Multiple share price catalysts on the horizon for Latin Resources

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

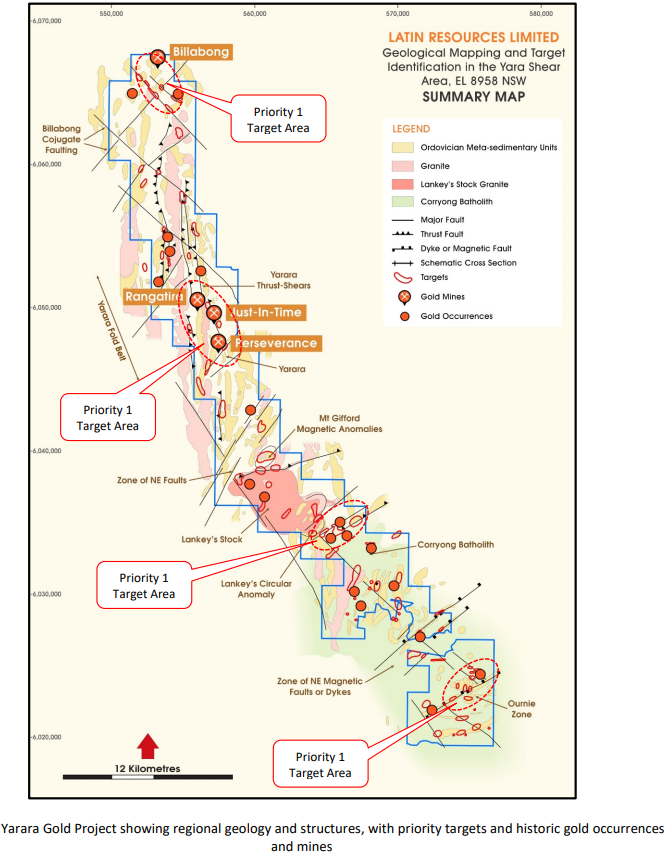

It has been a busy year for Australian-based mineral exploration company Latin Resources Limited (ASX:LRS), with the group progressing some of its established projects in South America, while acquiring the Noombenberry Halloysite project from Electric Metals in WA and also acquiring the Yarara gold project in NSW at the start of the year.

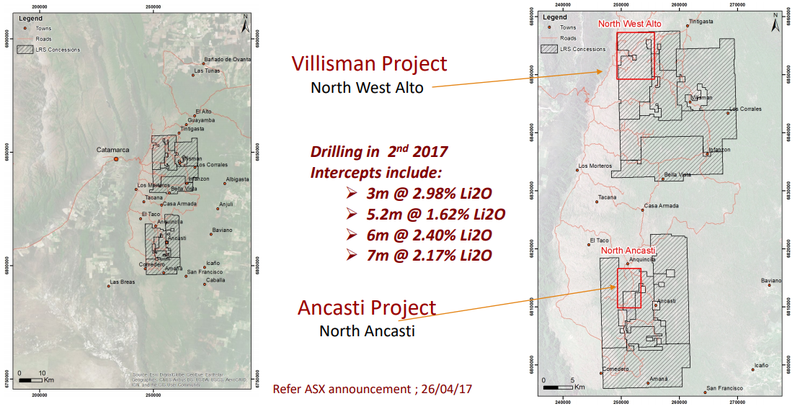

Latin Resources has projects in Latin America and Peru, in which they have secured over 173,000 hectares of exploration concessions in the lithium pegmatite districts of Catamarca and San Luis Provinces in Argentina. Latin recently secured a Joint Venture with Integra Capital to fund their Argentinian lithium projects.

Providing further diversification is the company’s MT03 Copper Porphyry project in the Ilo region of Peru which it is actively progressing with joint venture partner First Quantum Minerals Ltd, a Canadian giant with a $10 billion market cap.

Latins South American projects are now fully funded, so they can focus solely on their Australian projects.

With multiple projects across a variety of minerals and geographic locations, Latin Resources suits investors looking for an investment that will provide significant diversification.

However, to get a true appreciation of Latin Resources’ assets one needs to examine where they are at on the exploration curve, achievements that have been had to date, upcoming milestones and external factors that could positively or negatively impact the group’s projects.

As we will be referring to a number of events that have generated keen interest, it pays to have a share price chart to gain an appreciation of the impact.

