More upbeat news from Latin Resources after 15% share price rally

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Latin Resources Limited (ASX:LRS) informed the market on Thursday morning that exceptional results had been received from four grab/float samples collected as a part of a reconnaissance exercise in consultation with the landholder at the company’s 100% owned Noombenberry Halloysite Project in Western Australia.

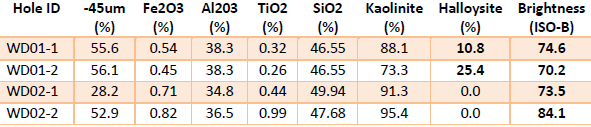

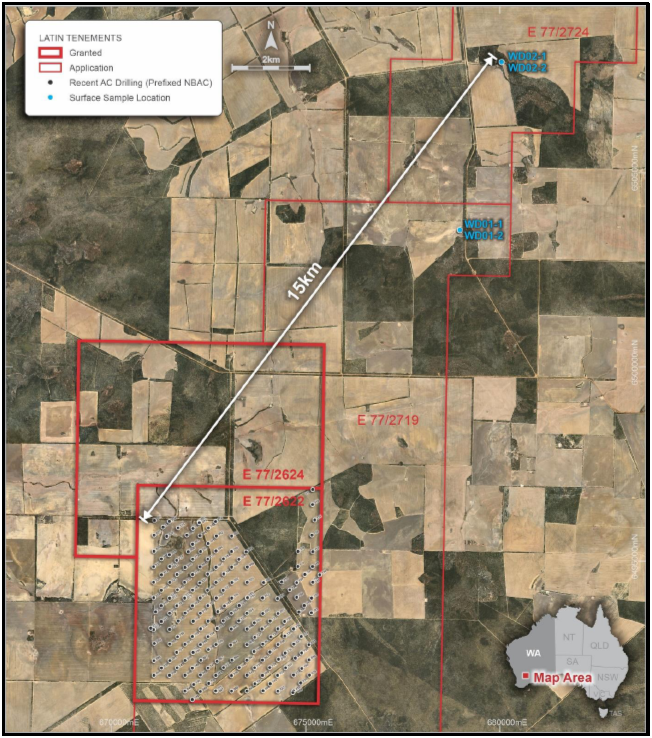

Results from four float samples collected from dam walls at two separate locations within Latin’s new tenement applications have confirmed bright white (>74 ISO-B) and ultra-bright white (>84 ISO-B) kaolin up to 15 kilometres along strike to the north-east of the company’s main drilling area.

This comes on the back of yesterday’s release of promising results from the first batch of samples from aircore drilling at the company’s Noombenberry project, a development that triggered a 15% surge in the company’s shares as they closed the day at a 12 month high of 8.3 cents.

Results from the first 100 samples submitted by LRS for test work have confirmed the project contains very high grade halloysite, with individual composite sample grades of up to 37% halloysite contained within the bright white (>75 ISO-B) to ultra-bright white (>84 IOS-B) kaolinite at Noombenberry.

This adds to the significance of today’s news where results have confirmed initial visual observations of bright to ultra-bright white (>84 IOS-B) kaolinitic clays in dam walls up to 15 kilometres along strike to the north-east of the company’s current focus for aircore drilling.

Both samples from one dam site sampled approximately 7 kilometres along strike to the north-east have returned high-grade (>10%) halloysite, with one sample returning over 25% halloysite.

Latin Resources prepares to fast track data for resource estimate

Management views this development as exceptional as the results highlight the potential scale of the high-quality kaolinite and high-grade halloysite mineralisation where the company is working towards generating its maiden JORC resource for the project.

The JORC resource estimate will be based on an area of approximately 4.0 x 4.5 kilometres (18 square kilometres), where the company has completed aircore drilling.

With results from analysis of drill samples still coming in, management’s immediate focus is generating the geological wireframes to enable the fast-tracking of the estimation process once all results have been received.

In parallel with this, preparations are being made to extend the current drilling pattern immediately to the north within the granted tenements where new land access agreements have recently been executed.

Work programs have been submitted to DMIRS, and drilling will commence upon receipt of approvals.

Potential to extend resource along north-east strike

Latin Resources will then turn its attention to these newly identified areas of high-quality kaolinite and high-grade halloysite along strike to the north-east and then further afield within the extensive tenement package which extends over a 100-kilometre strike length.

Commenting on these developments and their significance in terms of growing the resource, chief executive Chris Gale said, “These results from the reconnaissance sampling of the white dams along strike from our current drilling area are exceptional.

‘’They are not only significant in their own right, showing high-quality kaolinite and high-grade halloysite outside of our current area of drilling, but moreover they highlight the potential to significantly grow the exciting Noombenberry Project.

‘’These samples are up to 15 kilometres along strike from our main drilling area where we are undertaking a maiden JORC resource and is the first location sampled as part of our regional reconnaissance program.

‘’Latin’s tenement applications extend over a strike length of 100 kilometres where our exploration team has identified many more of these white dam locations.

‘’We are extremely confident that as we continue to expand our reconnaissance sampling into our new tenement areas, we will continue to highlight more high-grade zones like this.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.