Minbos delivers on all fronts as shares surge 40%

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

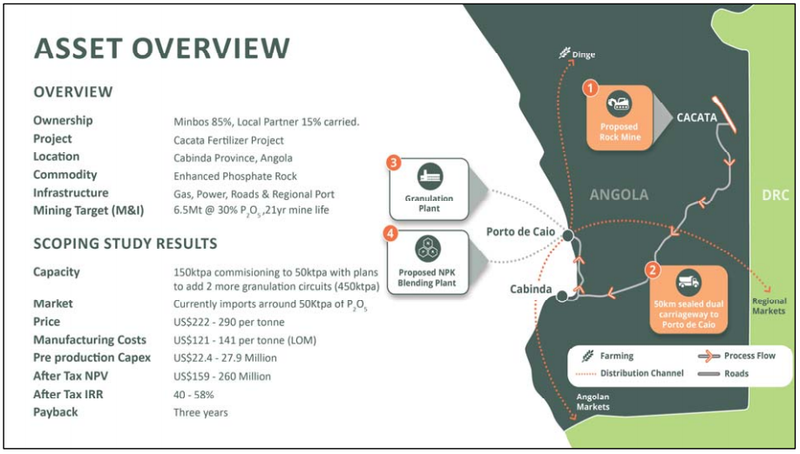

Shares in Minbos Resources Limited (ASX:MNB) surged more than 40% on Wednesday following the execution of a Mineral Investment Contract (MIC) for the Cabinda Phosphate Project located in the Cabinda Province of Angola.

While this represented a 12 month high, more importantly it was the realisation of a major milestone in paving the way for the company to complete approvals, land and access agreements, offtake agreements and an investment contract for the Caio Granulation Plant.

The key terms of the MIC are in accordance with the Mining Act in Angola and include a royalty rate of 3% on the value of phosphate rock sales, and income tax of 25% which will apply after the 8 year tax free period granted to projects in Cabinda.

As a backdrop, Minbos won an international tender for the Cabinda Phosphate Project in March 2020, highlighting the group’s swift progress in moving towards development.

The company and its in-country partner, Soul Rock Ltda (15% carried interest), won the tender based on producing Enhanced Phosphate Rock as a substitute for fertilisers currently imported by the Angolan Government for distribution to wholesalers and farmers.

Management’s vision is to build a nutrient supply and distribution business that stimulates agricultural production and promotes food security in Angola and the broader Middle Africa region.

Indeed, yesterday’s announcement that the company had executed the Mineral Investment Contract (MIC) for the Cabinda Phosphate Project represented a significant step in realising this vision.

Minbos has submitted a Technical Economic and Financial Feasibility Study (TEFFS) for the Cácata Mine, as required by the MIC, which confirms the project will move to the exploitation phase in 2021.

The life of the contract has been set for the life of the 6 million tonne mining target, as submitted in the TEFFS.

Minbos ready to move to DFS stage

A few months ago, Minbos released a Scoping Study indicating that only a moderate capital expenditure of US$27 million was required to progress to production, with the payback period expected to be just 3 years.

With a mine life of 21 years, the project has an After-Tax NPV of as much as US$260 million.

MNB is currently capped at around $37 million, suggesting it is a strong value proposition on an enterprise value to NPV basis.

The Mineral Resource for its Cacata Phosphate Rock Deposit within Cabinda stands at 27Mt @ 17.7% P2O5, with 15.2 Mt at 24% in the Measured & Inferred Categories.

The other interesting aspect of the business is its alignment with environmental, social and governance (ESG) criteria, an increasingly important consideration for institutional and retail investors.

Commenting on this development, Minbos Chief Executive Lindsay Reed said, “Execution of the Mineral Investment Contract is an important milestone for Minbos and a real value catalyst.

‘’We are now able to move beyond the definitive feasibility study and commence implementation planning with government and stakeholders.

‘’Middle Africa has 170 million people and vast areas of arable land but not a single fertilizer production facility - this project cannot advance fast enough to keep up with the expected demand.”