The following chart shows that Latin Resources got off to a slow start, but it needs to be borne in mind that the decline in its share price leading up to March was partly due to the COVID-related meltdown in broader equities markets.

Shares up five-fold since June

As you can see from the above chart, there has been accelerated interest since June with a standout moment being 8 September 2020, when the company’s shares surged from 1.1 cents to 1.5 cents under the highest daily volumes ever recorded.

This marked a capital raising that was negotiated at a premium to the group’s 10-day volume weighted average price (VWAP).

The share price response highlighted the degree of interest in the projects that were to be the subjects of the capital raised as more often than not such placements are conducted at a discount to the going price.

The funds raised from the placement were to fund exploration work at the company’s Yarara Gold Project in NSW, as well as providing capital for project development work and maintaining the company’s South American mineral properties in good standing.

The next significant uptick in the company’s share price was only a fortnight later when management provided an exploration update on two of its key assets, the Yarara Gold Project in the Lachlan Fold Belt in New South Wales and the Noombenberry Halloysite Kaolin Project in Western Australia.

On this occasion, Latin Resources’ shares soared nearly 50% to close at 2.4 cents, a level it hadn’t traded at for more than 12 months.

However, there have been further developments in relation to its Lachlan Fold portfolio, and we will go on to examine those in more detail now.

Noombenberry Halloysite Kaolin Project leveraged to high profile industry

The Noombenberry Halloysite Kaolin Project is one of Latin Resources’ key projects in Australia.

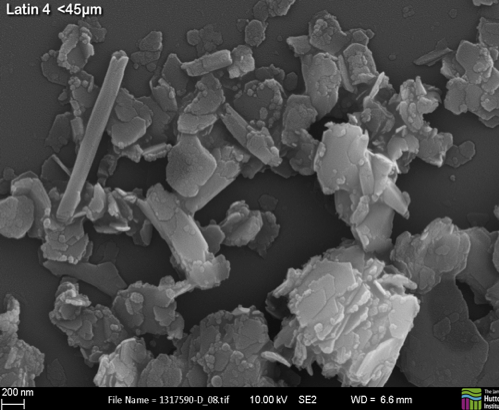

It presents as extremely compelling, being one of Australia’s few known occurrences of ultra-high-grade tubular halloysite.

Situated in Western Australia, the geology is very similar to that of Andromeda Metals Ltd’s (ASX: ADN) Great White Kaolin Project in South Australia.

Andromeda’s shares have performed extremely well as investors have gained an understanding of the resource and its applications.

Since September, Andromeda’s shares have increased more than five-fold, now having a market cap of $500M, suggesting that Noombenberry could emerge as a significant share price catalyst for Latin Resources.

A site reconnaissance and prospecting exercise over Noombenberry Project was conducted by Latin’s technical team in early September, with the aim of advancing site access discussions with key landholders and finalising a site access track for the proposed drilling campaign.

The company intends to carry out reconnaissance exploration drilling to ascertain the extent and material characteristics of the Halloysite mineralisation discovered during previous surface sampling.

Drilling permits are currently under assessment, and while the initial target area is currently under crop, an extensive network of farm access and fence line tracks will enable the completion of the initial Phase 1 drilling with minimal disruption to the current activities of landholders.

The aim of the proposed Phase 1 drilling is to provide an indication of continuity of the identified high-value Halloysite mineralisation, while also allowing the collection of samples throughout the mineralised thickness for deposit analysis and indication of tenor.

Management will then make assessments around a larger drilling program on the success of this initial reconnaissance work.

Pending receipt of final Program of Work approvals from the WA Department of Mines, Industry Regulation and Safety (DMIRS), Latin anticipates undertaking this Phase 1 exploration drilling in November/ December 2020.

Further reconnaissance prospecting while on site has led the company to secure additional tenure in the area through the submission of a new exploration licence.

Developments from these initiatives will represent further upside as test work on surface samples has already confirmed the presence of halloysite mineralisation on the project, with results showing up to 15% by weight in the 45 – 180um size fraction.

