Navarre collaborates with CSIRO on its Stawell Gold Corridor Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

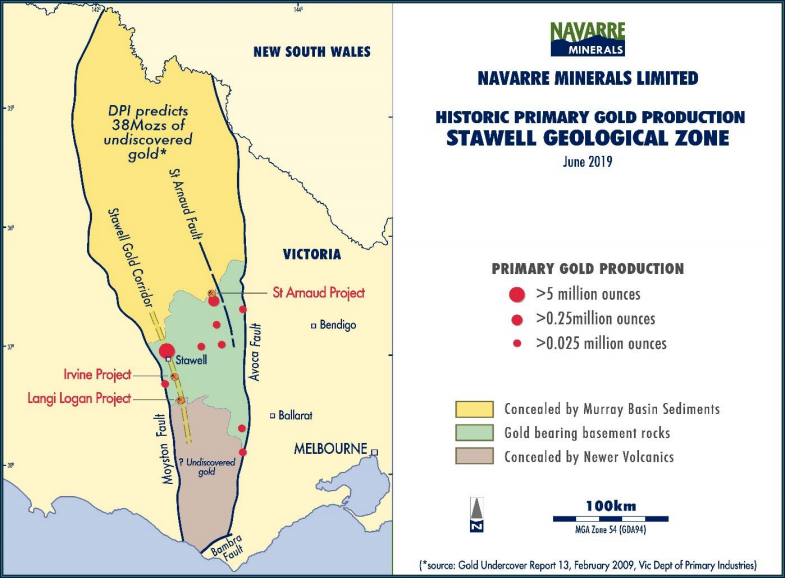

Navarre Minerals Limited (ASX:NML), which has a portfolio of early to advanced stage gold and base metals projects in Victoria, today announced it has commenced a collaborative research project with Australia’s national science agency, CSIRO Mineral Resources Division, at the Stawell Corridor Gold Project in western Victoria.

Navarre was recently awarded the grant under the Innovation Connections scheme of the Australian Government’s Department of Industry, Innovation and Science Entrepreneurs’ Programme that will assist with funding a collaborative research programme with CSIRO to identify potential sites of gold mineralisation along the flanks of the Irvine and Langi Logan basalts within Navarre’s Stawell Corridor Gold Project.

The Irvine and Langi Logan basalts are part of the company’s Stawell Corridor Gold Project, in an extension of a corridor of rocks that host the Stawell (~5Moz) and Ararat (~1Moz) goldfields.

The discovery of outcropping gold on the margins of the Irvine basalt dome and high-grade gold in shallow drilling at Langi Logan are a prime focus for the company.

Past studies on the nearby 4Moz Magdala gold deposit in Stawell have provided an understanding of the structural history and shape of the basalt which can be used to estimate the pathways of fluid flow (location of gold mineralisation) around the basalt domes at the time of gold mineralisation.

The research project will use the latest advanced technologies, including supercomputer-based simulations of deformation-fluid flow transport processes involved in the formation of gold deposits, to aid exploration by highlighting potential drill targets on the flanks of the Irvine and Langi Logan basalt domes.

The first step in the research involves collecting representative samples from diamond drill core from the Irvine Gold Project of both mineralised and host rocks to characterise their varying petrophysical properties including magnetic, gravity and electrical responses.

The petrophysical characterisation is expected to improve understanding of the origin of the different geophysical responses and if those responses are related to gold mineralisation.

This will support further interpretation and modelling of Navarre’s existing geophysical data to more accurately model the distribution and geometry of basalt domes at depth, including the effects of faulting.

The second step in the research project is to simulate the deformation driven fluid flow and heat transport processes involved in the mineralising event using a supercomputer. The results of the models have the potential to indicate prospective sites for mineralisation by identifying locations with optimal fluid focusing.

In summary, the research project will use the latest advanced technologies to identify broad areas of high fluid flow in order to reduce the search space and direct drill testing towards areas of potential concealed gold mineralisation.

Research will be coordinated by CSIRO in Perth with completion of data collection and computer modelling expected by April 2020. It will be led by Dr Peter Schaubs, Team Leader (3D Structural Geology and Numerical Modelling) who is an accomplished structural geologist with intimate knowledge of Victorian gold deposits.

Navarre considers there is significant potential to apply computer simulation not only for high-grade gold mineralisation at depth at Irvine and Langi Logan but also for the five other basalt dome targets yet to be appraised within the Stawell Corridor Gold Project.

Navarre’s Managing Director, Mr Geoff McDermott, said, “Navarre is excited to be collaborating with the CSIRO in cutting-edge, innovative research on our flagship Stawell Corridor Gold Project.

“Our Stawell Corridor Gold Project contains at least seven potential “Magdala” analogues in a 60km long tenement package south, on-strike of Stawell’s Magdala Gold Mine. Magdala’s mineralisation is believed to have resulted from periods of high fluid flow during periodic episodes of high strain.

“The research will aim to identify potential high fluid flow sites at our Irvine and Langi Logan basalt dome projects for drill testing.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.