Close to essential infrastructure and distribution markets

Cácata is well supported by key infrastructure. The deposit is situated within a kilometre of a dual lane highway and a sixty-minute drive to Porto de Caio, a billion-dollar port and industrial development.

Porto de Caio provides the ideal location for a granulation plant with a natural gas terminal and power station within five kilometres and access to a port for barging product to local and regional markets.

This is important because fertiliser consumption on the African continent is projected to reach 13.6 million tonnes by 2030.

Producing fertilisers locally will improve the availability of nutrients, reduce transport costs, and protect against exchange rate fluctuations.

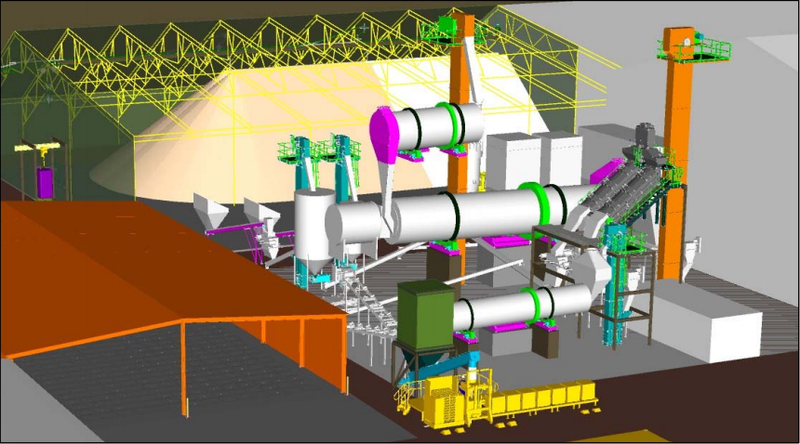

The following is a model of the granulation plant including hoppers and granulators, as well as the dryer and product bagging station.

In essence, this project could transform agriculture in Angola, assisting subsistence farmers in reducing local food prices, enhancing current and future food security and improving Africa’s economic competitiveness.

It may also mitigate the high cost of imported fertiliser, which is contributing to the issue of low crop yields.

Minbos hopes to address this issue by producing low-cost, locally-mined, manufactured and distributed fertiliser, tailor-made for local soils.

Trials support Cabinda Blend’s relative outperformance

Management has also negotiated a Memorandum of Understanding (MoU) with the International Fertiliser Development Centre (IFDC) to develop and grow the small-holder farmer market in Angola.

The IFDC is dedicated to global food production and empowering farmers to increase crop yields by using fertiliser.

Field trial activity with IFDC is already being conducted in Alabama.

It builds on the knowledge of all the previous experiments and, once again, is designed to compare the Cabinda Blend with (Mono-Ammonian Phosphate) MAP and Cabinda Phosphate Rock (CPR), but also to quantify some of the highlights from the previous experiments.

MAP and CPR are being compared to Cabinda Blend in both granulated and compacted form.

The nutrients were applied to pots initially planted with Soybean which has been harvested.

The same pots (without the addition of further nutrients) have been planted with Winter Wheat which will be harvested in June, after which the pots will be planted with further crops to test the repeater effect.

In addition to the usual comparison data for the blends versus MAP and CPR at different dose rates, this experiment will provide data on the differences between compacted and granulated form, the threshold dose of MAP required to provide the starter effect and the relative performance of the Cabinda Blend in the two residual crops.

In earlier trials, the Cabinda Blend showed better relative performance in residual crops (or subsequent crops), demonstrating the potential for economic benefit beyond the first season.

The performance suggests the Phosphate (P) continues to release slowly from the CPR in contrast to Water Soluble Products which release P quickly resulting in losses to the soil.

Consequently, Minbos has gone a long way to demonstrating it not only has a robust strategic plan and the financial metrics to take its flagship project to a company transforming stage, but there is also strong and credible evidence that the product it intends to sell into a diverse range of markets in Africa is well-suited to the prevailing growing conditions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.