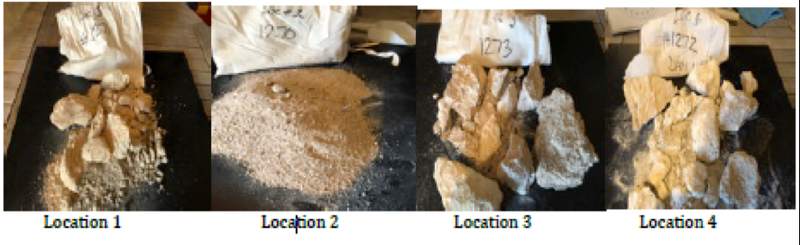

Results were tested by UK based First Test Minerals (specialists in kaolin for 30 years) and found:

- Identification of Halloysite located in multi-site surface sampling

- Good halloysite occurrence at multiple sample sites – forming as ‘plates’ and ‘tubes’

- Halloysite at up to 15% by weight at sample site No 4 noted (45 – 180um)

Location Sample 4 shows potential as Yield at <45 microns has been calculated 76% Kaolinite, 15% Halloysite and 11.3% K-feldspar.

The company is targeting the definition of a JORC Resource by the March 2021 quarter, potentially another significant share price catalyst.

Yarara and Manildra provide exposure to prominent gold-copper region

Complementing the Yarara Project is the securing of a major new project within the east Lachlan Fold Belt.

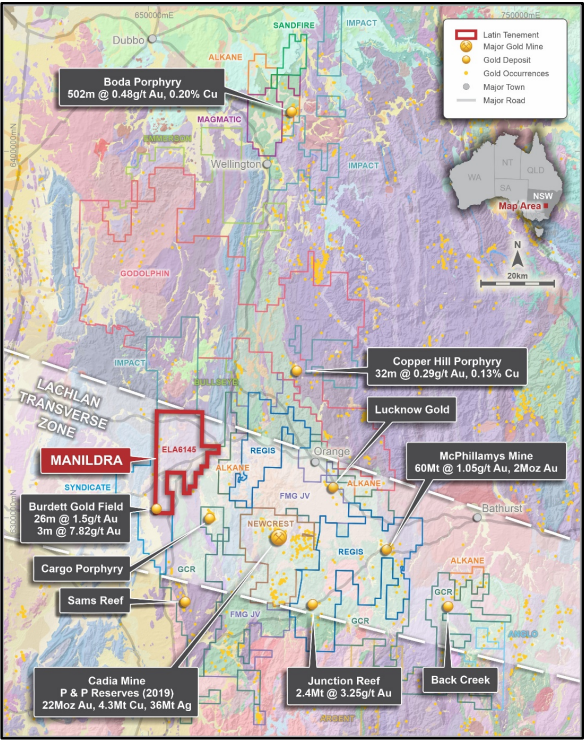

A new tenement application (ELA6145) was secured covering some 280 square kilometres of highly prospective territory in the eastern Lachlan Fold Belt, straddling the regional scale Manildra Fault.

The project is located 30 kilometres to the west of Orange in NSW, 30 kilometres to the north-west of the Newcrest’s (ASX:NCM) world class Cadia Gold-Copper Mine (22 million ounces gold, 4.3 million tonnes copper) and 60 kilometres west of Regis Resources’ (ASX:RRL) McPhillamys Gold project (2 million ounces gold) which is hosted by similar geological trends, including being situated within the regional Lachlan Transverse Zone (LTZ).

Consequently, this is an excellent address with the potential to deliver outstanding exploration results in the relatively near term, while also perhaps heralding the commencement of a flagship project for Latin Resources.

It is worth noting that these mines are traditionally low-cost, long-life projects with copper credits effectively driving down the costs of gold production.

As shown above, the Manildra Gold Project straddles the regional north-south trending Manildra Fault structure for some 30 kilometres along strike, which hosts a number of gold and copper occurrences, including the historic Lady Burdett mining centre in the south-western corner of the tenement where previous exploration has returned gold in shallow drilling, including 26 metres at 1.5 g/t gold from 25 metres and 3 metres at 7.8 g/t gold from 57 metres.

Independent reports regarding this area that were released by the New South Wales Department of Industry, Planning and Environment have concluded that there is potential for more mineralisation at depth with south plunging ore shoots present in Canowindra workings.

The report suggested that their presence at Burdett could be tested in the future and that further exploration should target cross cutting structures which could provide widened zones of mineralisation.

Following the granting of the new tenement, and securing land access and other statutory approvals, Latin proposes to complete regional and project scale first pass targeting exploration, which may include geophysical surveys and low-impact geochemical sampling followed by RC drilling of any defined targets.

