MZI cash flow positive and poised to generate strong FY17 earnings

Published 25-OCT-2016 13:45 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

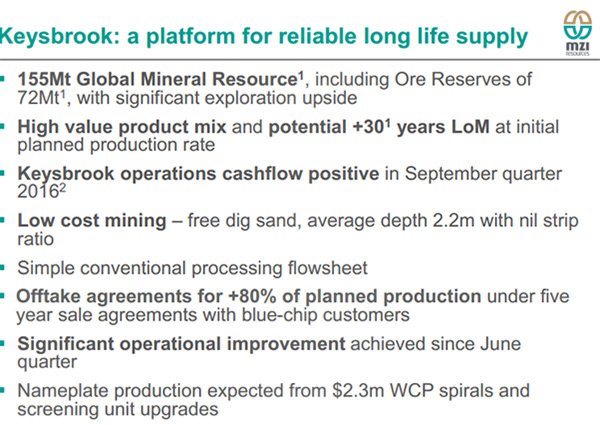

MZI Resources (ASX: MZI) has continued its transition from explorer to producer with strong first-quarter operating cash flow of $7.5 million. From an operational perspective, mineral sands production from its Keysbrook project located in Western Australia was up 24% to circa 13,400 tonnes. Mined grade was up slightly from 2.47% in the previous quarter to 2.53% heavy minerals.

Quarterly product sales of 10,000 tonnes generated sales revenue of $6.8 million. Another highlight of the performance was a significant improvement in plant performance.

On this note, Managing Director Trevor Matthews said, “At the operational level we achieved significantly improved plant performance ahead of the $2.3 million upgrade of spirals and screening equipment in the Keysbrook Wet Concentrator Plant which commenced in late September”.

Planned upgrades to drive efficiencies and volumes

Completion and commissioning of these upgrades is expected in November and this should have a substantial impact on earnings for the six months to June 30, 2017.

While the last 12 months has been an important period for MZI in terms of coming into production and securing important offtake agreements for its premium L88 product, as well as L70 and zircon concentrates, it also represents the foundations for expansion of the Keysbrook project which will maximise its potential 15 year reserve life.

Matthews announced the appointment of Rod Baxter as Chairman who has more than 25 years’ experience in the global resources and engineering sectors, making him well versed in understanding all facets of mining from digging to processing and tapping into end markets.

Today’s upbeat news coincides with a strengthening in commodity prices, particularly the group’s higher value products such as leucoxene.

Bell Potter sees MZI as undervalued

Shares in MZI have come off slightly in the last week, perhaps providing a buying opportunity given this morning’s opening price of 34 cents (+6.2%) represents a steep discount to Bell Potter’s 12 month price target of 56 cents.

However, it should be noted that historical trading patterns, as well as broker forecasts and price targets may not be an accurate indication of the company’s future performance and as such investors should seek independent financial advice if considering this stock.

David Coates from Bell Potter was expecting MZI to be free cash flow positive in the September quarter, indicating that box has been ticked. It is now up to MZI to execute on operational upgrades in order to deliver a strong second half performance.

Coates is forecasting MZI to generate a net profit of $13 million from sales of $75 million in fiscal 2017, representing earnings per share of 7 cents. This implies a PE multiple of approximately 4.5 relative to Tuesday morning’s opening price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.