MTA looks to Balama graphite extension, plans Q4 drilling

Published 28-AUG-2015 09:09 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Africa-focused graphite explorer Metals of Africa Limited (ASX: MTA) has confirmed high grade graphite mineralisation at its Balama Central Project in Mozambique, along strike from one of the world’s foremost graphite deposits.

The Company firmed up the prospect from rock chip samples taken from a recent pitting and trenching program earlier this week. Samples collected had visual graphite estimates of 5-20%, with flake sizes ranging from fine to jumbo and averaging large.

The sampling program also identified vanadium mineralisation.

While the results don’t confirm the presence of commercial quantities of graphite yet, it does give MTA the impetus to start drilling at the Balama Central Project in the fourth quarter of this year, after it has completed drilling at its Montepuez Graphite Project.

Both projects are in the world-famous Cabo Delgado province of Mozambique, and the Balama Central Project is along strike from Syrah Resources’ deposit that is contained in an adjoining tenement.

Metals of Africa is also looking into opportunities to refine the graphite on-site, and recently advised investors that it had managed to produce both graphene oxide and graphene from its graphite ore via a scalable process.

While the sampling and the numbers are early stage, it does throw up the possibility that the graphite at MTA’s Balama Central Project could be an extension of the same geological body that hosts Syrah’s deposit.

“Our recent trenching work has proven that the cause of the significant VTEM (versatile time-domain electromagnetic) conductor within our Balama Central Project is due to the presence of high grade graphitic material,” MTA Managing Director Cherie Leeden said.

“The mineralisation represents a compelling drill target, located immediately adjacent and along strike of the world’s premier graphite deposit.”

The forward plan will now be to complete sampling of 11 infill pits, and mapping and recording any structural data ahead of a drilling program in Q4.

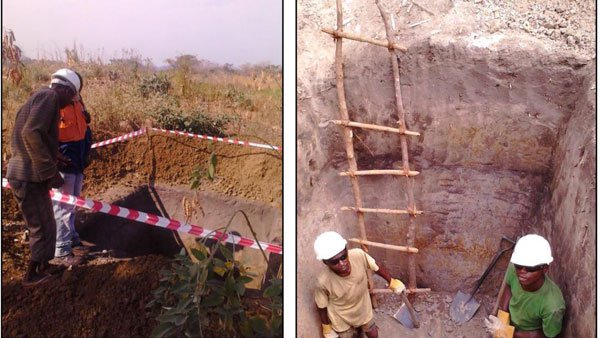

Trenching work at the project

The graphite market

Currently, the global market for graphite is valued at roughly $15.06 billion, according to a recent P&S Market Research report on the material.

The report has also tipped the market to grow by 4% per year until 2020, which means in 2020 the market will be worth approximately $17.14 billion. The market demand for the material is being driven by a number of factors, but is thought to be down to an increasing appetite for lithium-ion batteries.

The batteries power a number of consumer good electronics such as cameras and phones, and the revolutionary electric car company Tesla recently gave the graphite industry a shot in the arm by announcing that it would build a $5 billion lithium-ion factory in Nevada to produce the batteries which literals make the wheels on its electric cars go around.

In addition, new uses for graphene are being found all the time.

For instance, auto manufacturers are using graphene in brake pads as they make less noise while breaking, and solar manufacturers are using the material for solar panels. It is also being used in 3D printers as an ink.

With the world turning green, the material that will underpin this revolution is shaping up as graphite – and the good news is that there’s a shortage of it.

The global supply and demand gap is currently estimated to be about 1,500 tons, which means companies supplying the material will be doing so into a seller’s market.

How MTA fits in

The Australian explorer currently has three projects on its plate, with its two graphite projects in Mozambique and a zinc-lead project in Gabon.

Its flagship graphite project is at the Montepuez Central Graphite Project in the prolific Cabo Delgado graphite province.

So far, it has found three key prospects at the Montepuez Central Graphite Project including the Buffalo, Elephant, and Lion prospects. During the last quarter, it found high-grade mineralisation at the Buffalo prospect including a 50m section from surface with total graphite content of 9.86%.

Meanwhile at Elephant, it has found a mineralisation with 5-15% graphite content from 8.7m below the surface to 93m below the surface.

The second project at Balama Central sits smack-bang in the middle of two resources held by Triton Resources and Syrah Resources. Triton has a resource of 1.45 billion tons of raw material at 10.7% graphitic carbon and has a market cap of $84 million. Syrah has a resource of 1.15 billion tonnes of raw material with 10.2% graphitic carbon and has a market cap of $640 million.

Drilling at the Montepuez Central Project is set to continue this month, with an eye to providing the market an idea of just what it could be sitting on via a JORC-compliant resource.

However, MTA is not just planning to dig the stuff up, but process it and refine it as well in the future.

To make it to market, graphite has to undergo several processes to make it closer to the material used by manufacturers to put into batteries and other products. To do this, a company generally has two options.

It can either sell the raw graphite to a company which will then refine it and sell it on, or it can refine the material itself. The more it needs to be refined, the more it costs.

MTA however, with its high grade material, has managed to produce graphene oxide using a thermal process, a process which is easily scalable. Better yet, it has produced graphene which is comparable with synthetic graphene meaning it is more valuable to buyers.

Together with the Montepuez drilling ongoing, the news means that MTA will have plenty of activity well into the fourth quarter of 2015.

It’s not just graphite for MTA

Over in Gabon, MTA discovered the highest ever grades of zinc and lead ever recorded in the country as part of its rock sampling program at its Kroussou Project.

It returned grades of up to 9.69% zinc and 33.1% lead, with elevated copper and silver thrown in as a bonus.

As well as the rock sampling, it has also completed a detailed mapping project in the area, meaning that it now has a better idea of where to look next as it seeks to firm up the resource at Kroussou. The mapping work identified continuous cretaceous contact over the 85km project area, and is hoping it will provide further zinc and lead prospects to follow up on.

Interestingly, the company is also working with the local mines department to translate date from a significant drilling completed by the previous tenement holder ‘Kroussou Syndicate’. The Syndicate was the only company to explore in the tenement area to date, however the results were in hard-copy and in French. The Company has now digitised the data, and is processing the translation of the documents.

If MTA is able to translate the results and cross-reference them with its own data, there could be further drill targets to hit.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.