Minbos raises $7.3 million to fully fund DFS

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Minbos Resources Limited (ASX:MNB) has received firm commitments from sophisticated investors to subscribe for a placement of approximately 91.25 million fully paid ordinary shares at an issue price of $0.08 per share to raise gross proceeds of $7.3 million.

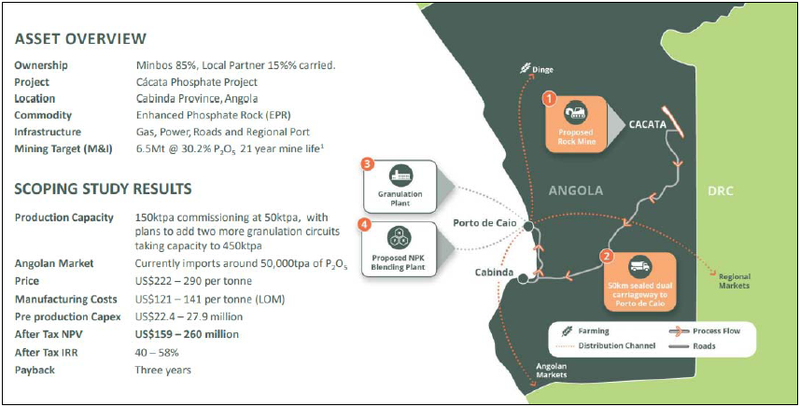

Funds raised from the Placement will be used for working capital requirements and to further DFS activities for the Cabinda Phosphate Project, Angola.

Consequently, this is an important development in terms of derisking the Cabinda Project and progressing towards the all-important DFS which is expected to be completed by November.

Minbos has already released an impressive scoping study that implies an after-tax net present value ranging between about US$159 million and US$260 million.

Bang for buck, this is one of the best mining projects on offer at the moment given the nominal anticipated upfront capital expenditure of about $25 million.

Improved commodity prices should see enhanced DFS economics

Expect the DFS to provide significant share price momentum as it will place more certainty around the financial metrics which appear to have improved due to commodity price movements since the scoping study was completed.

Notably, phosphate fertiliser prices have doubled since Minbos submitted its bid to international tender.

As the first primary fertiliser plant to be constructed in middle Africa, Minbos holds an important first-mover position which will strengthen its competitive edge.

The group’s strategic partnership with the International Fertiliser Development Centre will assist the company in targeting a small landholder sector.

The transformational social impact of the Cabinda Project has brought it under the spotlight of international investors that are focused on ESG (environmental, social, governance) enterprises, and this also will provide Minbos with a head start in terms of project financing.

Commenting on the placement and highlighting the Cabinda Project’s robust financial metrics and ESG appeal, chief executive Lindsay Read said, "We are delighted by the strong support for the placement which has fully funded our Definitive Feasibility Study and provided capacity for the company to move on growth opportunities that our project makes possible.

"In particular, we will now have the capacity to progress key project items ahead of project finance drawdown.

"With its mix of ESG impact and strong mining economics, the Cabinda Phosphate Project is one of the most exciting and rewarding projects I have been involved in.

"We look forward to delivering for shareholders, stakeholders and Angola.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.