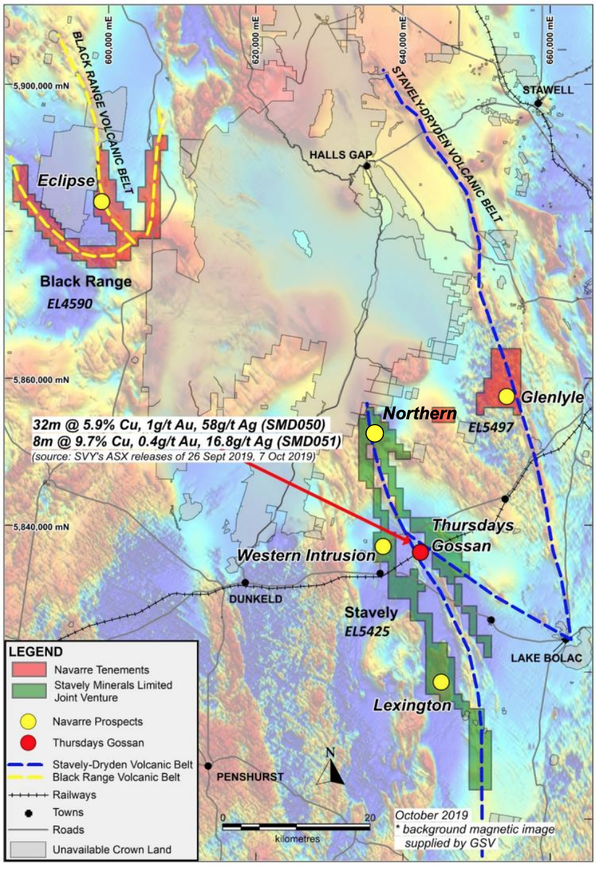

Navarre’s Stavely Arc mineral properties capture multiple, largely untested targets in approximately 100km of Stavely Arc volcanics, including the Eclipse, Glenlyle and Stavely project areas.

Diamond drilling is underway at two of the company’s mineral properties within the Stavely Arc: at the Eclipse prospect within the 100% owned Black Range Project (EL 4590); and at the Northern prospect within the Stavely Project (EL 5425) where Stavely Minerals Limited (ASX: SVY) may earn up to an 80% interest.

The volcanics within the Stavely Arc are mostly concealed by younger cover rocks. Small windows of basement exposure have led to the discovery of a number of copper and gold prospects such as Eclipse and Lexington.

The Stavely Arc is recognised as a continental margin arc setting similar to the Andes in South America, host to some of the world’s largest known copper deposits. Navarre is targeting large VMS, porphyry copper – gold and epithermal deposits.

Black Range Project (EL 4590)

The Black Range Project captures three fault-bound segments of the Stavely Arc volcanics. The Project area includes the Eclipse prospect where a supergene blanket of enriched copper (chalcocite) mineralisation has developed above widespread copper, gold and zinc mineralisation, interpreted to be associated with a potential deeper source of possible VMS or porphyry affinity.

The Company has commenced a 1,200m diamond drilling program (3 diamond holes) to test a large induced polarisation geophysical chargeability anomaly beneath the shallow chalcocite mineralisation. Results of the drilling are expected to be reported in 1Q20 following completion of the program.

Glenlyle Project(EL 5497)

The Glenlyle Project is located 25km north of Stavely Minerals Limited’s Thursdays Gossan prospect for which Stavely Minerals Limited has recently reported significant widths of high-grade copper mineralisation in drilling.

The Glenlyle Project occurs in the Stavely Arc where regional geophysics indicate a possible circular intrusive at depth with potential for porphyry, epithermal and VMS mineralisation as indicated by other prospects in the Stavely Arc. Shallow air core (AC) drilling to date at Glenlyle has identified a silver-gold anomaly at least 150m wide with grades of silver up to 390 g/t, gold up to 4.0 g/t, zinc up to 0.7% and lead up to 0.3%.

The anomalous zone remains open to the north, south and at depth. Due to the potential for VMS mineralisation and Thursdays Gossan skarn-style copper mineralisation, the company has expanded its plans for geophysical surveys and will undertake a VTEM survey over the entire exploration licence area to support drill targeting.

The survey is anticipated to occur in late January 2020.

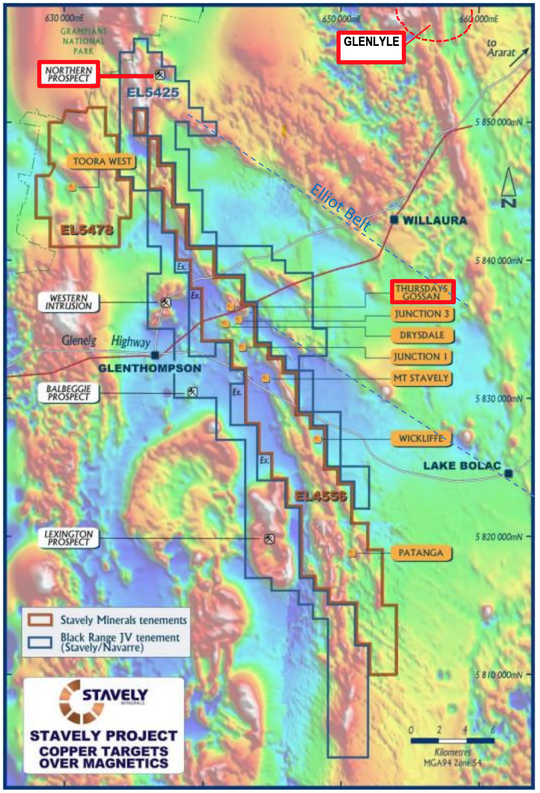

Stavely Project (EL 5425)

Stavely Minerals Limited (ASX: SVY) may earn up to an 80% equity interest in Exploration Licence EL 5425 from Navarre by spending $450,000 over a five year period. EL 5425 surrounds Stavely’s wholly owned EL 4556 tenement that contains the recent Thursdays Gossan copper discovery.

Stavely has already completed one of two planned 400m diamond core holes testing the Northern prospect in EL 5425, with assay results expected early in 1Q20.

The Northern prospect is interpreted to comprise two Cambrian intrusions within ultramafic and volcanic units of the Stavely Belt and is considered to have potential for porphyry copper-gold and epithermal gold mineralisation. The prospect occurs at the intersection of the northwest-trending Elliot Belt and the northerly-trending Stavely Belt in a similar structural setting to Thursdays Gossan.

The prospect has been partly tested by historical shallow AC drilling which recorded ultramafic, sandstone and intermediate volcanic lithologies containing some anomalous copper and gold.

The AC drilling did not resolve the presence of demagnetised zones within the ultramafic and intermediate volcanic units of the Stavely Belt.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.