Mustang kicks off Feasibility Study drilling at vanadium-graphite play

Published 08-AUG-2018 14:22 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

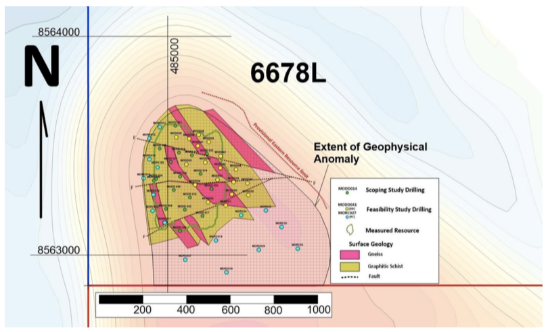

Mustang Resources Ltd (ASX:MUS | FRA:GGY) has today informed the market that the Feasibility Study drilling program is now underway at its flagship Caula Vanadium-Graphite project in Mozambique. MUS has planned 4075m of diamond and reverse-circulation (RC) drilling to be completed in the current third quarter of 2018, with a future Resource upgrade firmly in mind.

The purpose of the drilling program is not only to expand the existing Caula vanadium and graphite JORC Resource, but to provide additional core samples for feasibility level metallurgical testing programs; to conduct geological, geohydrology and geotechnical studies; and to act as a foundation for feasibility studies for the Caula project in the following two quarters.

The drilling program in detail

The drilling program for the Caula Project has been set out by MUS independent competent person Johan Erasmus of Sumsare Consulting, with 3025m of diamond drilling over 18 holes and 1025m of RC drilling over 16 holes.

A geological office, including core logging, cutting, sampling and storage facility has also been established and camp and site construction is currently underway.

It should be noted it is still early stages here, so investors should seek professional financial advice if considering this stock for their portfolio.

MUS Managing Director Dr Bernard Olivier commented on today’s announcement: “This drilling program is a significant step forward for Mustang Resources as we expect to see an expansion of the already valuable Caula Vanadium and Graphite Resources.

“Samples from the drilling will be used to conduct further metallurgical testwork to validate and confirm the company’s previous testwork and reinforce the simplicity of the recovery process. We look forward to updating the market once the results become available.”

The company believes the potential exists to expand the Caula Project significantly through the drilling program, which is in progress with independent drilling company, Major Drilling International Inc.

In the immediate vicinity of the Caula discovery, vanadium-graphite mineralisation has now been defined over a 540m strike length (open-ended to the south) and this mineralisation is up to 230m wide (estimated true thickness), with the depth being completely open-ended at the limit of the current drilling.

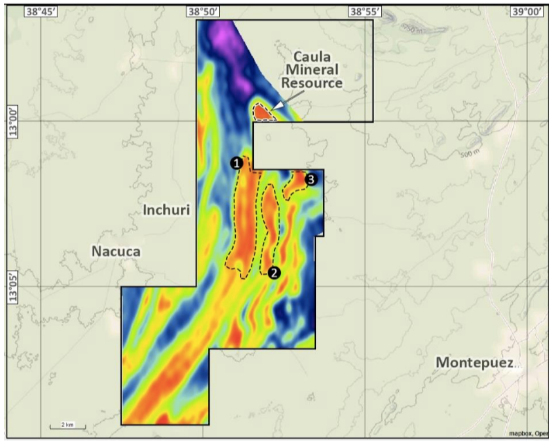

The 4075m of feasibility study diamond and reverse circulation drilling will test for both up-dip and down-dip extensions to the Caula deposit. The potential for MUS is not just to define additional vanadium-graphite mineralisation immediately adjacent to the existing Caula Measured Resource, but also define potential high-grade vanadium-graphite mineralisation over the significantly larger project area as illustrated shown below:

Vanadium production from mica (roscoelite) ore

The Caula Vanadium-Graphite deposit (and the deposits along strike to the South of Caula, including the Syrah Balama deposit) provide a unique opportunity to replicate the success achieved by American miners in the early 20th century, who used a simple and proven process to extract vanadium.

More recently, in 2014, Syrah Resources (ASX:SYR) reported the results of vanadium recovery testwork ore from its Balama project in northern Mozambique. From the testwork, it was noted that that the application of Wet High Intensity Magnetic Separator (WHIMS) and mica flotation processes to the graphite flotation tailings, was effective in recovering vanadium and could achieve a combined concentrate grade of > 3% V2O5.

In addition, further work showed that commercial grade vanadium pentoxide (98% and 99.9% purity), which is suitable for battery use, can be produced from this vanadium concentrate.

MUS metallurgy testwork

MUS metallurgical testwork conducted to date at Independent Metallurgical Operations Pty Ltd and Nagrom, both located in WA, has shown that the vanadium reports to the tailings during the graphite flotation process.

Vanadium recovery testwork on the flotation tailings demonstrated that a portion of the vanadium could be recovered and concentrated using WHIMS. The testwork also showed that additional vanadium could be recovered from the WHIMS tailings by a froth flotation procedure, aimed at recovering and concentrating micaceous minerals including roscoelite. Ongoing testwork is underway.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.