N27 publishes first drill results

Published 24-NOV-2017 16:05 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Following on from its successful ASX-listing in September, Northern Cobalt (ASX:N27) has published its first drill results from Wollogorang Cobalt Project in the Northern Territory (NT). N27 raised A$4.21 million in September, coming to the market with a succinct focus on cobalt exploration and eventual production close to end-user markets.

To further its strategy as an emerging cobalt development company, N27 has launched an extensive drilling program, consisting of 21 drill targets and over 100 drill-holes – many of which have yet to be drilled.

N27 reports that it has received assays for the first five (of 57 total) drill holes from the Stanton Deposit and has also completed a further 104 drill-holes at the Wollogorang Project, with drilling ongoing.

Source: Northern Cobalt

Highlights include 37 metres at 0.28% cobalt (Co), 18 metres at 0.33% Co and individual metre grades of up to 2.13% Co. N27 intends to shift its existing Inferred resource of 500,000 tonnes of 0.17% Co, 0.09% Ni, 0.11% Cu into indicated and measured categories in order to obtain sampling data for scoping and feasibility studies.

It should be noted here that is an early stage company and investors should seek professional financial advice if considering this stock for their portfolio.

The next batch of assay results is expected before the end November, with ongoing results expected to continue intermittently into January 2018. N27 hopes to have the necessary data to formalise its resource upgrade, now expected sometime in Q1 2018.

Today’s exploration update from N27 was taken positively by market participants, taking N27 shares higher on the day by 42%, at the time of writing.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

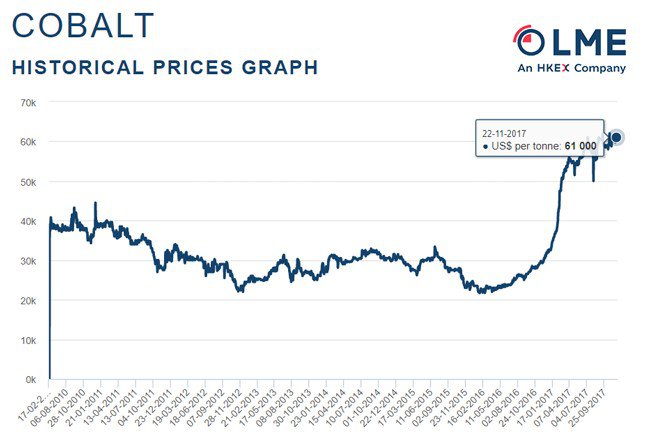

Meanwhile, cobalt spot prices have experienced consistent upward momentum since early 2016, rising from around US$20,000 in February 2016 to US$61,000 per tonne currently.

A significant reason for higher cobalt prices has been dwindling supplies (in addition to strong growing demand coming from the lithium-ion battery sector).

At present, over 50% of the worlds cobalt is mined from the Democratic Republic of the Congo (DRC) which has been cited by several global agencies as a high-risk region for mining activity. Taking into account the lack of confidence in the mining practises within the DRC – combined with DRC being the world’s largest producer — has meant DRC-sourced cobalt supplies have been prone to interruptions and supportive of market prices.

The DRC is also under scrutiny due to the use of child labour and poor working conditions –particularly with artisanal cobalt production. In recent months, large-scale cobalt end-users such as Tesla and Apple have indicated their preference for using ethically-mined cobalt obtained sustainably, as opposed to questionable methods highlighted in the DRC. This factor has been a significant price-sensitive influence and is likely to remain significant going into 2018.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.