Harking back to the Yarara Project, the securing of land access agreements has opened the door for the company to commence the on-ground reconnaissance mapping and prospecting work that is required to finalise drill target locations for ground disturbing applications.

In light of the extensive activity that will be taking place at these projects, management has expanded its NSW-based exploration team with the recent recruitment of a Senior Geologist to be based in Orange, who will be tasked with driving on-ground exploration efforts across the Yarara and Manildra Projects.

Commenting on these developments, executive director Chris Gale said, “The addition of the Manildra Gold Project to the company’s NSW portfolio is a significant step forward in our NSW gold strategy.

“It is very pleasing to be able to add a project of this quality in a highly sought after and proven world class mining district to the company’s portfolio at very low cost.

“This is a testament to the great work of our geological and tenement management team.

“Our land access team is making excellent progress, with the finalisation of several land access agreements over the past few weeks, which means that we are now able to get on the ground and begin reconnaissance field work to define targets for our drilling campaign.”

Latin also active in Argentina

Offshore assets also have the potential to be value accretive, particularly the group’s lithium projects in Argentina that have already attracted the attention of a prominent mining investment group in Integra Capital S.A.

Integra is an investment company that has a diversified portfolio covering more than ten countries. Founded in 1995, the group has developed projects and ventures with private institutions and investors valued at more than $16.5 billion.

Integra is one of Argentina’s largest lithium explorers and holds over 400,000 hectares of lithium brines projects in the Jujuy and Catamarca provinces.

Latin Resources’ Catamarca lithium pegmatite projects host the largest hard rock spodumene landholding in Argentina, and the presence of under-explored spodumene pegmatite swarms is highly encouraging.

Integra will spend up to US$1 million (A$1.4 million) under a Joint Venture which will underpin an aggressive exploration program on the Catamarca concessions, with the initial aim of delivering a Maiden JORC Resource.

On 1 October, Latin announced Integra had completed due diligence and would enter into a transformational joint venture agreement on the projects.

The agreement underpins the strategic approach by Latin in identifying, acquiring and advancing large-scale land positions of highly prospective mineral projects to attract joint venture partners.

The signing of the final Joint Venture Agreement was completed in October, , with Integra taking a 10% placement in Latin Resources to become their largest shareholder .

With the primary aim of delivering a Maiden JORC Resource, the Joint Venture focus will then turn to project development, including feasibility, engineering and metallurgy studies to produce a lithium spodumene concentrate.

Management has already developed a high-level scoping study with consulting engineers Primero Group for development of the Argentinian lithium assets.

Primero chairman Mark Connelly has extensive experience in developing projects located in overseas jurisdictions such as Africa from the ground up, indicating the relationship with Primero is very beneficial.

Under the JV, Latin will be free-carried through initial exploration with financing for the construction of the processing plant to be in line with percentage ownership between Integra and Latin of the project partnership at the time of the Final Investment Decision.

Commenting on the significance of the group’s relationship with Integra in terms of progressing exploration at the Catamarca projects and indeed potentially taking them through to development, Gale said, “We welcome Integra as our new JV partner and largest shareholder which now places Latin along with Integra in a position to become a significant global lithium player.

“Integra’s financial capacity combined with our track record and exploration experience in Latin America makes us a formidable team with the ability to rapidly explore and develop our lithium projects.

“This deal has confirmed the confidence in our lithium projects in South America that will potentially take Latin to another level in the globally developing Electric Vehicle and Storage sector.”

Copper in Peru

Latin Resources also has copper exploration interests in Peru, but on-ground activities on the company’s Joint Venture with First Quantum over the MT03 Copper Project have been delayed due to the Covid-19 lockdown restrictions in that country, and the state of emergency was extended until 31 October.

A detailed ground magnetic survey is now planned over the MT-03 anomaly to assist in the targeting of planned maiden drill testing of the initial anomaly.

Latin is working with a local contract group and First Quantum to enable this work to be undertaken in late November 2020.

It is worth noting that the company’s assets are located in relatively close proximity to prolific copper bearing regions of Peru.

The Western flanks of the Andes in southern Peru host a number of tier-1 porphyry copper deposits, including Cerro Verde (4 billion tonnes), Toquepala (3.4 billion tonnes) and Cuajone (2.4 billion tonnes) - together they account for over 40% of Peru’s copper production.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.